Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Compute the market Debt to Equity ratio. 2. Compute the cost of levered equity based on market Debt to Equity ratio. 3. Compute the

1. Compute the market Debt to Equity ratio.

2. Compute the cost of levered equity based on market Debt to Equity ratio.

3. Compute the current weighted average cost of capital (WACC).

4. Repeat steps 2 and 3 for Scenario i) issue 1 billion in debt to repurchase stock, and Scenario ii) issue 1 billion in stock to repurchase debt. Briefly comment the results.

(Please make havard style references as well, thank you so much!)

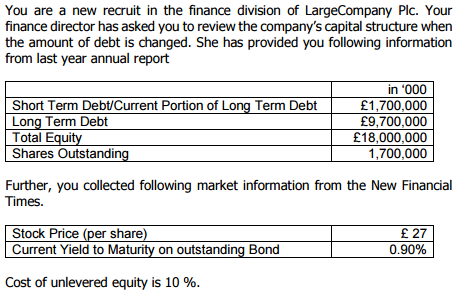

You are a new recruit in the finance division of LargeCompany Plc. Your finance director has asked you to review the company's capital structure when the amount of debt is changed. She has provided you following information from last year annual report Short Term Debt/Current Portion of Long Term Debt Long Term Debt Total Equit Shares Outstandin in '000 1,700,000 9,700,000 18,000,000 1,700,000 Further, you collected following market information from the New Financial Times. Stock Price (per share Current Yield to Mat E 27 0.90% on outstanding Bond Cost of unlevered equity is 10 %Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started