Answered step by step

Verified Expert Solution

Question

1 Approved Answer

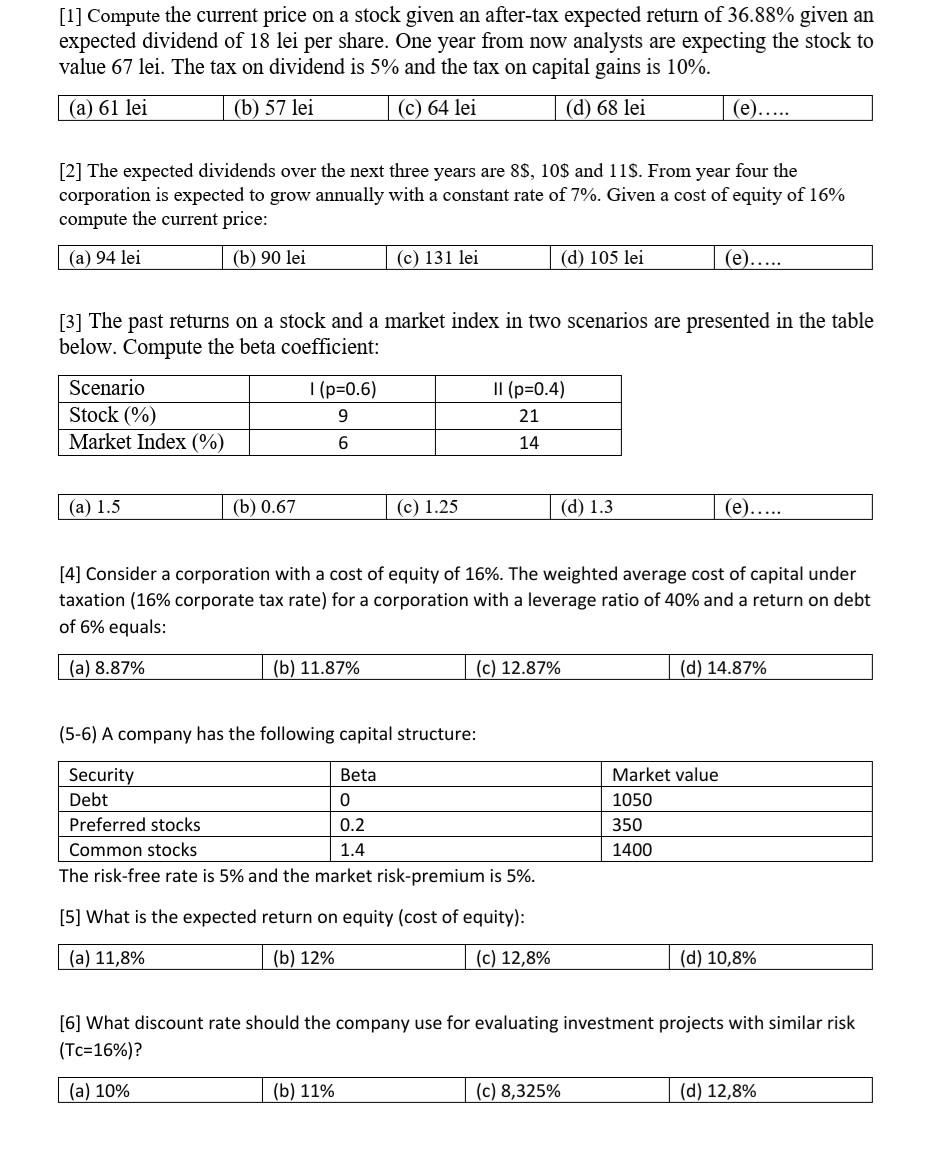

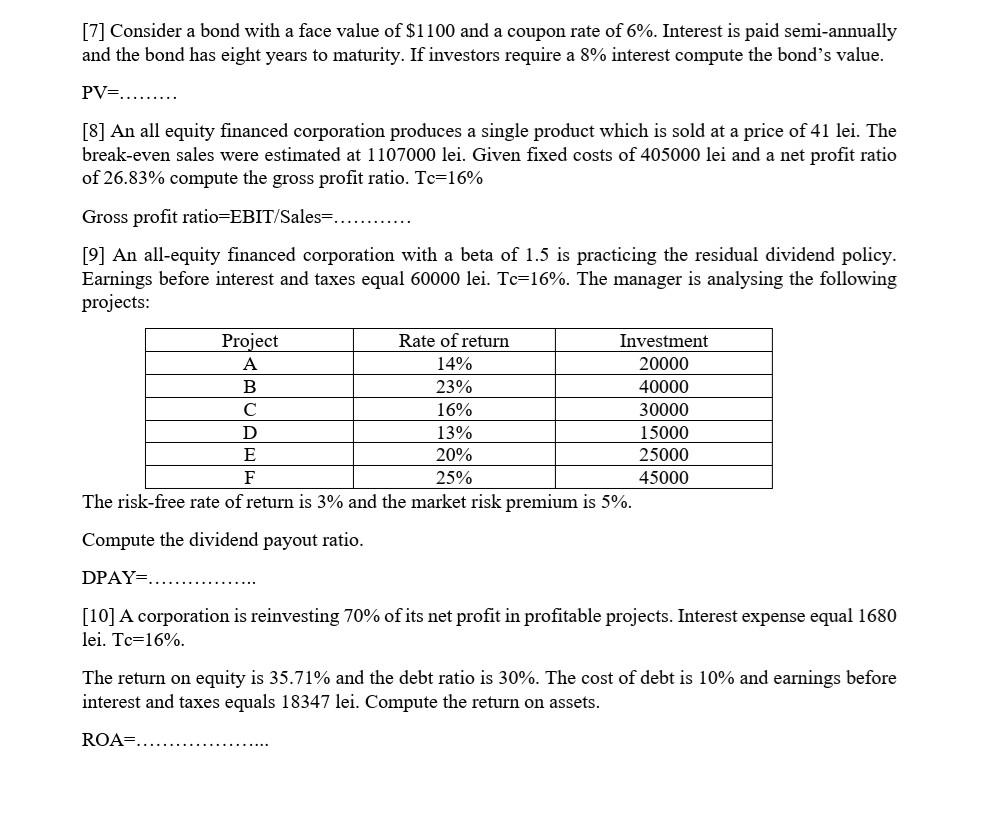

[1] Compute the current price on a stock given an after-tax expected return of 36.88% given an expected dividend of 18 lei per share. One

[1] Compute the current price on a stock given an after-tax expected return of 36.88% given an expected dividend of 18 lei per share. One year from now analysts are expecting the stock to value 67 lei. The tax on dividend is 5% and the tax on capital gains is 10%. (a) 61 lei (b) 57 lei (C) 64 lei (d) 68 lei (e)..... [2] The expected dividends over the next three years are 8$, 10$ and 119. From year four the corporation is expected to grow annually with a constant rate of 7%. Given a cost of equity of 16% compute the current price: (a) 94 lei (b) 90 lei (c) 131 lei (d) 105 lei (e)..... [3] The past returns on a stock and a market index in two scenarios are presented in the table below. Compute the beta coefficient: Scenario Stock (%) Market Index (%) (p=0.6) 9 II (p=0.4) 21 6 14 (a) 1.5 (b) 0.67 (c) 1.25 (d) 1.3 (e)..... [4] Consider a corporation with a cost of equity of 16%. The weighted average cost of capital under taxation (16% corporate tax rate) for a corporation with a leverage ratio of 40% and a return on debt of 6% equals: (a) 8.87% (b) 11.87% (c) 12.87% (d) 14.87% (5-6) A company has the following capital structure: Security Beta Debt 0 Preferred stocks 0.2 Common stocks 1.4 The risk-free rate is 5% and the market risk-premium is 5%. Market value 1050 350 1400 [5] What is the expected return on equity (cost of equity): (a) 11,8% (b) 12% (c) 12,8% (d) 10,8% [6] What discount rate should the company use for evaluating investment projects with similar risk (Tc=16%)? (a) 10% (b) 11% (c) 8,325% (d) 12,8% [7] Consider a bond with a face value of $1100 and a coupon rate of 6%. Interest is paid semi-annually and the bond has eight years to maturity. If investors require a 8% interest compute the bond's value. PV=......... [8] An all equity financed corporation produces a single product which is sold at a price of 41 lei. The break-even sales were estimated at 1107000 lei. Given fixed costs of 405000 lei and a net profit ratio of 26.83% compute the gross profit ratio. Tc=16% Gross profit ratio=EBIT/Sales=.. [9] An all-equity financed corporation with a beta of 1.5 is practicing the residual dividend policy. Earnings before interest and taxes equal 60000 lei. Tc=16%. The manager is analysing the following projects: Project Rate of return Investment A 14% 20000 B 23% 40000 16% 30000 D 13% 15000 E 20% 25000 F 25% 45000 The risk-free rate of return is 3% and the market risk premium is 5%. Compute the dividend payout ratio. DPAY=. [10] A corporation is reinvesting 70% of its net profit in profitable projects. Interest expense equal 1680 lei. Tc=16%. The return on equity is 35.71% and the debt ratio is 30%. The cost of debt is 10% and earnings before interest and taxes equals 18347 lei. Compute the return on assets. ROA=. [1] Compute the current price on a stock given an after-tax expected return of 36.88% given an expected dividend of 18 lei per share. One year from now analysts are expecting the stock to value 67 lei. The tax on dividend is 5% and the tax on capital gains is 10%. (a) 61 lei (b) 57 lei (C) 64 lei (d) 68 lei (e)..... [2] The expected dividends over the next three years are 8$, 10$ and 119. From year four the corporation is expected to grow annually with a constant rate of 7%. Given a cost of equity of 16% compute the current price: (a) 94 lei (b) 90 lei (c) 131 lei (d) 105 lei (e)..... [3] The past returns on a stock and a market index in two scenarios are presented in the table below. Compute the beta coefficient: Scenario Stock (%) Market Index (%) (p=0.6) 9 II (p=0.4) 21 6 14 (a) 1.5 (b) 0.67 (c) 1.25 (d) 1.3 (e)..... [4] Consider a corporation with a cost of equity of 16%. The weighted average cost of capital under taxation (16% corporate tax rate) for a corporation with a leverage ratio of 40% and a return on debt of 6% equals: (a) 8.87% (b) 11.87% (c) 12.87% (d) 14.87% (5-6) A company has the following capital structure: Security Beta Debt 0 Preferred stocks 0.2 Common stocks 1.4 The risk-free rate is 5% and the market risk-premium is 5%. Market value 1050 350 1400 [5] What is the expected return on equity (cost of equity): (a) 11,8% (b) 12% (c) 12,8% (d) 10,8% [6] What discount rate should the company use for evaluating investment projects with similar risk (Tc=16%)? (a) 10% (b) 11% (c) 8,325% (d) 12,8% [7] Consider a bond with a face value of $1100 and a coupon rate of 6%. Interest is paid semi-annually and the bond has eight years to maturity. If investors require a 8% interest compute the bond's value. PV=......... [8] An all equity financed corporation produces a single product which is sold at a price of 41 lei. The break-even sales were estimated at 1107000 lei. Given fixed costs of 405000 lei and a net profit ratio of 26.83% compute the gross profit ratio. Tc=16% Gross profit ratio=EBIT/Sales=.. [9] An all-equity financed corporation with a beta of 1.5 is practicing the residual dividend policy. Earnings before interest and taxes equal 60000 lei. Tc=16%. The manager is analysing the following projects: Project Rate of return Investment A 14% 20000 B 23% 40000 16% 30000 D 13% 15000 E 20% 25000 F 25% 45000 The risk-free rate of return is 3% and the market risk premium is 5%. Compute the dividend payout ratio. DPAY=. [10] A corporation is reinvesting 70% of its net profit in profitable projects. Interest expense equal 1680 lei. Tc=16%. The return on equity is 35.71% and the debt ratio is 30%. The cost of debt is 10% and earnings before interest and taxes equals 18347 lei. Compute the return on assets. ROA=

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started