Answered step by step

Verified Expert Solution

Question

1 Approved Answer

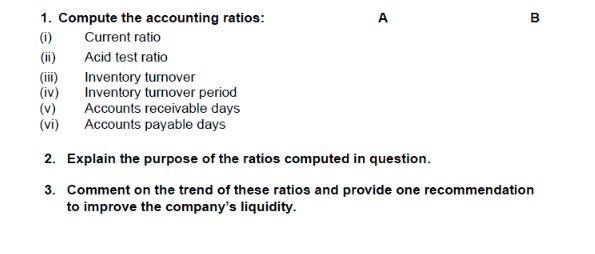

1. Compute the accounting ratios: (1) (iii) (iv) (V) (vi) Current ratio Acid test ratio Inventory turnover Inventory turnover period Accounts receivable days Accounts

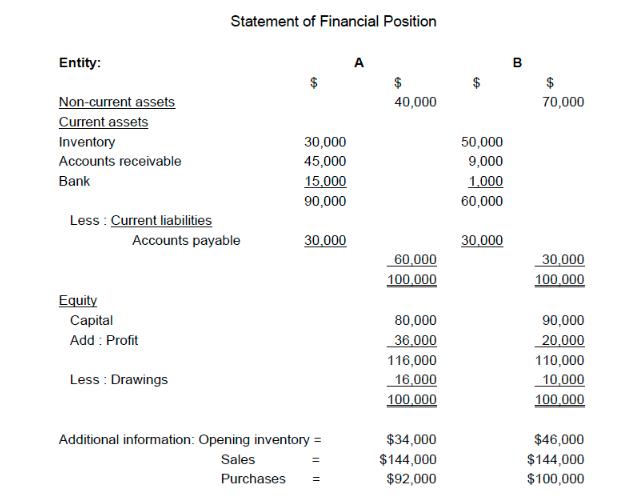

1. Compute the accounting ratios: (1) (iii) (iv) (V) (vi) Current ratio Acid test ratio Inventory turnover Inventory turnover period Accounts receivable days Accounts payable days A B 2. Explain the purpose of the ratios computed in question. 3. Comment on the trend of these ratios and provide one recommendation to improve the company's liquidity. Entity: Non-current assets Current assets Inventory Accounts receivable Bank Less: Current liabilities Equity Accounts payable Capital Add: Profit Statement of Financial Position Less: Drawings 30,000 45,000 15,000 90,000 30,000 Additional information: Opening inventory = Sales Purchases 11 II: A $ 40,000 60,000 100,000 80,000 36,000 116,000 16,000 100,000 $34,000 $144,000 $92,000 50,000 9,000 1,000 60,000 30,000 B $ 70,000 30,000 100,000 90,000 20,000 110,000 10,000 100,000 $46,000 $144,000 $100,000

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Lets calculate the accounting ratios for Entity A and Entity B and then explain their purposes Accounting Ratios i Current Ratio Current Assets Current Liabilities For Entity A Current Ratio 30000 450...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started