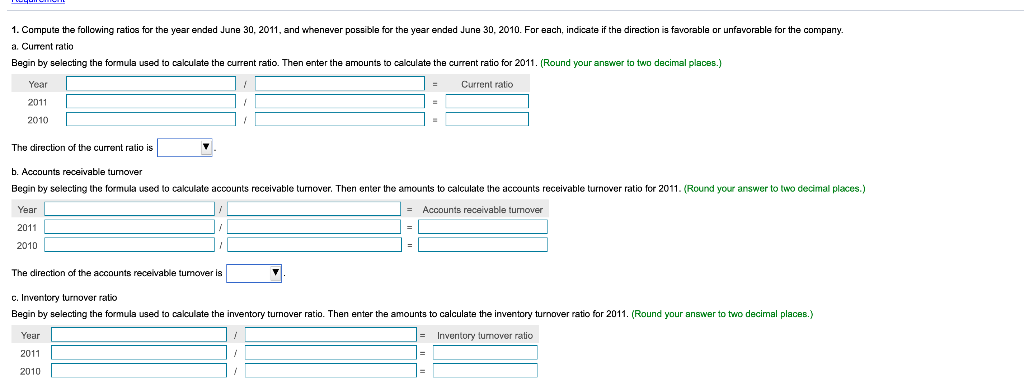

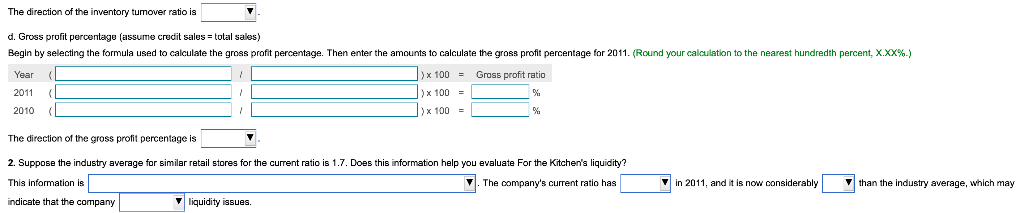

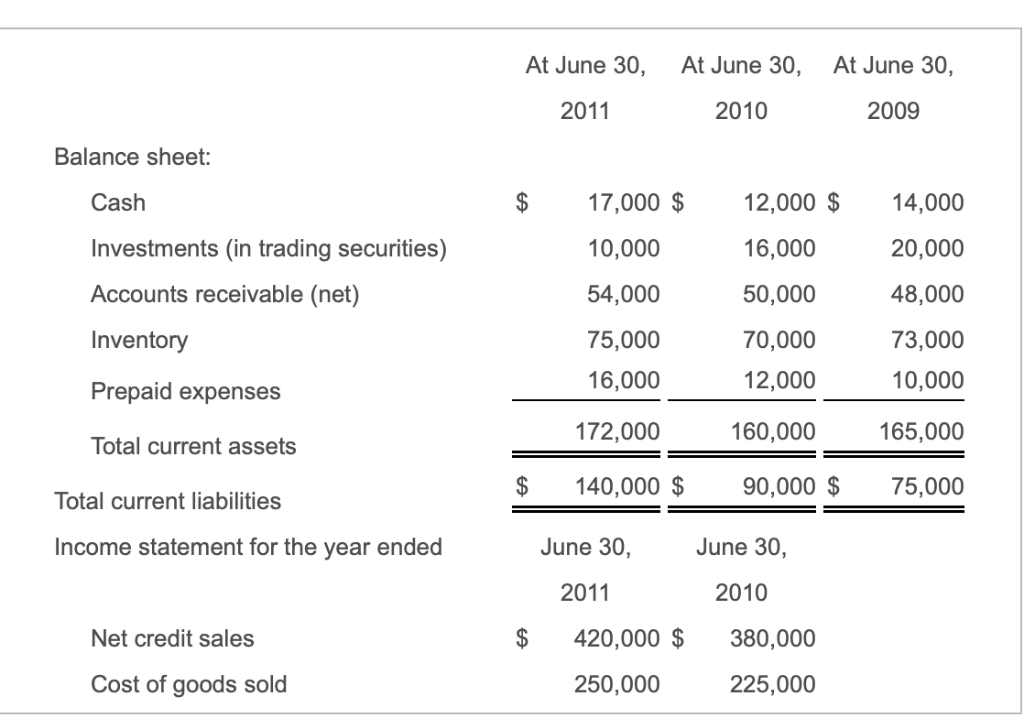

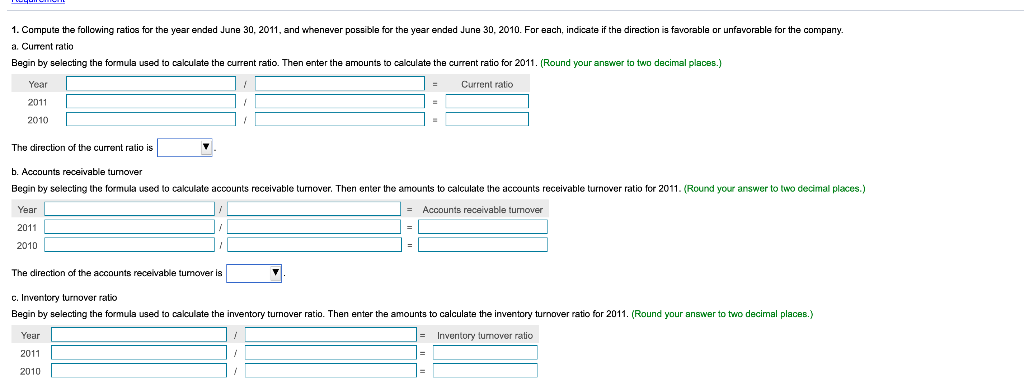

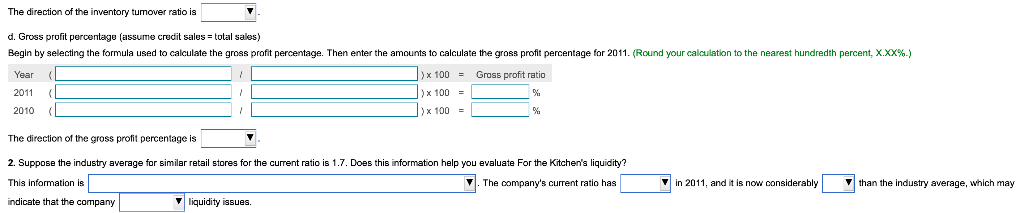

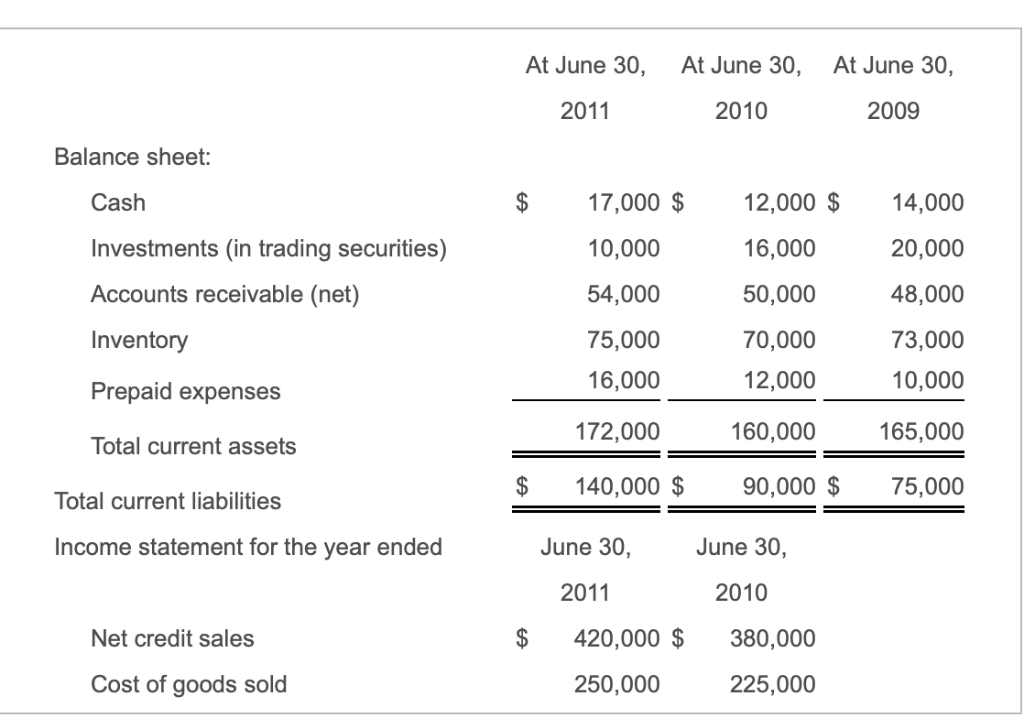

1. Compute the following ratios for the year ended June 30, 2011, and whenever possible for the year ended June 30, 2010. For each, indicate if the diraction is favorable or unfavorable for the company. a. Current ratio two decimal places.) Begin by selecting the formula used to calculate the current ratio. Then enter the amounts to calculate the current ratio for 2011. (Round your answer Year Current ratio 2011 2010 The direction of the current ratio is b. Accounts receivable tumover selecting the formula used to calculate accounts receivable turnover. Then enter the amounts to calculate the accounts receivable turnover ratio for 2011. (Round your answer to two decimal places.) Begin b Year =Accounts receivable tumover 2011 2010 The direction of the accounts receivable tumover is . Inventory turnover ratio Begin by selecting the formula used to calculate the inventory turnover ratio. Then enter the amounts to calculate the inventory turnover ratio for 2011. (Round your answer to two decimal places.) Inventory tumover ratio Year 2011 2010 The direction of the inventory tumover ratio is Gross profit percentage (assume credit sales total sales) 2011. (Round your calculation to the nearest hundredth percent, X.XX% . ) Begin by selecting the formula used to calculate the gross prafit percentage. Then enter the amounts to calculate the gross profit percentage x 100 Gross profit ratio Year 2011 100 2010 100 The direction of the gross profit percentage is Suppose the industry average for similar retail stores for the curent ratio is 1.7. Does this information help you evaluate For the Kitchen's liquidity? The company's current ratio has in 2011, and it is now considerably than the industry average, which may This information is liquidity issues. indicate that the company At June 30, At June 30, At June 30, 2011 2010 2009 Balance sheet: $ 17,000 $ 12,000 $ Cash 14,000 Investments (in trading securities) 10,000 16,000 20,000 Accounts receivable (net) 54,000 50,000 48,000 73,000 Inventory 75,000 70,000 12,000 16,000 10,000 Prepaid expenses 172,000 160,000 165,000 Total current assets $ 140,000 $ 90,000 $ 75,000 Total current liabilities June 30 Income statement for the year ended June 30, 2011 2010 $ 420,000 $ Net credit sales 380,000 Cost of goods sold 225,000 250,000