Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. compute the Schedule A and Form 4684 deduction. 2. Determine the tax liability or tax refund for this taxpayer. Needing help with this problem.

1. compute the Schedule A and Form 4684 deduction.

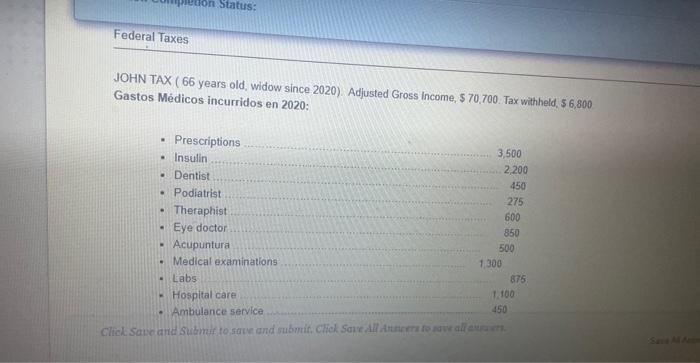

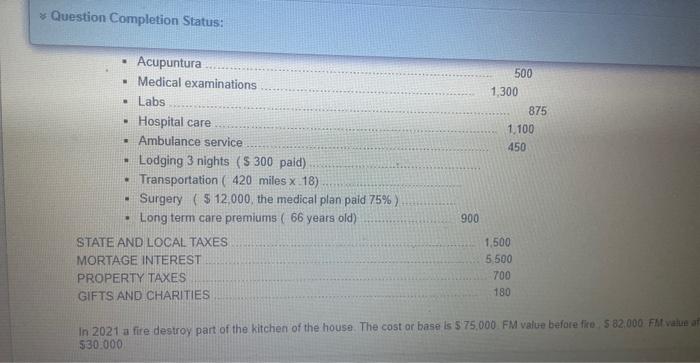

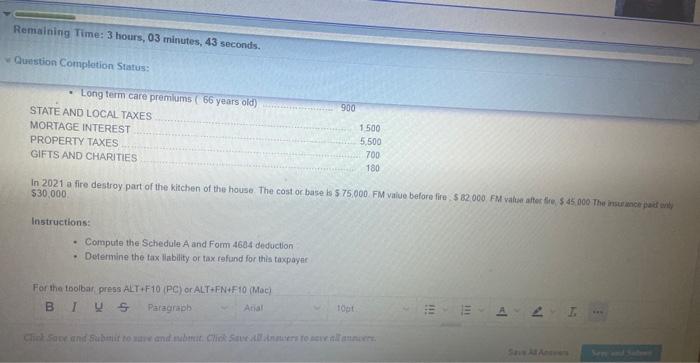

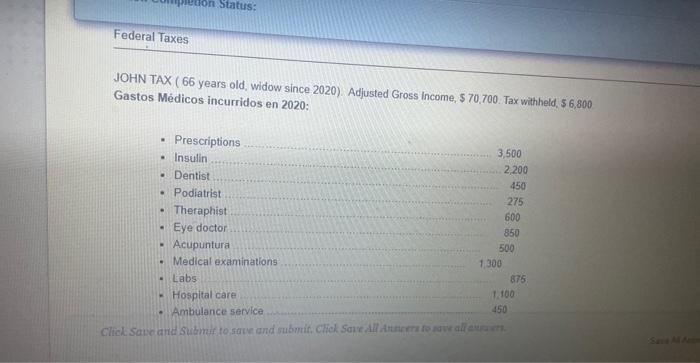

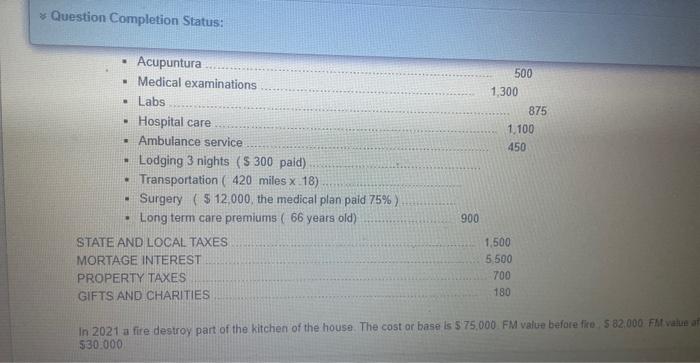

JOHN TAX ( 66 years old, widow since 2020). Adjusted Gross income, $70,700. Tax withheld, $6,800 Gastos Mdicos incurridos en 2020: In 2021 a fire destroy part of the kitchen of the house. The cost or base is 575,000 FM valua before fire 522,000 Fht value 530.000 $30,000 Instructions: - Compute the Schedule A and Form 4604 deduction - Determine the tax llability or tax rafund for this taxpayde JOHN TAX ( 66 years old, widow since 2020). Adjusted Gross income, $70,700. Tax withheld, $6,800 Gastos Mdicos incurridos en 2020: In 2021 a fire destroy part of the kitchen of the house. The cost or base is 575,000 FM valua before fire 522,000 Fht value 530.000 $30,000 Instructions: - Compute the Schedule A and Form 4604 deduction - Determine the tax llability or tax rafund for this taxpayde 2. Determine the tax liability or tax refund for this taxpayer.

Needing help with this problem. Thanks in advance :)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started