Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Concepts used in cash flow estimation and risk analysis You can come across different situations in your life where the concepts from capital budgeting

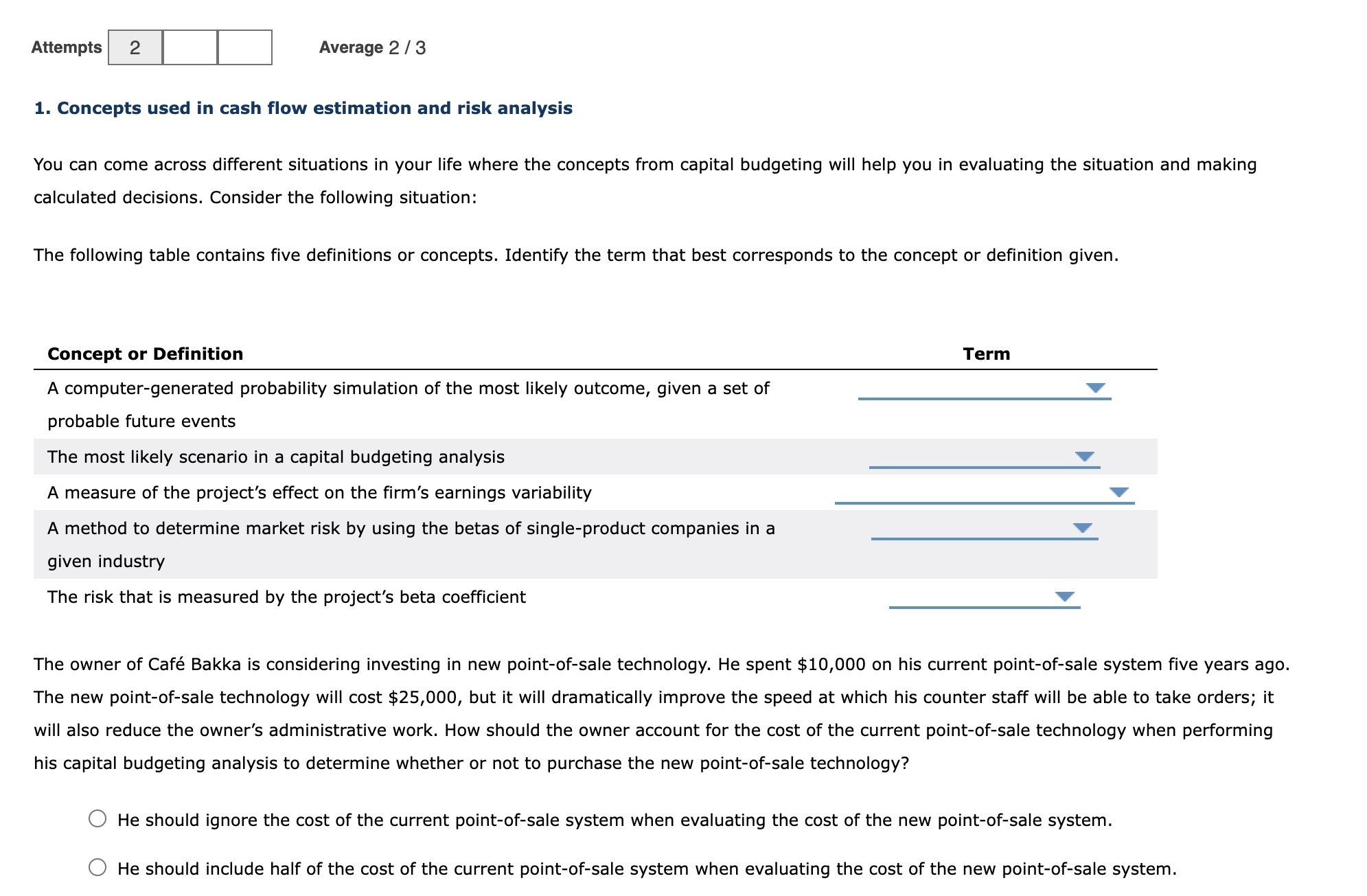

1. Concepts used in cash flow estimation and risk analysis You can come across different situations in your life where the concepts from capital budgeting will help you in evaluating the situation and making calculated decisions. Consider the following situation: The following table contains five definitions or concepts. Identify the term that best corresponds to the concept or definition given. The owner of Caf Bakka is considering investing in new point-of-sale technology. He spent $10,000 on his current point-of-sale system five years ago. The new point-of-sale technology will cost $25,000, but it will dramatically improve the speed at which his counter staff will be able to take orders; it will also reduce the owner's administrative work. How should the owner account for the cost of the current point-of-sale technology when performing his capital budgeting analysis to determine whether or not to purchase the new point-of-sale technology? He should ignore the cost of the current point-of-sale system when evaluating the cost of the new point-of-sale system. He should include half of the cost of the current point-of-sale system when evaluating the cost of the new point-of-sale system. 1. Concepts used in cash flow estimation and risk analysis You can come across different situations in your life where the concepts from capital budgeting will help you in evaluating the situation and making calculated decisions. Consider the following situation: The following table contains five definitions or concepts. Identify the term that best corresponds to the concept or definition given. The owner of Caf Bakka is considering investing in new point-of-sale technology. He spent $10,000 on his current point-of-sale system five years ago. The new point-of-sale technology will cost $25,000, but it will dramatically improve the speed at which his counter staff will be able to take orders; it will also reduce the owner's administrative work. How should the owner account for the cost of the current point-of-sale technology when performing his capital budgeting analysis to determine whether or not to purchase the new point-of-sale technology? He should ignore the cost of the current point-of-sale system when evaluating the cost of the new point-of-sale system. He should include half of the cost of the current point-of-sale system when evaluating the cost of the new point-of-sale system

1. Concepts used in cash flow estimation and risk analysis You can come across different situations in your life where the concepts from capital budgeting will help you in evaluating the situation and making calculated decisions. Consider the following situation: The following table contains five definitions or concepts. Identify the term that best corresponds to the concept or definition given. The owner of Caf Bakka is considering investing in new point-of-sale technology. He spent $10,000 on his current point-of-sale system five years ago. The new point-of-sale technology will cost $25,000, but it will dramatically improve the speed at which his counter staff will be able to take orders; it will also reduce the owner's administrative work. How should the owner account for the cost of the current point-of-sale technology when performing his capital budgeting analysis to determine whether or not to purchase the new point-of-sale technology? He should ignore the cost of the current point-of-sale system when evaluating the cost of the new point-of-sale system. He should include half of the cost of the current point-of-sale system when evaluating the cost of the new point-of-sale system. 1. Concepts used in cash flow estimation and risk analysis You can come across different situations in your life where the concepts from capital budgeting will help you in evaluating the situation and making calculated decisions. Consider the following situation: The following table contains five definitions or concepts. Identify the term that best corresponds to the concept or definition given. The owner of Caf Bakka is considering investing in new point-of-sale technology. He spent $10,000 on his current point-of-sale system five years ago. The new point-of-sale technology will cost $25,000, but it will dramatically improve the speed at which his counter staff will be able to take orders; it will also reduce the owner's administrative work. How should the owner account for the cost of the current point-of-sale technology when performing his capital budgeting analysis to determine whether or not to purchase the new point-of-sale technology? He should ignore the cost of the current point-of-sale system when evaluating the cost of the new point-of-sale system. He should include half of the cost of the current point-of-sale system when evaluating the cost of the new point-of-sale system Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started