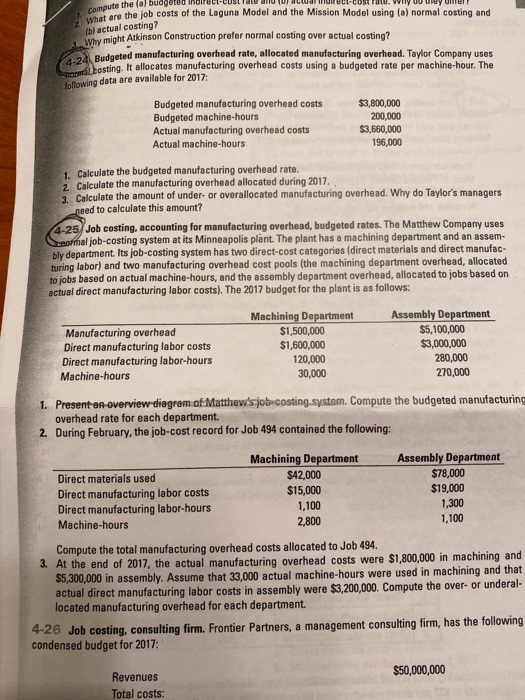

1. Compute the (a) budgeted Y UNI What are the job costs of the Laguna Model and the Mission Model using (a) normal costing and Why might Atkinson Construction prefer normal costing over actual costing? 4-24 Budgeted manufacturing overhead rate, allocated manufacturing overhead. Taylor Company uses bosting. It allocates manufacturing overhead costs using a budgeted rate per machine-hour. The following data are available for 2017: Budgeted manufacturing overhead costs $3,800,000 Budgeted machine-hours 200,000 Actual manufacturing overhead costs $3,660,000 Actual machine-hours 196,000 1. Calculate the budgeted manufacturing overhead rate, 2 Calculate the manufacturing overhead allocated during 2017 3. Calculate the amount of under-or overallocated manufacturing overhead. Why do Taylor's managers need to calculate this amount? 4-25 Job costing, accounting for manufacturing overhead, budgeted rates. The Matthew Company uses normal job-costing system at its Minneapolis plant. The plant has a machining department and an assem- bly department. Its job-costing system has two direct-cost categories (direct materials and direct manufac- turing labor) and two manufacturing overhead cost pools (the machining department overhead, allocated to jobs based on actual machine-hours, and the assembly department overhead, allocated to jobs based on actual direct manufacturing labor costs). The 2017 budget for the plant is as follows: Manufacturing overhead Direct manufacturing labor costs Direct manufacturing labor-hours Machine-hours Machining Department $1,500,000 $1,600,000 120,000 30,000 Assembly Department $5,100,000 $3,000,000 280,000 270,000 1. Present an overview diagram of Matthew's job-costing system. Compute the budgeted manufacturing overhead rate for each department. 2. During February, the job-cost record for Job 494 contained the following: Direct materials used Direct manufacturing labor costs Direct manufacturing labor-hours Machine-hours Machining Department $42,000 $15,000 1,100 2,800 Assembly Department $78,000 $19,000 1,300 1,100 Compute the total manufacturing overhead costs allocated to Job 494. 3. At the end of 2017, the actual manufacturing overhead costs were $1,800,000 in machining and $5,300,000 in assembly. Assume that 33,000 actual machine-hours were used in machining and that actual direct manufacturing labor costs in assembly were $3,200,000. Compute the over- or underal- located manufacturing overhead for each department 4-26 Job costing, consulting firm. Frontier Partners, a management consulting firm, has the following condensed budget for 2017: Revenues $50,000,000 Total costs