Answered step by step

Verified Expert Solution

Question

1 Approved Answer

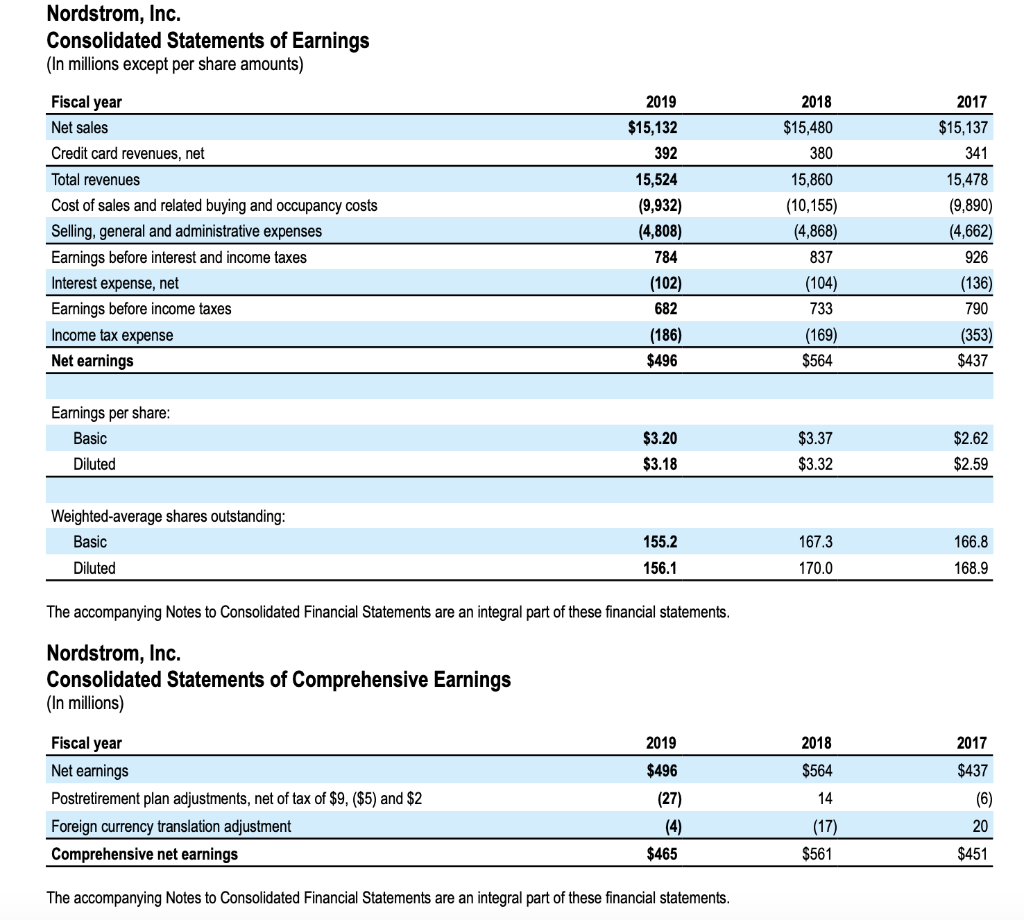

1) compute the inventory turnover (INVT) for fiscal year 2019, interpret their turnover ratios 2) compute property, plant and equipment turnover (PPET) for fiscal year

1) compute the inventory turnover (INVT) for fiscal year 2019, interpret their turnover ratios

1) compute the inventory turnover (INVT) for fiscal year 2019, interpret their turnover ratios

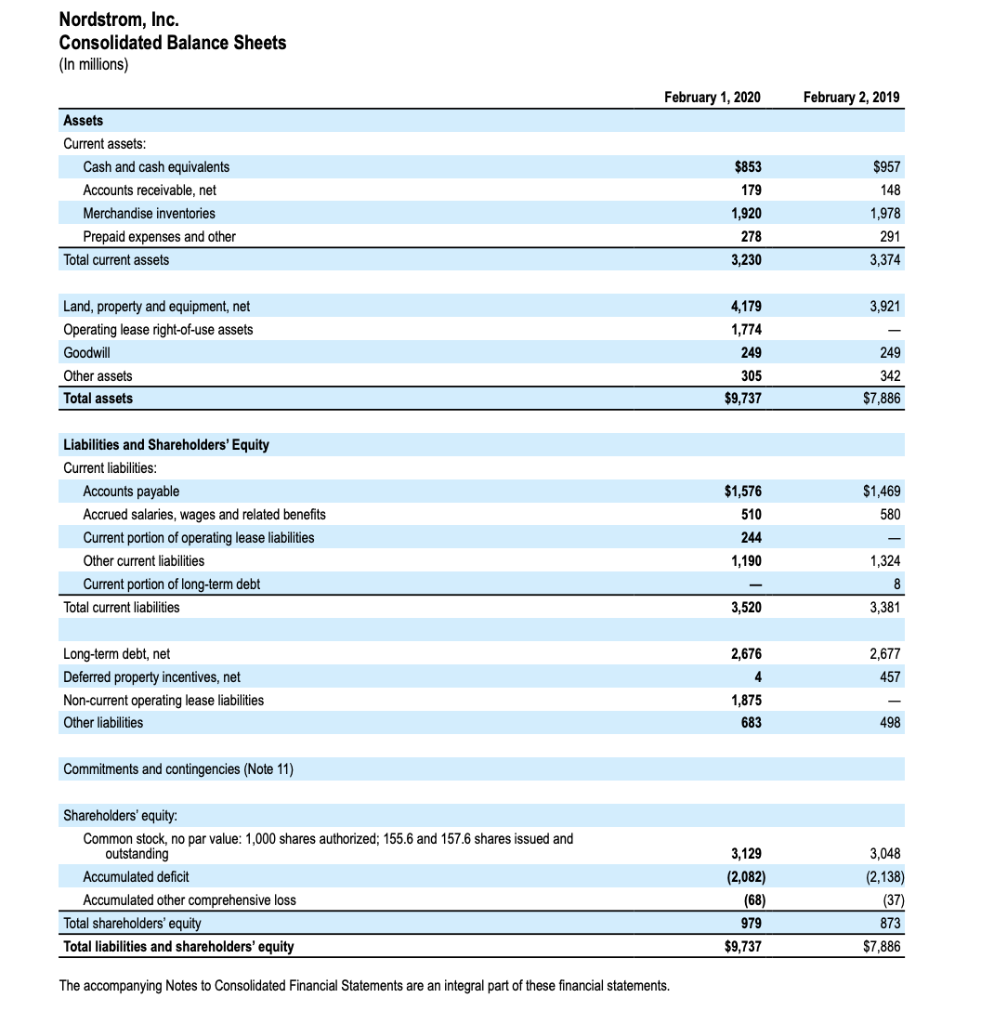

2) compute property, plant and equipment turnover (PPET) for fiscal year 2019 both with and without including the operating lease right-of-use assets. Which measure do you think is more reflective of property, plant and equipment turnover and why?

3) Evaluate liquidity and solvency. Compute each companys current ratio, quick ratio times interest earned ratio, and debt-to-equity ratio for the most recent year.

Nordstrom, Inc. Consolidated Statements of Earnings (In millions except per share amounts) 2018 Fiscal year Net sales Credit card revenues, net Total revenues Cost of sales and related buying and occupancy costs Selling, general and administrative expenses Earnings before interest and income taxes Interest expense, net Earnings before income taxes Income tax expense Net earnings 2019 $15,132 392 15,524 (9,932) (4,808) 784 (102) $15,480 380 15,860 (10,155) (4,868) 837 (104) 733 (169) $564 2017 $15,137 341 15,478 (9,890) (4,662) 926 (136) 790 (353) $437 682 (186) $496 Earnings per share: Basic Diluted $3.20 $3.18 $3.37 $3.32 $2.62 $2.59 Weighted average shares outstanding: Basic Diluted 155.2 167.3 166.8 156.1 170.0 168.9 The accompanying Notes to Consolidated Financial Statements are an integral part of these financial statements. Nordstrom, Inc. Consolidated Statements of Comprehensive Earnings (In millions) 2019 2018 2017 $496 $564 $437 Fiscal year Net earnings Postretirement plan adjustments, net of tax of $9, ($5) and $2 Foreign currency translation adjustment Comprehensive net earnings 14 (6) (27) (4) 20 (17) $561 $465 $451 The accompanying Notes to Consolidated Financial Statements are an integral part of these financial statements. Nordstrom, Inc. Consolidated Balance Sheets (In millions) February 1, 2020 February 2, 2019 $853 Assets Current assets: Cash and cash equivalents Accounts receivable, net Merchandise inventories Prepaid expenses and other Total current assets 179 1,920 278 3,230 $957 148 1,978 291 3,374 3,921 Land, property and equipment, net Operating lease right-of-use assets Goodwill Other assets Total assets 4,179 1,774 249 305 $9,737 249 342 $7,886 $1,469 580 Liabilities and Shareholders' Equity Current liabilities: Accounts payable Accrued salaries, wages and related benefits Current portion of operating lease liabilities Other current liabilities Current portion of long-term debt Total current liabilities $1,576 510 244 1,190 1,324 3,520 3,381 2,677 457 Long-term debt, net Deferred property incentives, net Non-current operating lease liabilities Other liabilities 2,676 4 1,875 683 498 Commitments and contingencies (Note 11) Shareholders' equity: Common stock, no par value: 1,000 shares authorized; 155.6 and 157.6 shares issued and outstanding Accumulated deficit Accumulated other comprehensive loss Total shareholders' equity Total liabilities and shareholders' equity 3,129 (2,082) (68) 979 $9,737 3,048 (2,138) (37) 873 $7,886 The accompanying Notes to Consolidated Financial Statements are an integral part of these financial statementsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started