Question

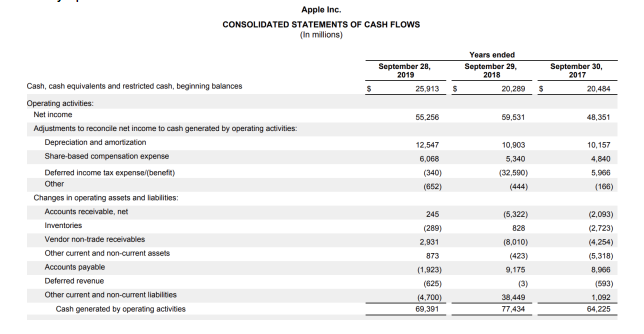

1. Compute the cash conversion ratio for each year; [3 points] 2. Discuss on the cashflow conversion performance of the business; [3 points] 3. Only

1. Compute the cash conversion ratio for each year; [3 points]

2. Discuss on the cashflow conversion performance of the business; [3 points]

3. Only in the period to 28th September, 2019, assume that the opening balance of PP&E of Apple Inc. was (in millions) $123,465 and the closing balance for the same period was $146,203. Calculate what amount Apple Inc. incurred for capital expenditure in the most recent year (Make the assumption that no disposals and zero amortization on intangibles and that all depreciation relates to PP&E) [ 5 points] All 3 questions please!

Apple Inc. CONSOLIDATED STATEMENTS OF CASH FLOWS (In millions) September 20, 2019 25.913 Years ended September 29, 2018 20.289 September 30, 2017 20,484 $ $ $ 56,256 59,531 48,351 10,903 12,547 6,068 (340) (652) 5,340 (32,590) 10,157 4,840 5.966 (166) Cash, cash equivalents and restricted cash, beginning balances Operating activities Net income Adjustments to reconcile net income to cash generated by operating activities: Depreciation and amortization Share-based compensation expense Deferred income tax expense (benefit) Other Changes in operating assets and liabilities: Accounts receivable, net Inventories Vendor non-trade receivables Other current and non-current assets Accounts payable Deferred revenue Other current and non-current liabilities Cash generated by operating activities 245 (289) (5,322) 828 (8,010) (423) 9,175 2,931 873 (1.923) (625) 14.700) 69.391 (2,093) (2.723) (4,254) (5,318) 8,906 (593) 1,092 64,225 38,449 77.434Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started