Question

1. Compute the deposits in transit at the end of August by comparing the deposits on the bank statement to the deposits listed on the

1. Compute the deposits in transit at the end of August by comparing the deposits on the bank statement to the deposits listed on the cash ledger account.

2. Compute the outstanding checks at the end of August by comparing the checks listed on the bank statement with those on the cash ledger account and the list of outstanding checks at the end of July.

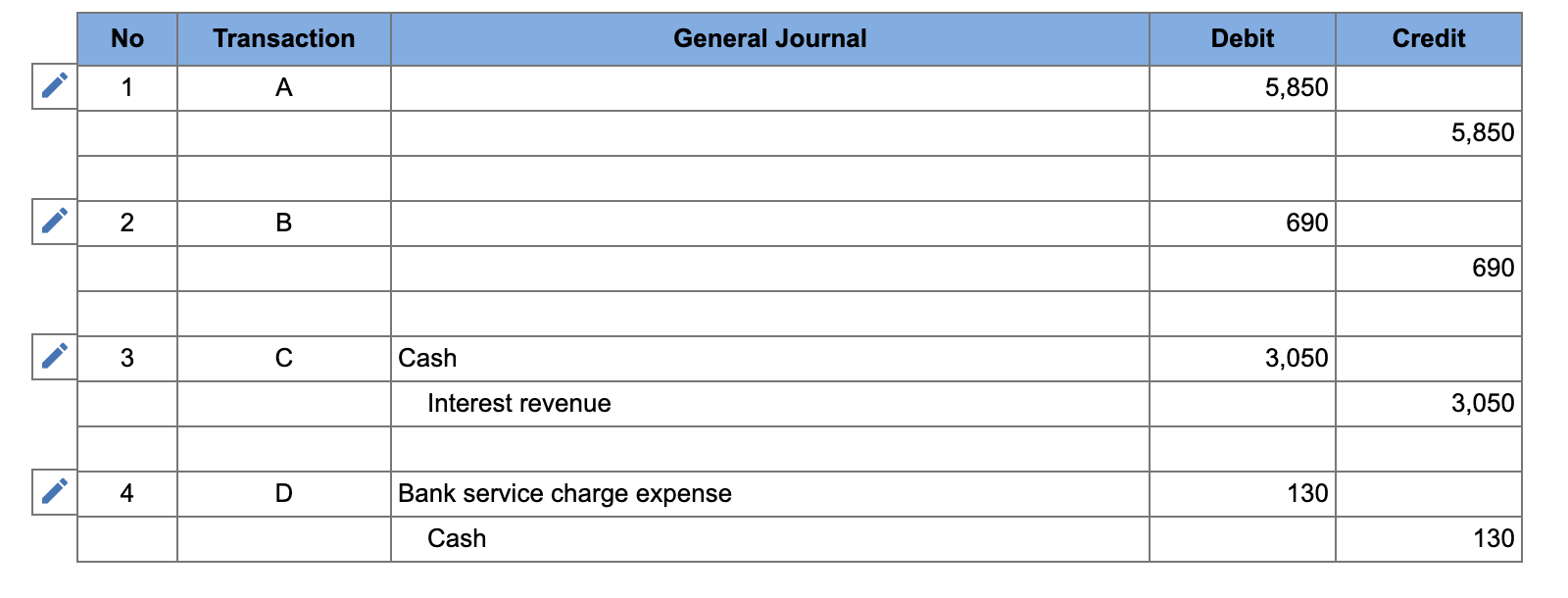

4. Prepare journal entries that the company should make as a result of the bank reconciliation. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

- Record the entry for deposits during August.

- Record the entry for checks cleared during August.

- Record entry for interest collected.

- Record entry for service charges deducted from bank balance.

5. What total amount of cash should be reported on the August 31, Current Year, balance sheet?

5. What total amount of cash should be reported on the August 31, Current Year, balance sheet?

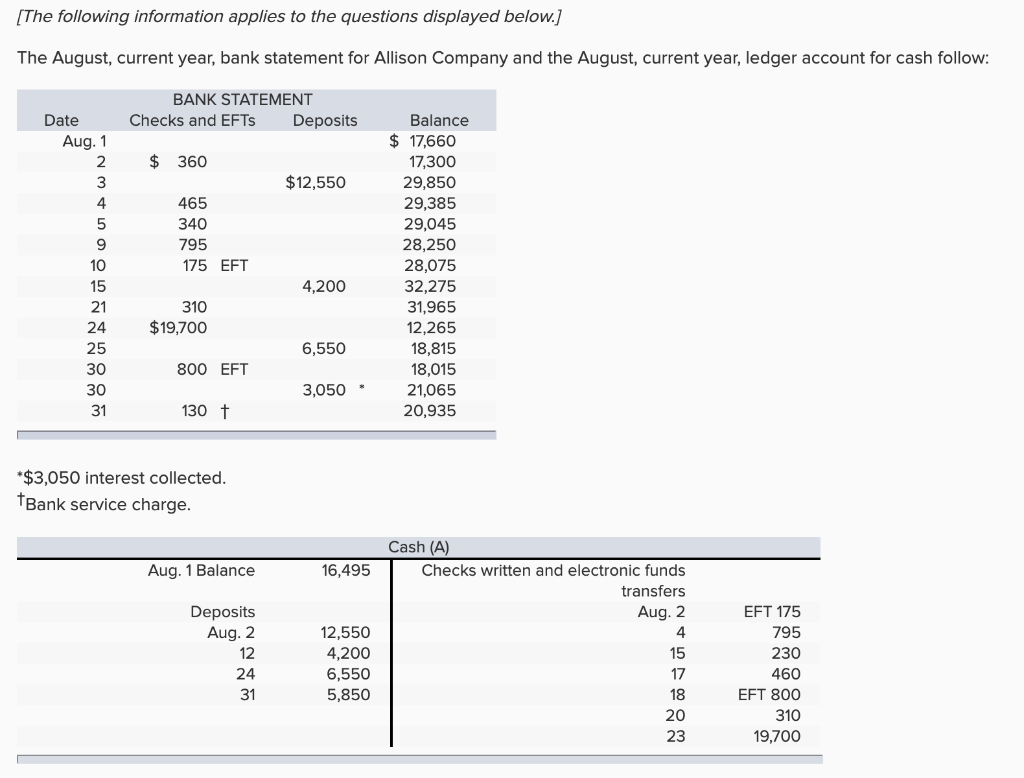

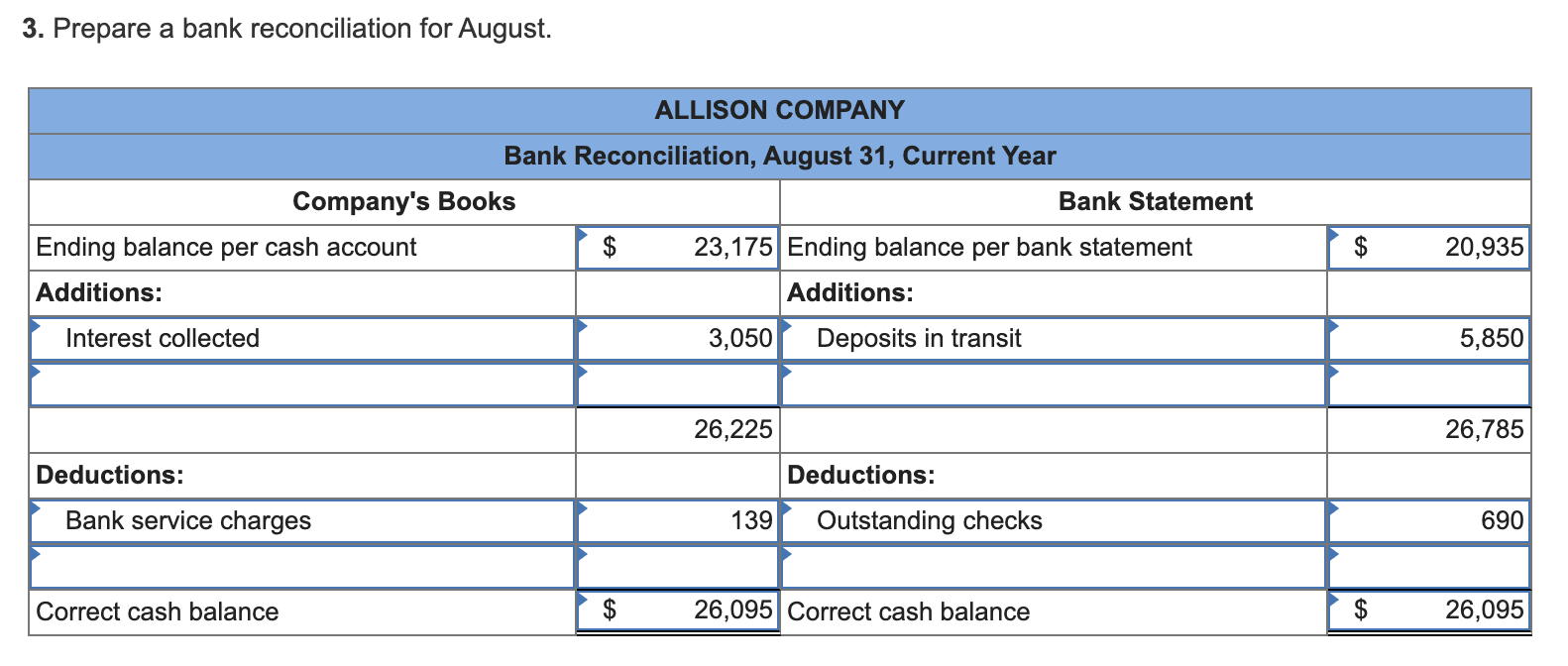

[The following information applies to the questions displayed below.] The August, current year, bank statement for Allison Company and the August, current year, ledger account for cash follow: BANK STATEMENT Checks and EFTs Deposits $ 360 $12,550 Date Aug. 1 2 3 4 5 9 10 15 21 465 340 795 175 EFT Balance $ 17,660 17,300 29,850 29,385 29,045 28,250 28,075 32,275 31,965 12,265 18,815 18,015 21,065 20,935 w o > 4,200 310 $19,700 6,550 800 EFT 25 30 30 31 3,050 * 130 t *$3,050 interest collected. tBank service charge. Aug. 1 Balance 16,495 Deposits Aug. 2 12 24 31 12,550 4,200 6,550 5,850 Cash (A) Checks written and electronic funds transfers Aug. 2 4 15 17 18 20 23 EFT 175 795 230 460 EFT 800 310 19,700 3. Prepare a bank reconciliation for August. ALLISON COMPANY Bank Reconciliation, August 31, Current Year Company's Books Bank Statement Ending balance per cash account 23,175 Ending balance per bank statement Additions: Additions: 20,935 Interest collected 3,050 Deposits in transit 5,850 26,225 26,785 Deductions: Deductions: Bank service charges 139 Outstanding checks 690 Correct cash balance $ 26,095 Correct cash balance 26,095 No Transaction General Journal Debit Credit 1 A 5,850 5,850 2 B 690 690 3 Cash 3,050 Interest revenue 3,050 4 D Bank service charge expense 130 Cash 130

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started