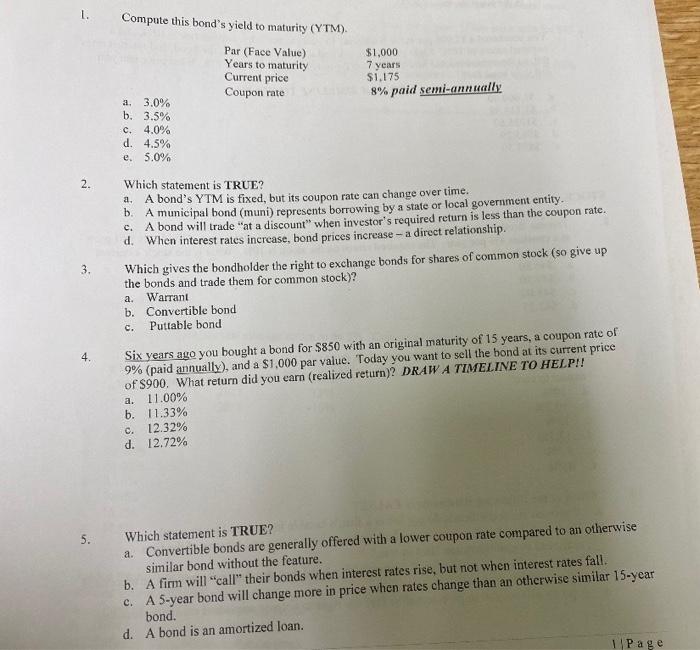

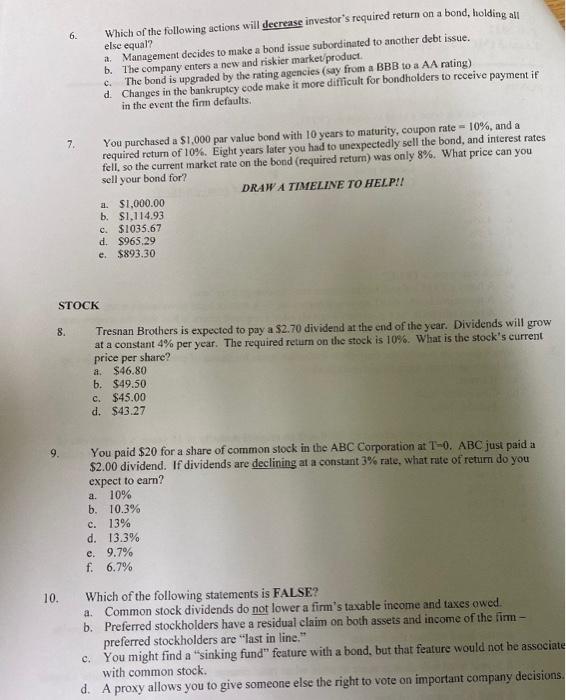

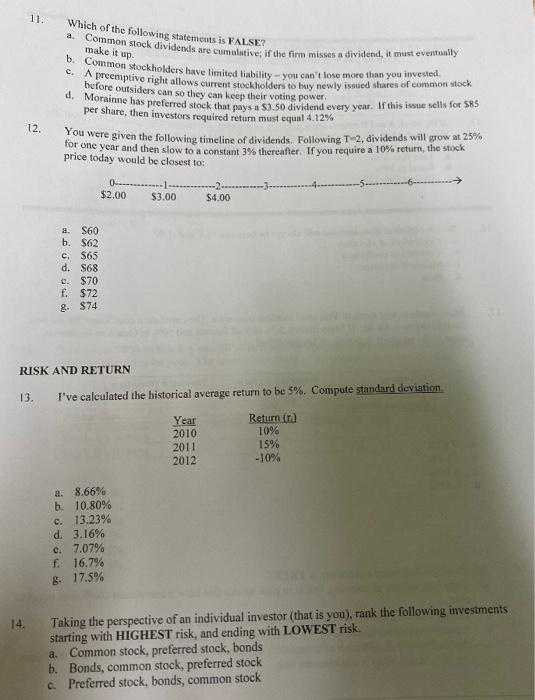

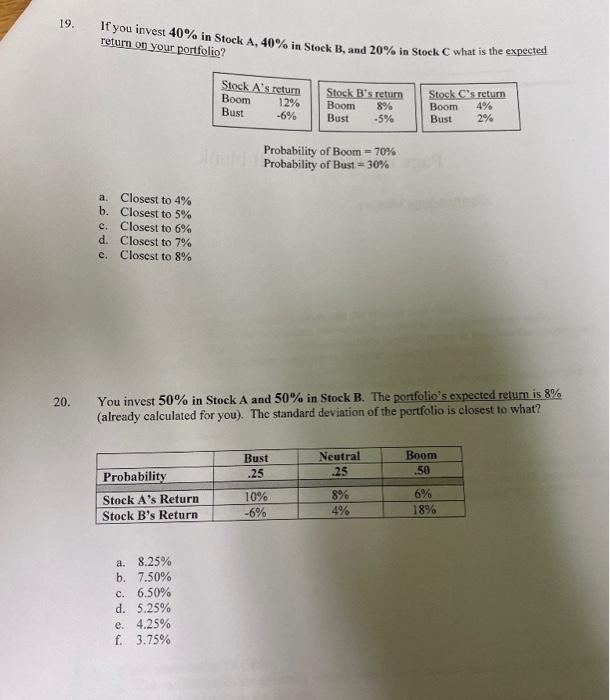

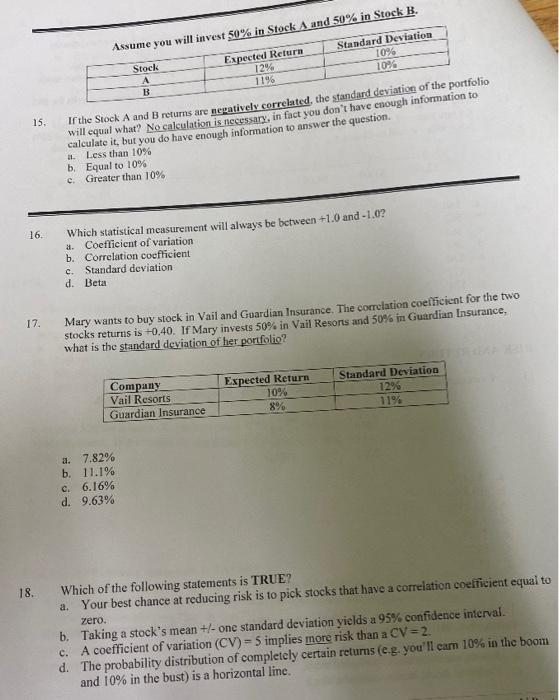

1. Compute this bond's yield to maturity (YTM). a. 3.0% b. 3.5% c. 4.0% d. 4.5% e. 5.0% 2. Which statement is TRUE? a. A bond's YTM is fixed, but its coupon rate can change over time. b. A municipal bond (muni) represents borrowing by a state or local government entity. c. A bond will trade "at a discount" when investor's required return is less than the coupon rate. d. When interest rates increase, bond prices increase - a direct relationship. 3. Which gives the bondholder the right to exchange bonds for shares of common stock (so give up the bonds and trade them for common stock)? a. Warrant b. Convertible bond c. Puttable bond 4. Six years ago you bought a bond for $850 with an original maturity of 15 years, a coupon rate of 9% (paid annually), and a $1,000 par value. Today you want to sell the bond at its current price of $900. What return did you earn (realized return)? DRAW A TIMELINE TO HELPI! a. 11.00% b. 11.33% c. 12.32% d. 12.72% a. Convertible bonds are generally offered with a lower coupon rate compared to an otherwise 5. Which statement is TRUE? b. A firm will "call" their bonds when interest rates rise, but not when interest rates fall. similar bond without the feature. c. A 5-year bond will change more in price when rates change than an othcrwise similar 15 -year bond. d. A bond is an amortized loan. 6. Which of the following actions will deerease investor's required return on a bond, holding all a. Management decides to make a bond issue subordinated to another debt issue. else equal? b. The company enters a new and riskier market product. c. The bond is upgraded by the rating agencies (say from a BBB to a AA rating) d. Changes in the bankruptcy code make it more difficult for bondholders to receive payment if in the event the fim defaults. 7. You purchased a $1,000 par value bond with 10 years to maturity, coupon rate =10%, and a required return of 10%. Eight years later you had to unexpectedly sell the bond, and interest rates fell, so the current market rate on the bond (required return) was only 8%. What price can you sell your bond for? DRAW A TMELINE TO HELPI! a. $1,000.00 b. $1,114.93 c. $1035.67 d. $965,29 e. $893.30 STOCK 8. Tresnan Brothers is expected to pay a $2.70 dividend at the end of the year. Dividends will grow at a constant 4% per year. The required return on the stock is 10%. What is the stock's current price per share? a. $46.80 b. $49.50 c. $45.00 d. $43.27 9. You paid $20 for a share of common slock in the ABC Corporation at T=0. ABC just paid a $2.00 dividend. If dividends are declining at a constant 3% rate, what rute of return do you expect to earn? a. 10% b. 10.3% c. 13% d. 13.3% e. 9.7% f. 6.7% 10. Which of the following statements is FALSE? a. Common stock dividends do not lower a firm's taxable income and taxes owed. b. Preferred stockholders have a residual claim on both assets and income of the fimm preferred stockholders are "last in line," c. You might find a "sinking fund" feature with a bond, but that feature would not he asseciat with common stock. d. A proxy allows you to give someone else the right to vote on important company decisions 11. Which of the following statements is FALSE? a. Common stock dividends are cumulutive; if the firm misses a dividend, it must eventunily make it up. b. Common stockholders have limited liability - you can't lose more than you imvested. c. A preemptive right allows current stockholders to buy newly issued shares of common stock before outsiders can so they can keep their voting power. d. Morainne has preferred stock that pays a 53 . So dividend every year, If this issue sells for 58.5 per share, then investors required retum must equal 4.12% 12. You were given the following timeline of dividends. Following T2, dividends will grow at 25% for one year and then slow to a constant 3% thereafter. If you require a 10% return, the stock price today would be closest to: a. $60 b. $62 c. $65 d. $68 c. $70 f. $72 g. $74 RISK AND RETURN 13. I've calculated the historical average return to be 5%. Compute standard doviation. a. 8.66% b. 10.80% c. 13.23% d. 3.16% c. 7.07% f. 16.7% g. 17.5% 14. Taking the perspective of an individual investor (that is you), rank the following investments starting with HIGHEST risk, and ending with LOWEST risk. a. Common stock, preferred stock, bonds b. Bonds, common stock, preferred stock c. Preferred stock, bonds, common stock 19. If you invest 40% in Stock A,40% in Stoek B, and 20% in Stock C what is the expected return on your portfolio? Probability of Boom =70% Probability of Bust =30% a. Closest to 4% b. Closest to 5% c. Closest to 6% d. Closest to 7% c. Closest to 8% 20. You invest 50% in Stock A and 50% in Stock B. The portfolio's expected retum is 8% (already calculated for you). The standard deviation of the portfolio is closest to what? a. 8.25% b. 7.50% c. 6.50% d. 5.25% e. 4.25% f. 3.75% will equal what? No calculation is necessary, in fact y ou don't nave conmo If the Stock A and B returns are nepatiy calculate it, but you do have enough information to answer the question. a. Less than 10% b. Equal to 10% c. Greater than 10% 16. Which statistical measurement will always be between +1.0 and -1.0 ? a. Coefficient of variation b. Correlation coefficient c. Standard deviation d. Beta 17. Mary wants to buy stock in Vail and Guardian lnsurance. The corrolation coefficicnt for the two Macy wants to buy stock in Vail and Guardian insurance. The correlation coeficicot for the the 40 . If Mary invests 50% in. Vail Resors and 50% in Guardian Insurance, what is the standard deviation of her porfolio? a. 7,82% b. 11.1% c. 6.16% d. 9.63% a. Your best chance at reducing risk is to pick stocks that have a correlation coefinient equal to 18. Which of the following statements is TRUE? b. Taking a stock's mean +/ - one standard deviation yields a 95% confidenoe inicrval. zero. c. A coefficient of variation (CV)=5 implies more risk than a CV=2. d. The probability distribution of completely certain returs (e.g.you'll cam 10% in the boom and 10% in the bust) is a horizontal line