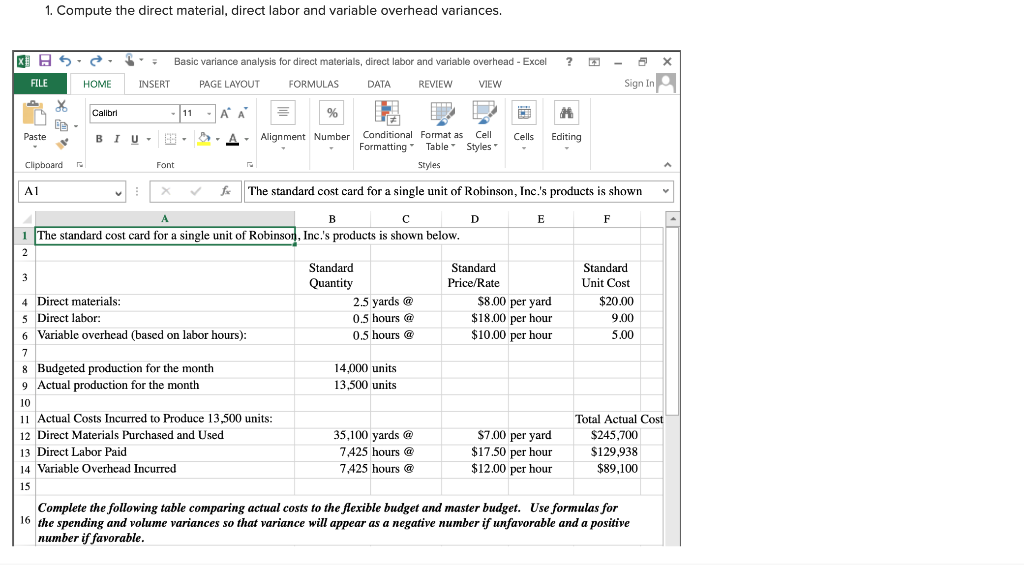

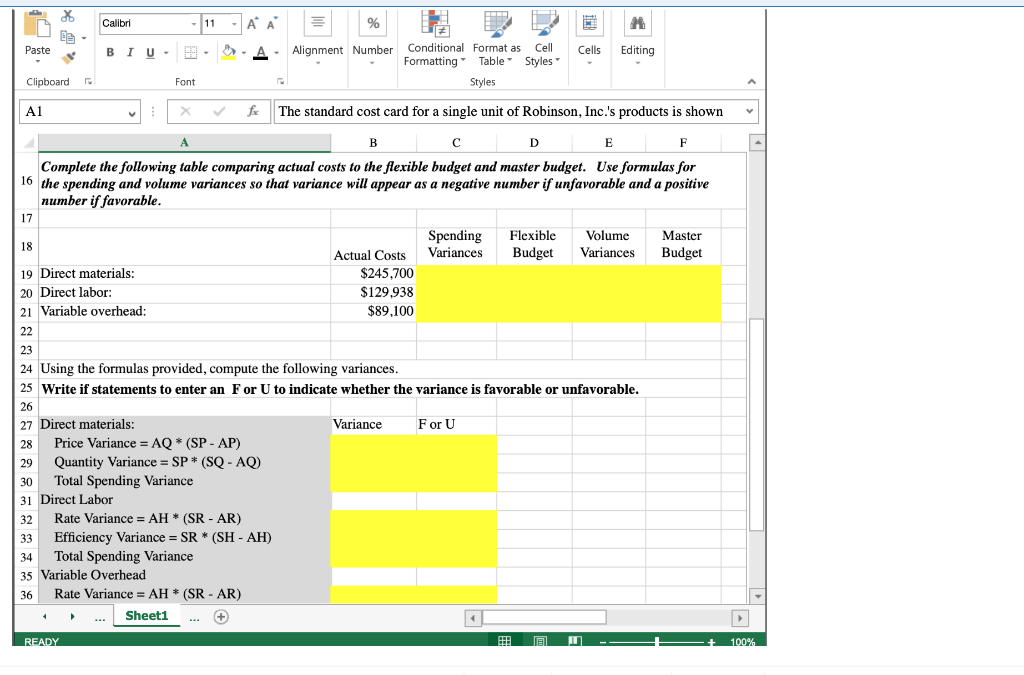

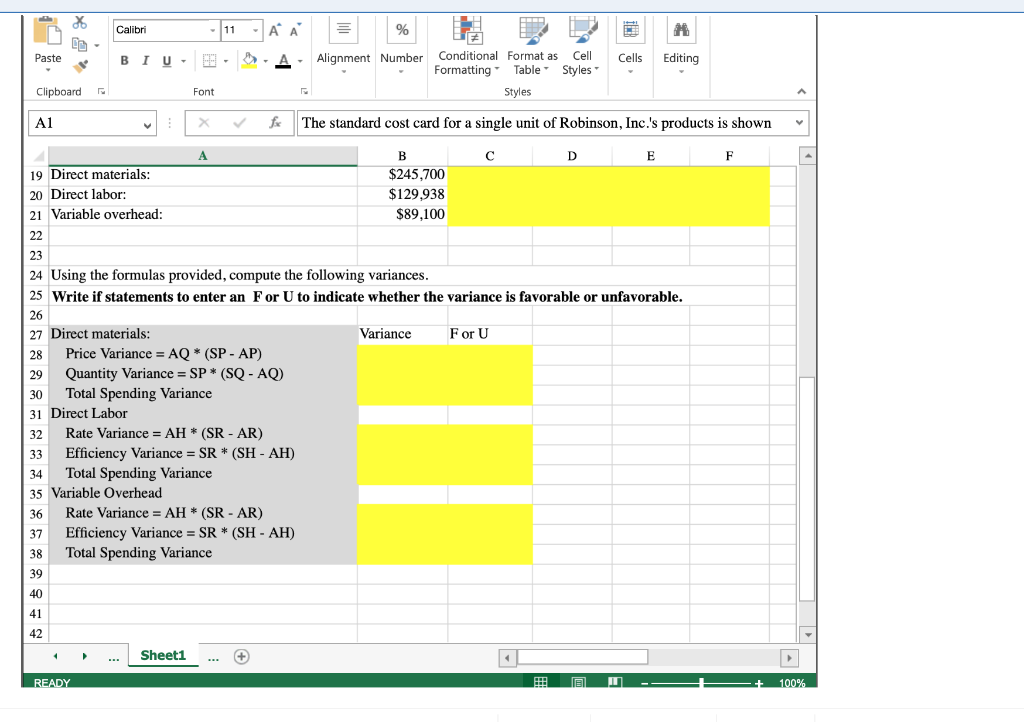

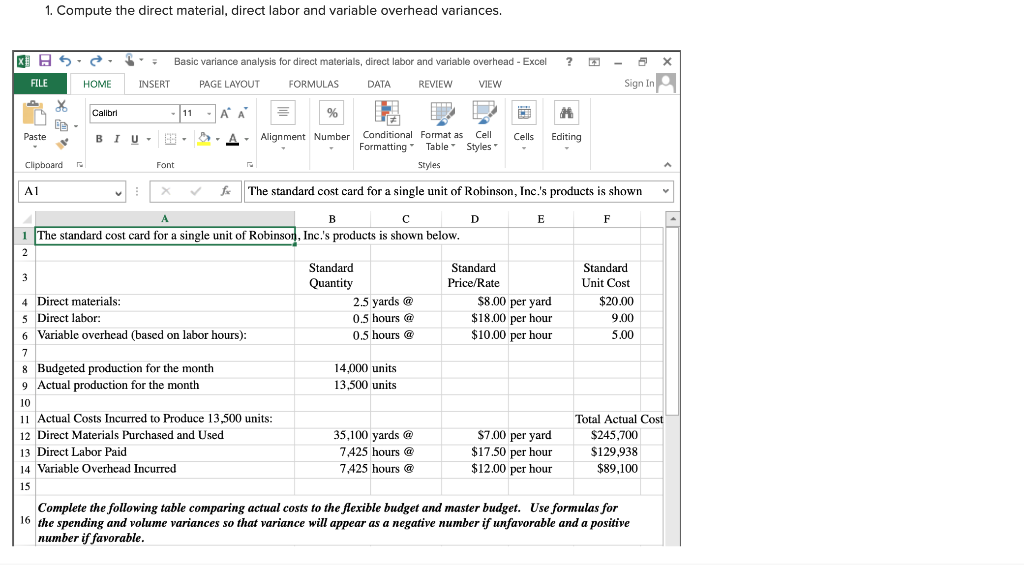

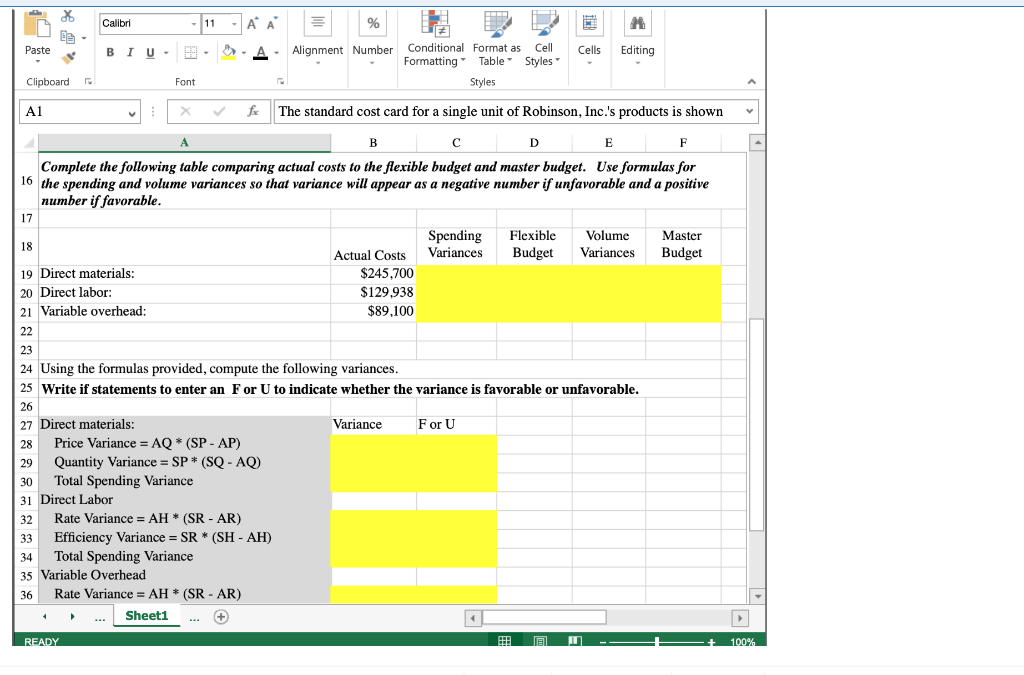

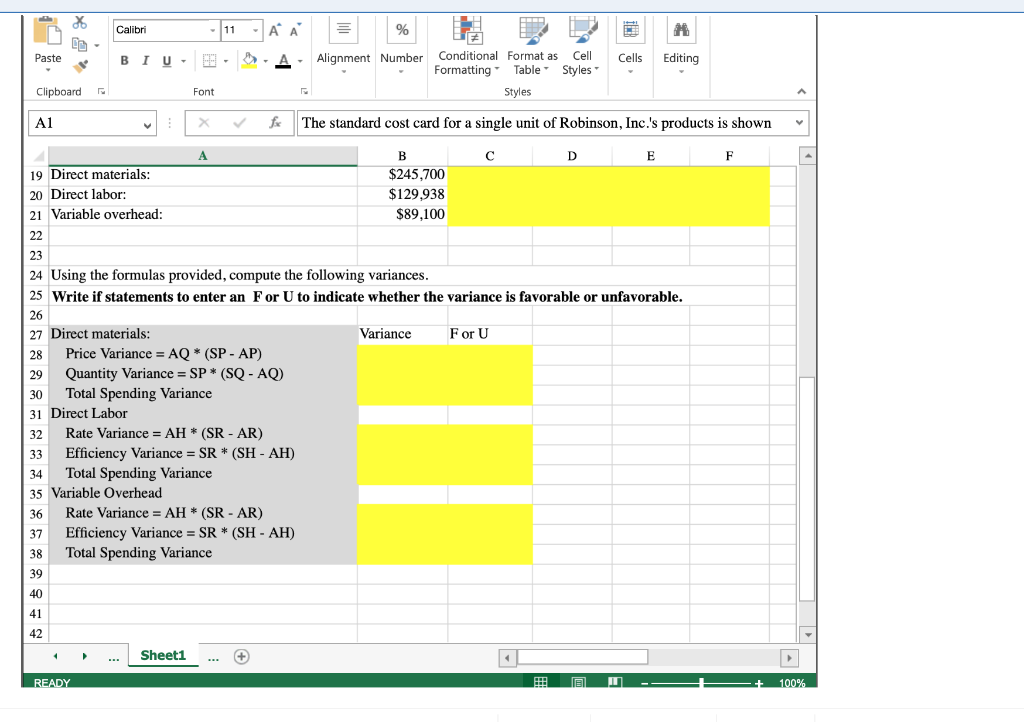

1. Compute the direct material, direct labor and variable overhead variances. X ? X 5. . HOME . Basic variance analysis for direct materials, direct labor and variable overhead - Excel INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW - 5 Sign In FILE Calibri B I A A A U 11 . 3- Font Alignment Number Cells Editing Conditional Format as Cell Formatting Table Styles Styles Clipboard X for The standard cost card for a single unit of Robinson, Inc.'s products is shown DEF 1 The standard cost card for a single unit of Robinson, Inc.'s products is shown below. 4 Direct materials: 5 Direct labor: 6 Variable overhead (based on labor hours): Standard Quantity 2.5 yards @ 0.5 hours @ 0.5 hours @ Standard Price/Rate $8.00 per yard $18.00 per hour $10.00 per hour Standard Unit Cost $20.00 9.00 5.00 8 Budgeted production for the month 9 Actual production for the month 14,000 units 13,500 units 11 Actual Costs Incurred to Produce 13,500 units: 12 Direct Materials Purchased and Used 13 Direct Labor Paid 14 Variable Overhead Incurred 35,100 yards @ 7,425 hours @ 7,425 hours @ $7.00 per yard $17.50 per hour $12.00 per hour Total Actual Cost $245,700 $129,938 $89,100 Complete the following table comparing actual costs to the flexible budget and master budget. Use formulas for 10 the spending and volume variances so that variance will appear as a negative number if unfavorable and a positive number if favorable. Calibri E- Paste B I U . 29. A Alignment Number Cells Editing Conditional Format as Formatting' Table Styles Cell Styles Clipboard Font A1 x fx The standard cost card for a single unit of Robinson, Inc.'s products is shown D E F Complete the following table comparing actual costs to the flexible budget and master budget. Use formulas for 16 the spending and volume variances so that variance will appear as a negative number if unfavorable and a positive number if favorable. Spending Variances Flexible Budget Volume Variances Master Budget 19 Direct materials: 20 Direct labor: 21 Variable overhead: Actual Costs $245,700 $129,938 $89,100 | 24 Using the formulas provided, compute the following variances. 25 Write if statements to enter an For U to indicate whether the variance is favorable or unfavorable. Variance For U 27 Direct materials: 28 Price Variance = AQ * (SP-AP) Quantity Variance = SP* (SQ - AQ) 30 Total Spending Variance 31 Direct Labor 32 Rate Variance = AH * (SR - AR) 33 Efficiency Variance = SR* (SH - AH) 34 Total Spending Variance 35 Variable Overhead 36 Rate Variance = AH * (SR - AR) . ... Sheet1 ... + READY t 100% Calibri Calibri 11 A A = % DD Paste B I U . . >> A. Alignment Number Cells Editing Conditional Format as Cell Formatting Table Styles Styles Clipboard Font A1 fx The standard cost card for a single unit of Robinson, Inc.'s products is shown B C D E F $245,700 $129,938 $89,100 19 Direct materials: 20 Direct labor: 21 Variable overhead: 24 Using the formulas provided, compute the following variances. 25 Write if statements to enter an For U to indicate whether the variance is favorable or unfavorable. Variance For U 27 Direct materials: 28 Price Variance = AQ * (SP-AP) 29 Quantity Variance = SP* (SQ - AQ) 30 Total Spending Variance 31 Direct Labor 32 Rate Variance = AH * (SR - AR) 33 Efficiency Variance = SR* (SH - AH) 34 Total Spending Variance 35 Variable Overhead Rate Variance = AH * (SR - AR) Efficiency Variance = SR* (SH - AH) Total Spending Variance ... Sheet1 ... + READY - + 100%