Answered step by step

Verified Expert Solution

Question

1 Approved Answer

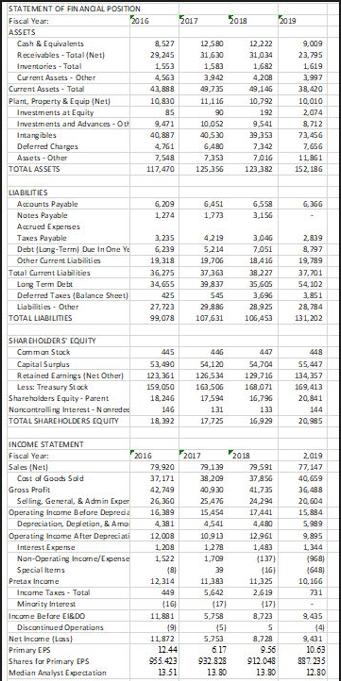

1. Compute the five component ratios of a decomposition of ROE (net profit margin, total asset turnover, return on assets, financial leverage, return on equity)

- 1. Compute the five component ratios of a decomposition of ROE (net profit margin, total asset turnover, return on assets, financial leverage, return on equity) for IBM's fiscal years 2016-2019 (present your results)

- 2. What patterns do you see? What are the implications of these patterns?

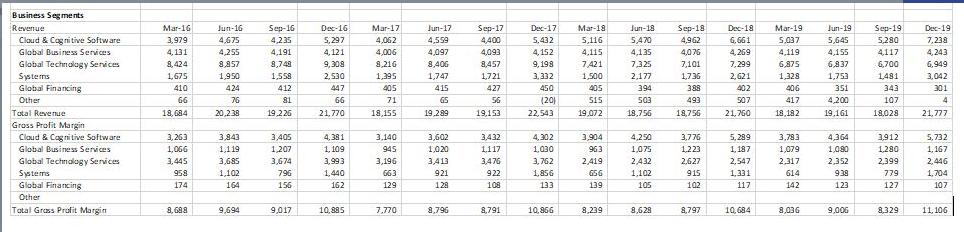

- 3. Compute each segment's revenue as a percentage of IBM total revenues by quarter.

- 4. What patterns do you see? What are the implications of these patterns?

- 5. Compute the gross margin percentage, by quarter, for each of IBM's segments (present your results).

- 6. What patterns do you see? What are the implications of these patterns?

- 7. Compute the year-to-year change, by quarter, in Revenues for each of IBM's business segments (present your results).

- 8. What patterns to you see? What are the implications of these patterns?

- 9. Compute the year-to-year change in gross margin percentage, by quarter, for each of IBM's segments (present your results).

- 10. What patterns to you see? What are the implications of these patterns?

- 11. Which segment(s) are positively (negatively) influencing IBM's recent performance? What are the implications of this?

- 12. What does your analysis indicate regarding IBM's future performance?

STATEMENT OF FINANCIAL POSITION Fiscal Year: 2016 ASSETS Cash & Equivalents Receivables-Total (Net) Inventories - Total Current Assets Other Current Assets- Total Plant, Property & Equip (Net) Investments at Equity Investments and Advances - O Intangibles Deferred Charges Assets Other TOTAL ASSETS LIABILITIES Accounts Payable Notes Payable Accrued Expenses Taxes Payable Debt (Long-Term Due In One Ye Other Current Liabilities Total Current Liabilities Long Term Debt Deferred Taxes (Balance Sheet) Liabilities - Other TOTAL LIABILITIES SHAREHOLDERS' EQUITY Comman Stock Capital Surplus Retained Earnings (Net Other) Less: Treasury Stock Shareholders Equity-Parent Noncontrolling Interest-Nonrede TOTAL SHAREHOLDERS EQUITY INCOME STATEMENT Fiscal Year: Sales (Net) Cast of Goods Sold Gross Profit Selling General, & Admin Exper Operating Income Before Deprecia Depreciation, Depletion, & Amo Operating Income After Depreciati Interest Expense Non-Operating Income/Expense Special items Pretax Income Income Taxes - Total Minority Interest Income Before E1&00 Discontinued Operations Net Income (Lass} Primary EPS Shares for Primary EPS Median Analyst Expectation 8.527 29,245 1,553 4,563 43,888 10.830 85 9,471 40,887 4,761 7,548 117,470 6.209 1,274 3,235 6,239 19,318 36,275 34,655 425 27,723 99,078 445 53,490 123.361 159,050 18,246 14G 18.392 2016 79,920 37,171 42,749 26,360 16,389 4,381 12,008 1,208 1,522 (8) 12,314 449 (16) 11,881 (9) 11,872 12.44 955.423 13.51 2017 12,580 31,630 1,583 3,942 49,735 11,116 90 10.052 40,530 6,480 7,353 125,356 6,451 1,773 446 54,120 126,534 163,506 17,594 131 17,725 2017 4219 3,046 5,214 7,051 19,706 18,416 37,363 38,227 39,837 35,605 545 3,696 29,986 28,925 107,631 106,453 79,139 39,209 40,930 25,476 15,454 4,541 10.913 1,278 1,709 39 11,383 5,642 (17) 5,758 (5) 5,753 2018 6.17 932.828 13.80 12,222 31,034 1,682 4,208 49,146 10,792 192 9,541 39,353 7,342 7,016 123,382 6,558 3,156 447 54,704 129,716 168,071 16,796 133 16,929 2018 79,591 37,856 41,735 24,294 17,441 4,480 12,961 1,483 (137) (16) 11,325 2,619 (17) 8,723 5 8,728 9.56 912.048 13.30 2019 9,009 23,795 1,619 3,997 38,420 10,010 2,074 8,712 73,456 7,656 11,961 152,186 6.366 2,839 8,797 19,7989 37,701 54,102 3.851 28,784 131,202 448 55,447 134,357 169,413 20,841 144 20,985 2,019 77,147 40,659 36,488 20,004 15,884 5,999 9,895 1,344 (968) (648) 10.166 731 . 9,435 (4) 9,431 10.63 387.235 12.90

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

1 Component ratios of ROE for IBMs fiscal years 20162019 2016 Net Profit Margin 1187279920 100 1485 Total Asset Turnover 79920117470 068 Return on Assets 11872117470 1009 Financial Leverage 1174701839...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started