Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 12 Identify the correct statement about an arm's-length transaction. 1 pts It is a transaction involving a party that is controlled by another

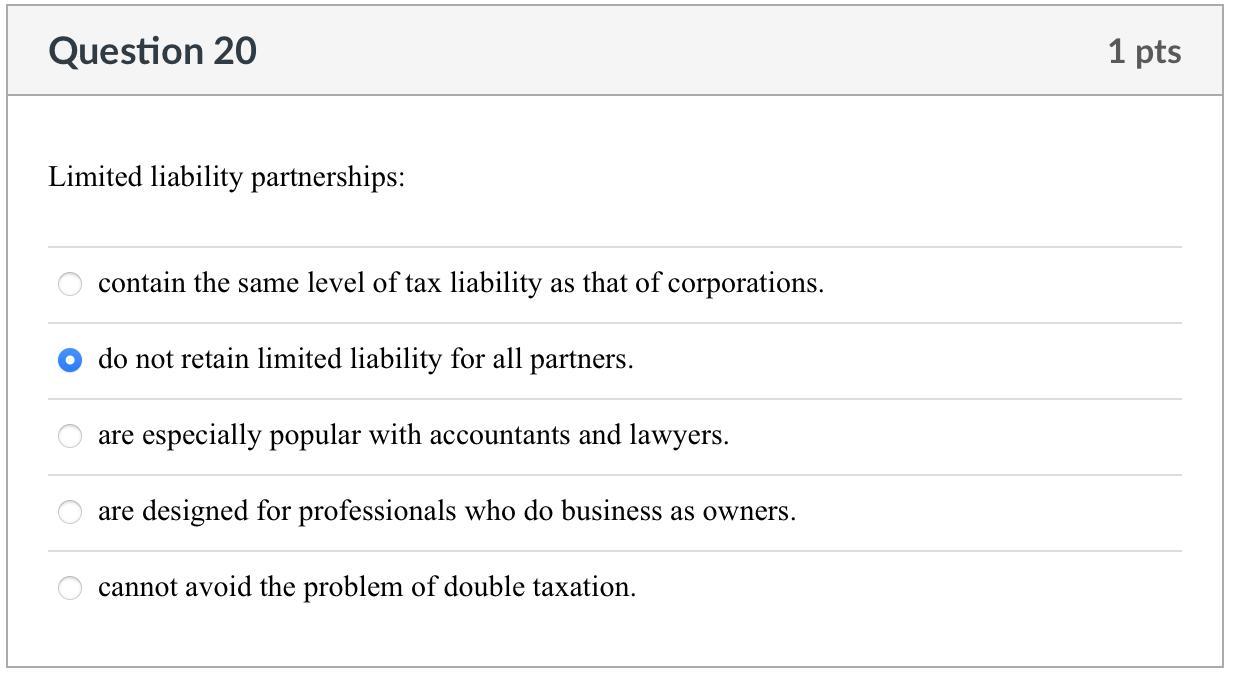

Question 12 Identify the correct statement about an arm's-length transaction. 1 pts It is a transaction involving a party that is controlled by another entity and does not act on its own behalf. It is a transaction made by parties as if they were unrelated, in a free market system, each acting in its own best interest. It is a transaction in which one party sets aside independent interest so as to focus on the wishes of the controlling party. An arm's-length transaction should involve at least one interested party that is concerned about the probable consequences of the transaction. A transaction involving subsidiaries would not be considered an arm's-length transaction because the parties are acting independently. Question 17 A limited liability company: is treated as a corporation for tax purposes. can file d.b.a. filings to assume another name. cannot be created with only one member. can be more difficult to start than a corporation. is the right form for taking a company public and selling stock. 1 pts Question 18 A corporation whose stock is held by only a small number of shareholders is a(n): partnership. publicly traded corporation. mutual benefit nonprofit corporation. sole proprietorship. closely held corporation. Question 19 1 pts Double taxation takes place when: shareholders are forced to pay a dividend tax corporations pay a federal, state and local tax rate double that of individuals corporations are forced to pay taxes twice in one calendar year past tax payments are credited to current tax bills shareholders pay a fee to the government for selling their stock prior to an agreed-upon date. Question 20 Limited liability partnerships: contain the same level of tax liability as that of corporations. do not retain limited liability for all partners. are especially popular with accountants and lawyers. are designed for professionals who do business as owners. cannot avoid the problem of double taxation. 1 pts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To answer the question on the quiz 1 Question 12 The correct statement about an armslength transacti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started