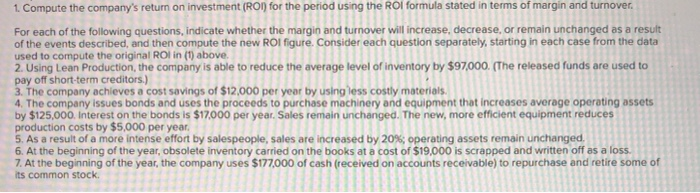

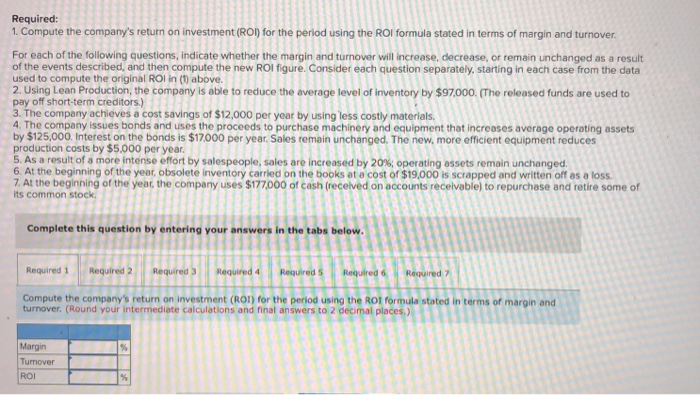

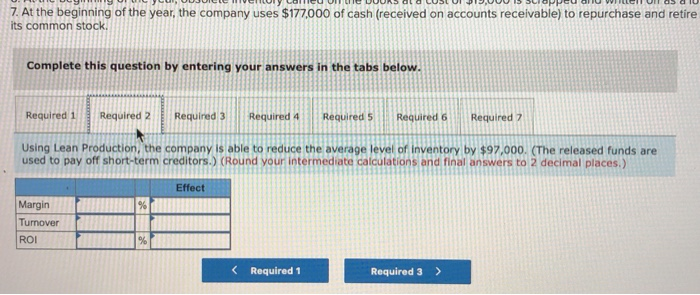

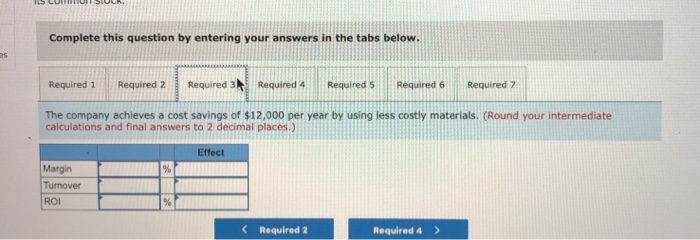

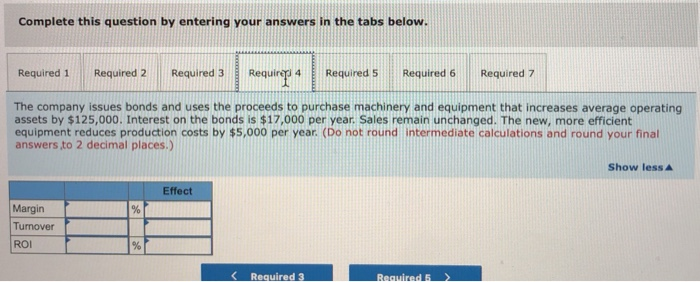

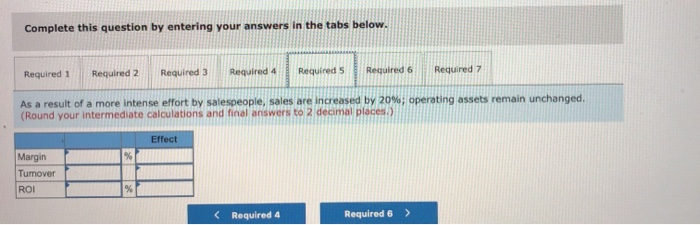

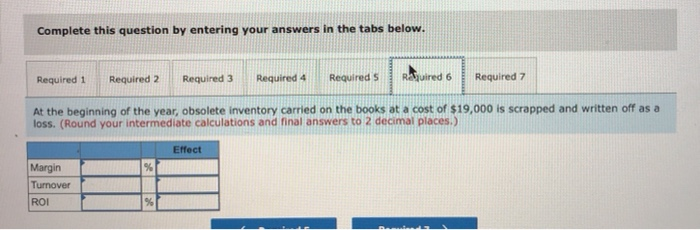

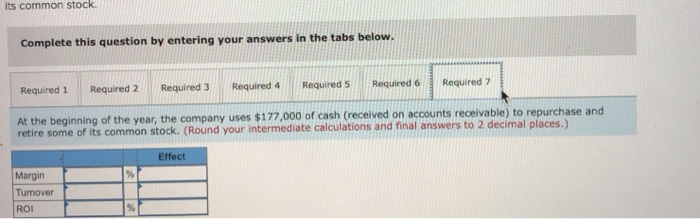

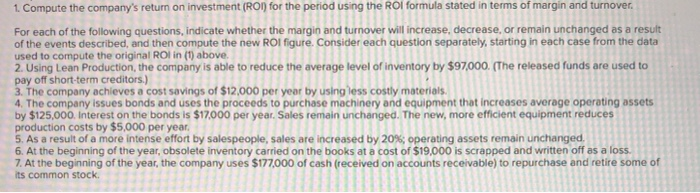

1. Compute the company's return on investment (RON) for the period using the ROI formula stated in terms of margin and turnover. For each of the following questions, indicate whether the margin and turnover will increase, decrease, or remain unchanged as a result of the events described, and then compute the new ROI figure. Consider each question separately, starting in each case from the data used to compute the original ROI in (1) above. 2. Using Lean Production, the company is able to reduce the average level of inventory by $97,000. (The released funds are used to pay off short-term creditors.) 3. The company achieves a cost savings of $12,000 per year by using less costly materials 4. The company issues bonds and uses the proceeds to purchase machinery and equipment that increases average operating assets by $125,000. Interest on the bonds is $17,000 per year. Sales remain unchanged. The new, more efficient equipment reduces production costs by $5,000 per year. 5. As a result of a more intense effort by salespeople, sales are increased by 20%; operating assets remain unchanged. 6. At the beginning of the year, obsolete inventory carried on the books at a cost of $19,000 is scrapped and written off as a loss. 7. At the beginning of the year, the company uses $177,000 of cash (received on accounts receivable) to repurchase and retire some of its common stock Required: 1. Compute the company's return on investment (ROI) for the period using the ROI formula stated in terms of margin and turnover. For each of the following questions, indicate whether the margin and turnover will increase, decrease, or remain unchanged as a result of the events described, and then compute the new ROI figure. Consider each question separately, starting in each case from the data used to compute the original ROI in (1) above. 2. Using Lean Production, the company is able to reduce the average level of inventory by $97,000. (The released funds are used to pay off short-term creditors.) 3. The company achieves a cost savings of $12,000 per year by using less costly materials. 4. The company issues bonds and uses the proceeds to purchase machinery and equipment that increases average operating assets by $125,000. Interest on the bonds is $17.000 per year. Sales remain unchanged. The new, more efficient equipment reduces production costs by $5,000 per year. 5. As a result of a more intense effort by salespeople, sales are increased by 20%; operating assets remain unchanged. 6. At the beginning of the year, obsolete inventory carried on the books at a cost of $19,000 is scrapped and written off as a loss. 7. At the beginning of the year, the company uses $177,000 of cash (received on accounts receivable) to repurchase and retire some of its common stock Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Required 7 Compute the company's return on investment (ROI) for the period using the ROI formula stated in terms of margin and turnover. (Round your intermediate calculations and final answers to 2 decimal places.) Margin Tumover ROI 7. At the beginning of the year, the company uses $177,000 of cash (received on accounts receivable) to repurchase and retire its common stock Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Required 2 Using Lean Production, the company is able to reduce the average level of Inventory by $97,000. (The released funds are used to pay off short-term creditors.) (Round your intermediate calculations and final answers to 2 decimal places.) Effect Margin Turnover ROI % Required 1 Required 3 Complete this question by entering your answers in the tabs below. 25 Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Required 7 The company achieves a cost savings of $12,000 per year by using less costly materials. (Round your intermediate calculations and final answers to 2 decimal places.) Effect % Margin Turnover ROI % Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Requireret Required 5 Required 6 Required 7 The company issues bonds and uses the proceeds to purchase machinery and equipment that increases average operating assets by $125,000. Interest on the bonds is $17,000 per year. Sales remain unchanged. The new, more efficient equipment reduces production costs by $5,000 per year. (Do not round intermediate calculations and round your final answers to 2 decimal places.) Show less Effect % Margin Turnover ROI % Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Required 7 As a result of a more intense effort by salespeople, sales are increased by 20%, operating assets remain unchanged. (Round your intermediate calculations and final answers to 2 decimal places) Effect Margin Tumover ROI (Required 4 Required 6 > Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required s Raquired 6 Required 7 At the beginning of the year, obsolete inventory carried on the books at a cost of $19,000 is scrapped and written off as a loss. (Round your intermediate calculations and final answers to 2 decimal places.) Effect % Margin Turnover ROI % its common stock Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Required 7 At the beginning of the year, the company uses $177,000 of cash (received on accounts receivable) to repurchase and retire some of its common stock. (Round your intermediate calculations and final answers to 2 decimal places.) Effect Margin Tumover ROI 1. Compute the company's return on investment (RON) for the period using the ROI formula stated in terms of margin and turnover. For each of the following questions, indicate whether the margin and turnover will increase, decrease, or remain unchanged as a result of the events described, and then compute the new ROI figure. Consider each question separately, starting in each case from the data used to compute the original ROI in (1) above. 2. Using Lean Production, the company is able to reduce the average level of inventory by $97,000. (The released funds are used to pay off short-term creditors.) 3. The company achieves a cost savings of $12,000 per year by using less costly materials 4. The company issues bonds and uses the proceeds to purchase machinery and equipment that increases average operating assets by $125,000. Interest on the bonds is $17,000 per year. Sales remain unchanged. The new, more efficient equipment reduces production costs by $5,000 per year. 5. As a result of a more intense effort by salespeople, sales are increased by 20%; operating assets remain unchanged. 6. At the beginning of the year, obsolete inventory carried on the books at a cost of $19,000 is scrapped and written off as a loss. 7. At the beginning of the year, the company uses $177,000 of cash (received on accounts receivable) to repurchase and retire some of its common stock Required: 1. Compute the company's return on investment (ROI) for the period using the ROI formula stated in terms of margin and turnover. For each of the following questions, indicate whether the margin and turnover will increase, decrease, or remain unchanged as a result of the events described, and then compute the new ROI figure. Consider each question separately, starting in each case from the data used to compute the original ROI in (1) above. 2. Using Lean Production, the company is able to reduce the average level of inventory by $97,000. (The released funds are used to pay off short-term creditors.) 3. The company achieves a cost savings of $12,000 per year by using less costly materials. 4. The company issues bonds and uses the proceeds to purchase machinery and equipment that increases average operating assets by $125,000. Interest on the bonds is $17.000 per year. Sales remain unchanged. The new, more efficient equipment reduces production costs by $5,000 per year. 5. As a result of a more intense effort by salespeople, sales are increased by 20%; operating assets remain unchanged. 6. At the beginning of the year, obsolete inventory carried on the books at a cost of $19,000 is scrapped and written off as a loss. 7. At the beginning of the year, the company uses $177,000 of cash (received on accounts receivable) to repurchase and retire some of its common stock Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Required 7 Compute the company's return on investment (ROI) for the period using the ROI formula stated in terms of margin and turnover. (Round your intermediate calculations and final answers to 2 decimal places.) Margin Tumover ROI 7. At the beginning of the year, the company uses $177,000 of cash (received on accounts receivable) to repurchase and retire its common stock Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Required 2 Using Lean Production, the company is able to reduce the average level of Inventory by $97,000. (The released funds are used to pay off short-term creditors.) (Round your intermediate calculations and final answers to 2 decimal places.) Effect Margin Turnover ROI % Required 1 Required 3 Complete this question by entering your answers in the tabs below. 25 Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Required 7 The company achieves a cost savings of $12,000 per year by using less costly materials. (Round your intermediate calculations and final answers to 2 decimal places.) Effect % Margin Turnover ROI % Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Requireret Required 5 Required 6 Required 7 The company issues bonds and uses the proceeds to purchase machinery and equipment that increases average operating assets by $125,000. Interest on the bonds is $17,000 per year. Sales remain unchanged. The new, more efficient equipment reduces production costs by $5,000 per year. (Do not round intermediate calculations and round your final answers to 2 decimal places.) Show less Effect % Margin Turnover ROI % Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Required 7 As a result of a more intense effort by salespeople, sales are increased by 20%, operating assets remain unchanged. (Round your intermediate calculations and final answers to 2 decimal places) Effect Margin Tumover ROI (Required 4 Required 6 > Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required s Raquired 6 Required 7 At the beginning of the year, obsolete inventory carried on the books at a cost of $19,000 is scrapped and written off as a loss. (Round your intermediate calculations and final answers to 2 decimal places.) Effect % Margin Turnover ROI % its common stock Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Required 7 At the beginning of the year, the company uses $177,000 of cash (received on accounts receivable) to repurchase and retire some of its common stock. (Round your intermediate calculations and final answers to 2 decimal places.) Effect Margin Tumover ROI