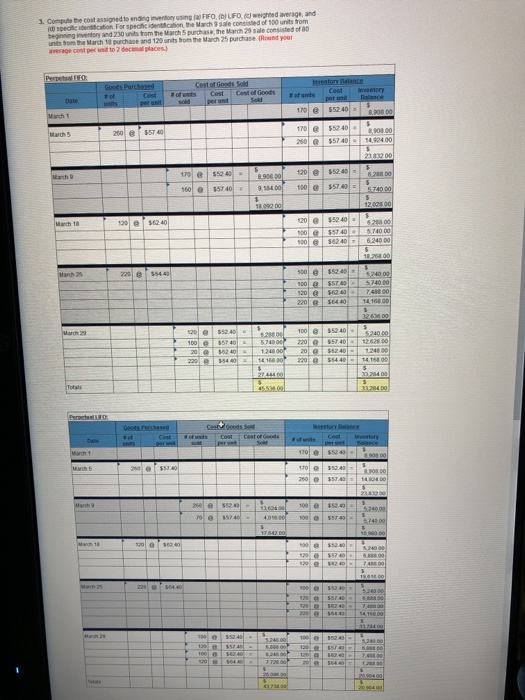

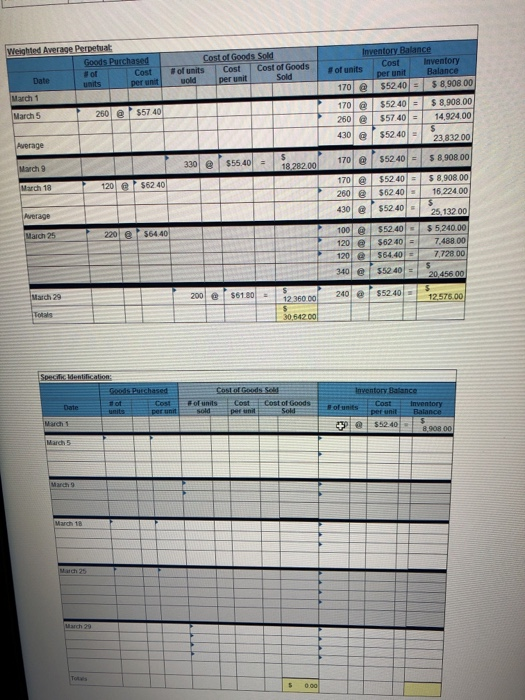

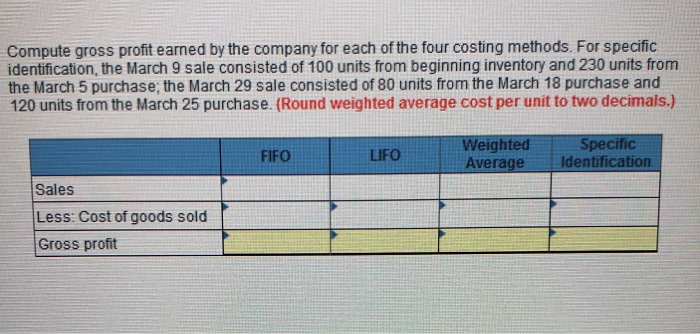

1. Compute the coassigned to ending inventory Sing FIFO, DUFO weighted average and spectic identition for speci fication the Marche consisted of 100 units from beginning w ord 230 units from the March purchase the March 29 se consisted of units to the March 1 purchase and 120 units to the March 25 purchase and your coperto 2 decimal places:) Perpetual Goods Purchased Cost of Goods Sold ons 170 e 55240 170 260 552 40 0 00 $57401490400 e T1705540 150155140 120 100 55.40 57.40 3 e 120 100 552.40 $5740 5740 DO 100 552.00 100 a $5240 240 rettory Bace - 200 550014 100 352.00 5054 10 55240 220 e 36 .168 100 0 2 :40 - 1301574- 1000 OD Weighted Average Perpetual Goods Purchased of Cost per unit March 1 Cost of Goods Sold of units Cost Cost of Goods wold per unit Sold Date units March 5 260 @ $5740 Average 330 555.40 = 1828200 Inventory Balance Cost Inventory of units per unit Balance 170 @ 552 40 = $ 8,908 00 170 @ 552 40 = $ 8,908.00 260 @ $57.40 14.924.00 430 @ $52.40 = 23,832 00 170 @ $5240 = 8,908.00 170 @ $52.40 = $ 8,908,00 260 @ $62.40 16.224.00 430@ 55240 - 25,132.00 100 @ $52.40 $5,240.00 120 @ 562 40 = 7,488.00 120 e 564.40 7.728 00 340 e 55240 = 20.456 00 240 55240 12575.00 March 18 120 @ $62.40 Average March 25 220 @ 564.40 200 | 56180 12.360.00 Specific identification: Inventory Balance Cascada #of units Cost Cost of Goods Date of units March 1 @ $52.40 March 5 Compute gross profit earned by the company for each of the four costing methods. For specific identification, the March 9 sale consisted of 100 units from beginning inventory and 230 units from the March 5 purchase, the March 29 sale consisted of 80 units from the March 18 purchase and 120 units from the March 25 purchase. (Round weighted average cost per unit to two decimals.) FIFO LIFO Weighted Average Specific . Identification Sales Less: Cost of goods sold Gross profit 1. Compute the coassigned to ending inventory Sing FIFO, DUFO weighted average and spectic identition for speci fication the Marche consisted of 100 units from beginning w ord 230 units from the March purchase the March 29 se consisted of units to the March 1 purchase and 120 units to the March 25 purchase and your coperto 2 decimal places:) Perpetual Goods Purchased Cost of Goods Sold ons 170 e 55240 170 260 552 40 0 00 $57401490400 e T1705540 150155140 120 100 55.40 57.40 3 e 120 100 552.40 $5740 5740 DO 100 552.00 100 a $5240 240 rettory Bace - 200 550014 100 352.00 5054 10 55240 220 e 36 .168 100 0 2 :40 - 1301574- 1000 OD Weighted Average Perpetual Goods Purchased of Cost per unit March 1 Cost of Goods Sold of units Cost Cost of Goods wold per unit Sold Date units March 5 260 @ $5740 Average 330 555.40 = 1828200 Inventory Balance Cost Inventory of units per unit Balance 170 @ 552 40 = $ 8,908 00 170 @ 552 40 = $ 8,908.00 260 @ $57.40 14.924.00 430 @ $52.40 = 23,832 00 170 @ $5240 = 8,908.00 170 @ $52.40 = $ 8,908,00 260 @ $62.40 16.224.00 430@ 55240 - 25,132.00 100 @ $52.40 $5,240.00 120 @ 562 40 = 7,488.00 120 e 564.40 7.728 00 340 e 55240 = 20.456 00 240 55240 12575.00 March 18 120 @ $62.40 Average March 25 220 @ 564.40 200 | 56180 12.360.00 Specific identification: Inventory Balance Cascada #of units Cost Cost of Goods Date of units March 1 @ $52.40 March 5 Compute gross profit earned by the company for each of the four costing methods. For specific identification, the March 9 sale consisted of 100 units from beginning inventory and 230 units from the March 5 purchase, the March 29 sale consisted of 80 units from the March 18 purchase and 120 units from the March 25 purchase. (Round weighted average cost per unit to two decimals.) FIFO LIFO Weighted Average Specific . Identification Sales Less: Cost of goods sold Gross profit