Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Compute the deductible interest expense.2. Compute the total itemized deductions.3. Compute the deductible contributions to pension and trusts.4. Compute the taxable income.5. Compute the

1. Compute the deductible interest expense.2. Compute the total itemized deductions.3. Compute the deductible contributions to pension and trusts.4. Compute the taxable income.5. Compute the deductible depreciation expense.6. Compute the deductible research and development costs.7. Compute the deductible entertainment, amusement, and recreation expense.8. Compute the deductible taxes.

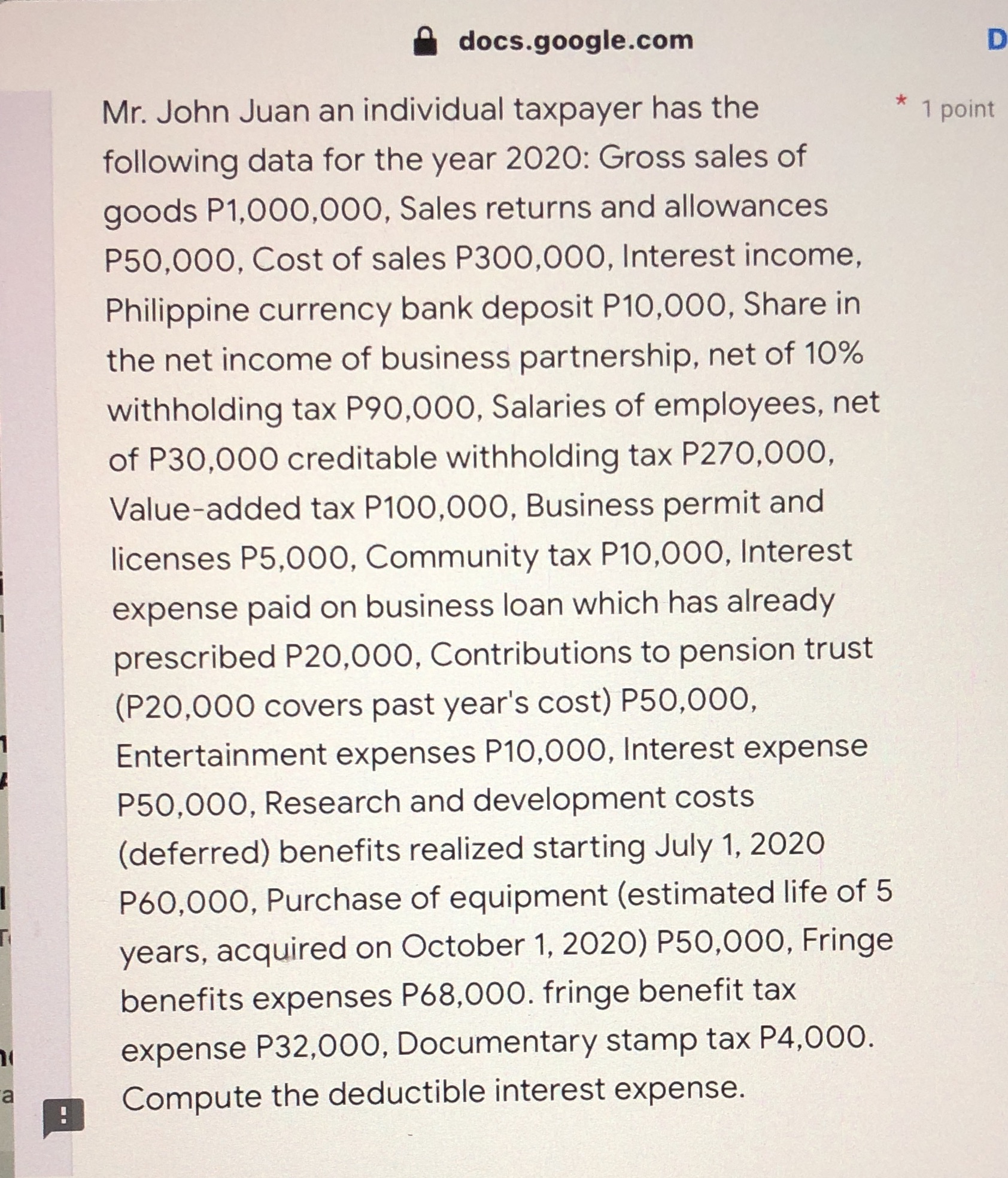

( a docs.google.com Mr. John Juan an individual taxpayer has the following data for the year 2020: Gross sales of goods P1,000,000, Sales returns and allowances P50,000, Cost of sales P300,000, Interest income, Philippine currency bank deposit P10,000, Share in the net income of business partnership, net of 10% withholding tax P90,000, Salaries of employees, net of P30,000 creditable withholding tax P270,000, Value-added tax P100,000, Business permit and licenses P5,000, Community tax P10,000, Interest expense paid on business loan which has already prescribed P20,000, Contributions to pension trust (P20,000 covers past year's cost) P50,000, Entertainment expenses P10,000, Interest expense P50,000, Research and development costs (deferred) benefits realized starting July 1, 2020 P60,000, Purchase of equipment (estimated life of 5 years, acquired on October 1, 2020) P50,000, Fringe benefits expenses P68,000. fringe benefit tax expense P32,000, Documentary stamp tax P4,000. Compute the deductible interest expense. D 1 point

Step by Step Solution

★★★★★

3.47 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

1 Compute the deductible interest expense Given Interest expense P50000 Interest expense that has al...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started