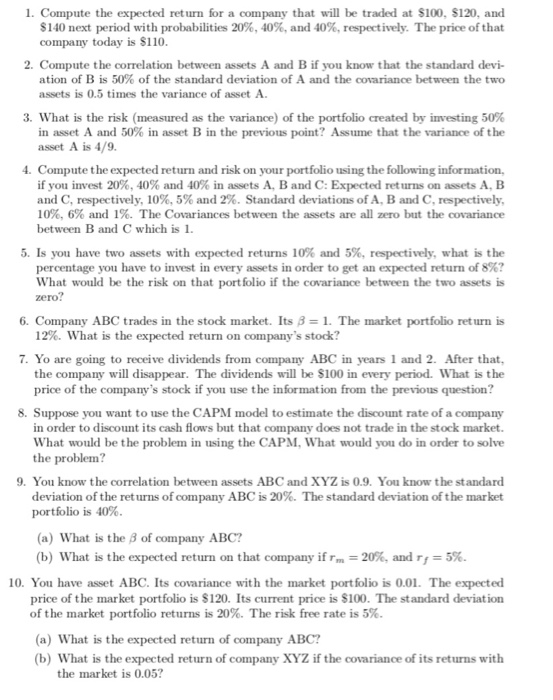

1. Compute the expected return for a company that will be traded at $100, $120, and $140 next period with probabilities 20%, 40%, and 40%, respectively. The price of that company today is S110. 2. Compute the correlation between assets A and B if you know that the standard devi- ation of B is 50% of the standard deviation of A and the covariance between the two assets is 0.5 times the variance of asset A 3, what is the risk (measured as the variance) of the portfolio created by investing 50% in asset A and 50% in asset B in the previous point? Assume that the variance of the asset A is 4/9. 4. Compute the expected return and risk on your portfolio using the following information if you invest 20%, 40% and 40% in assets A, B and C: Expected returns on assets A. B and C, respectively, 10%, 5% and 2%. Standard deviations of A. B and C. respectively, 10%, 6% and 1%. The Covariances between the assets are all zero but the covariance between B and C which is 1 5. Is you have two assets with expected returns 10% and 5%, respectively, what is the percentage you have to invest in every assets in order to get an expected return of 8%? What would be the risk on that port folio if the covariance between the two assets is zero 6, Company ABC trades in the stock market. Its 1. The market portfolio return is 12%. What is the expected return on company's stock? 7. are going to receive dividends fron company ABC in years 1 and 2" After that. the company will disappear. The dividends will be $100 in every period. What is the price of the company's stock if you use the information from the previous question? 8. Suppose you want to use the CAPM model to estimate the discount rate of a company in order to discount its cash flows but that company does not trade in the stock market. What would be the problem in using the CAPM, What would you do in order to solve the problem? 9. You know the correlation between assets ABC and XYZ is 0.9. You know the standard deviation of the returns of company ABC is 20%. The standard deviation of the market portfolio is 40%. (a) What is the B of company ABC? (b) What is the expected return on that company if rm-20%, and rf 5%. 10. You have asset ABC. Its covariance with the market port folio is 0.01. The expected price of the market portfolio is S120. Its current price is $100. The standard deviation of the market portfolio returns is 20%. The risk free rate is 5%. (a) What is the expected return of company ABC? (b) What is the expected return of company XYZ if the coariance of its returns with the market is 0.05