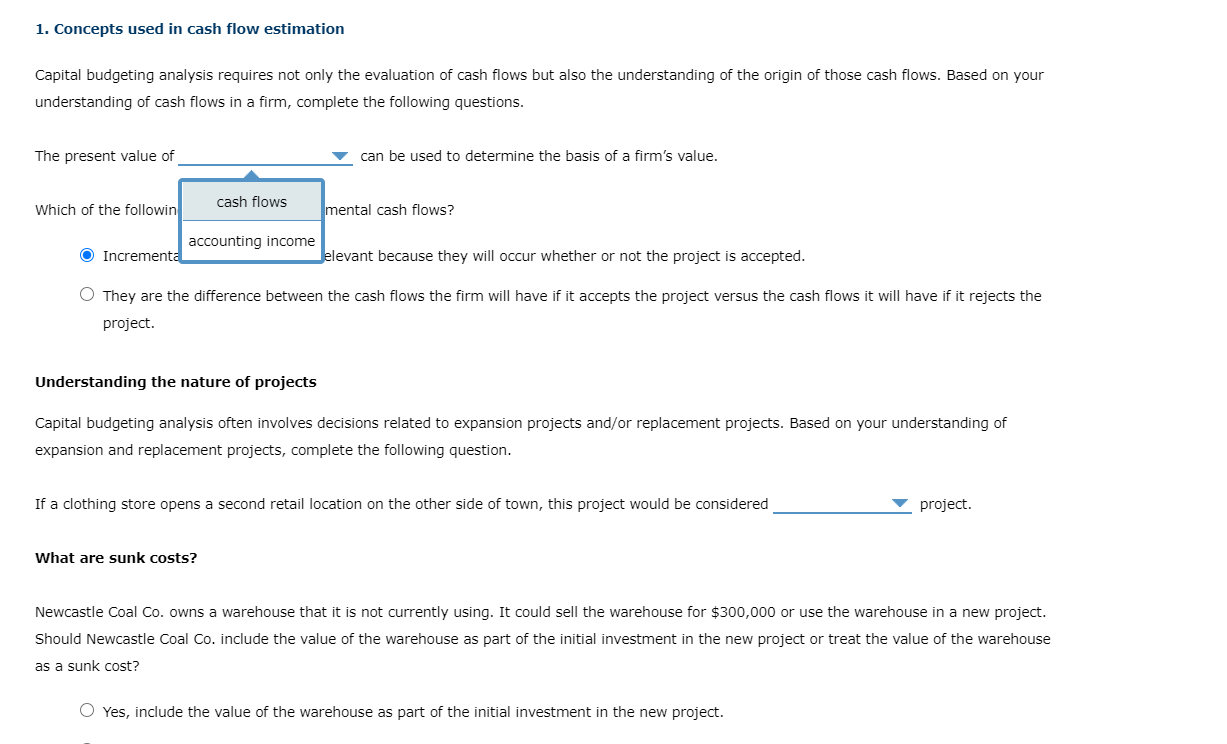

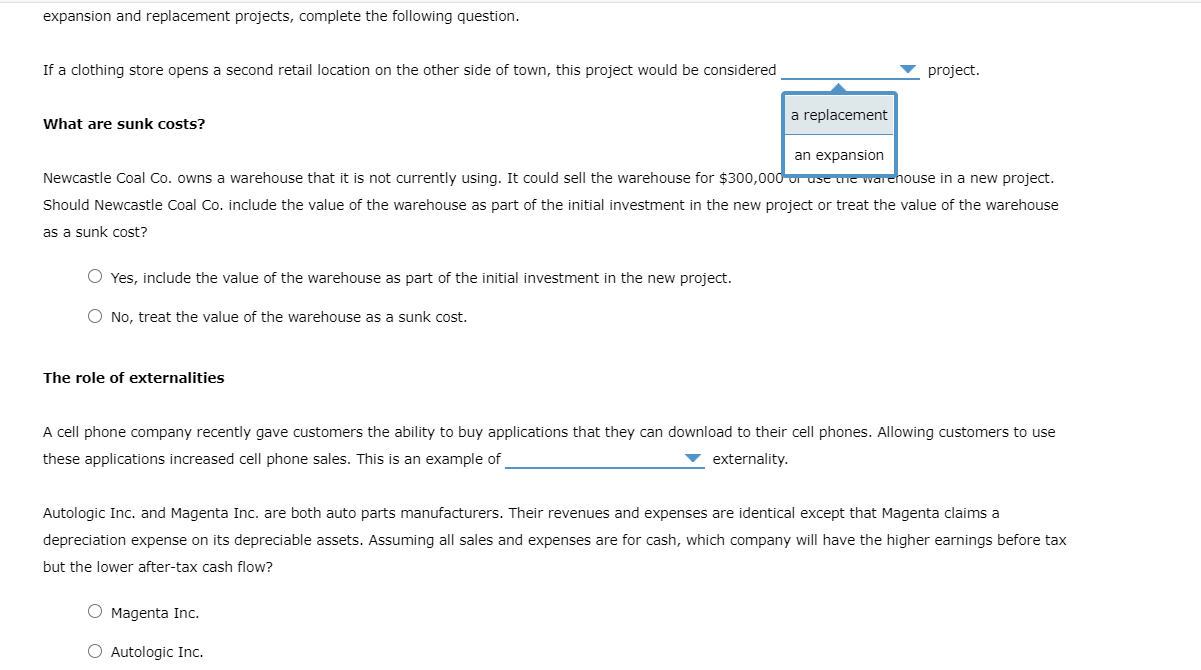

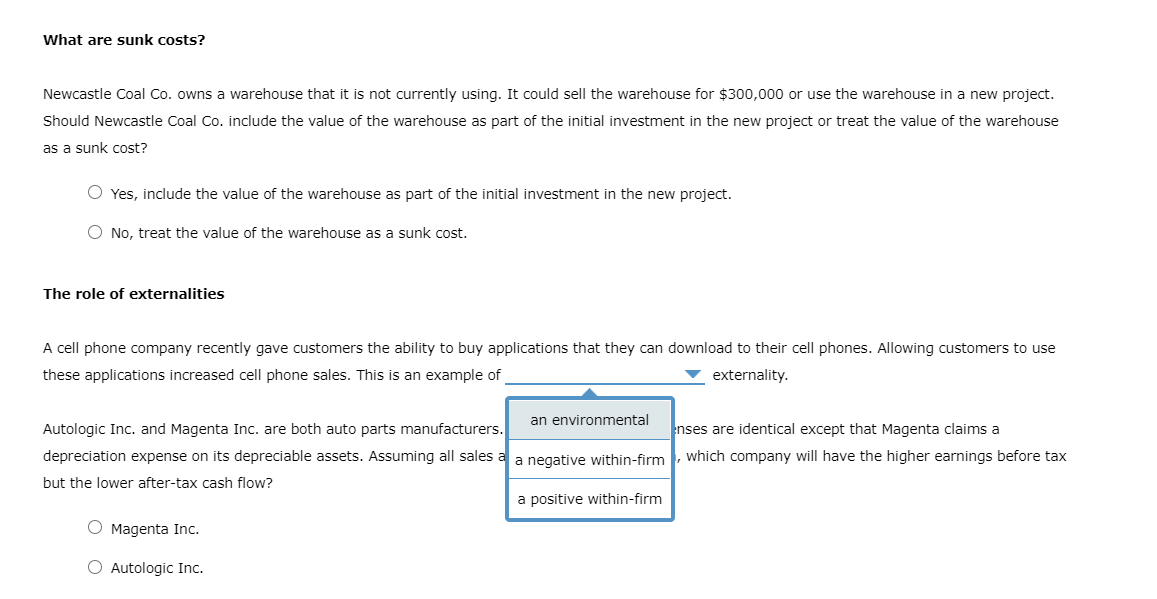

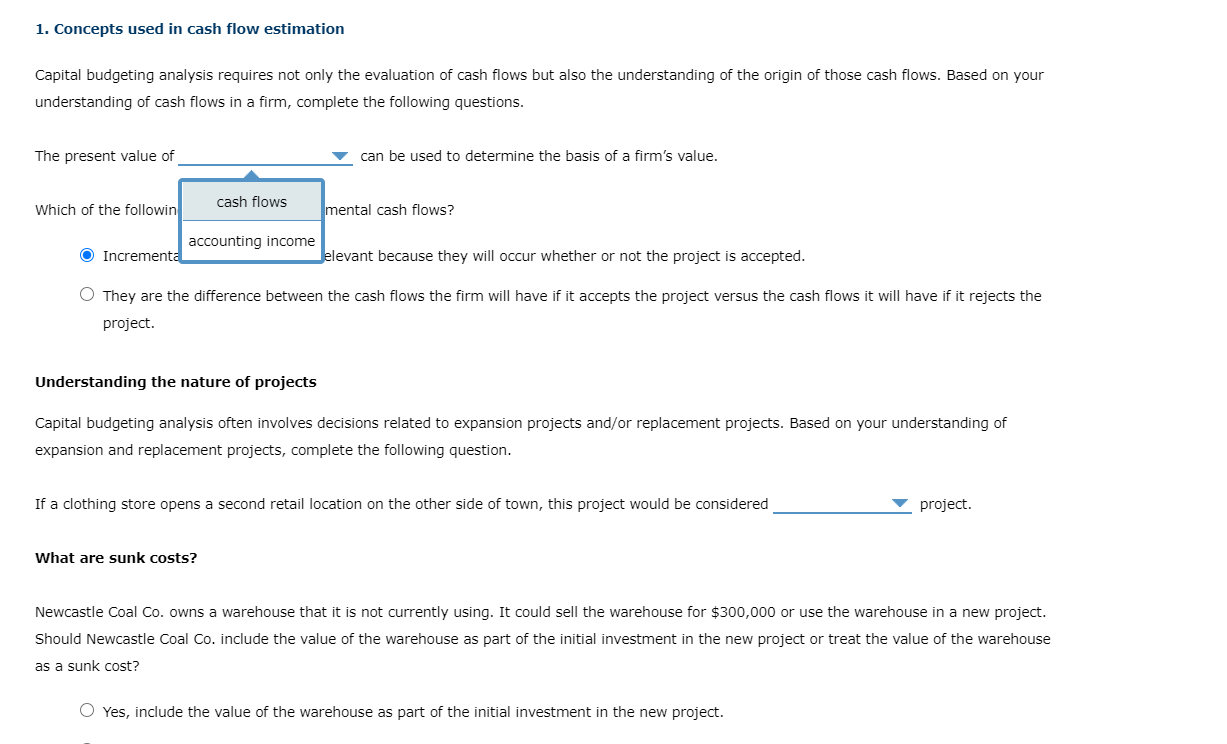

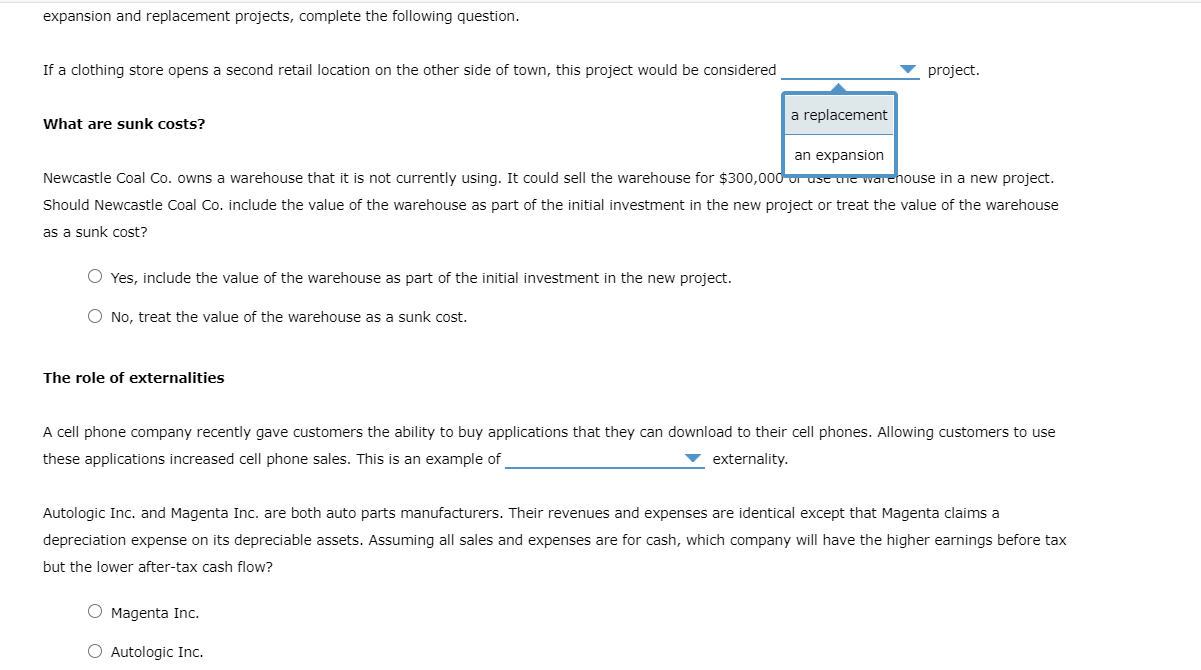

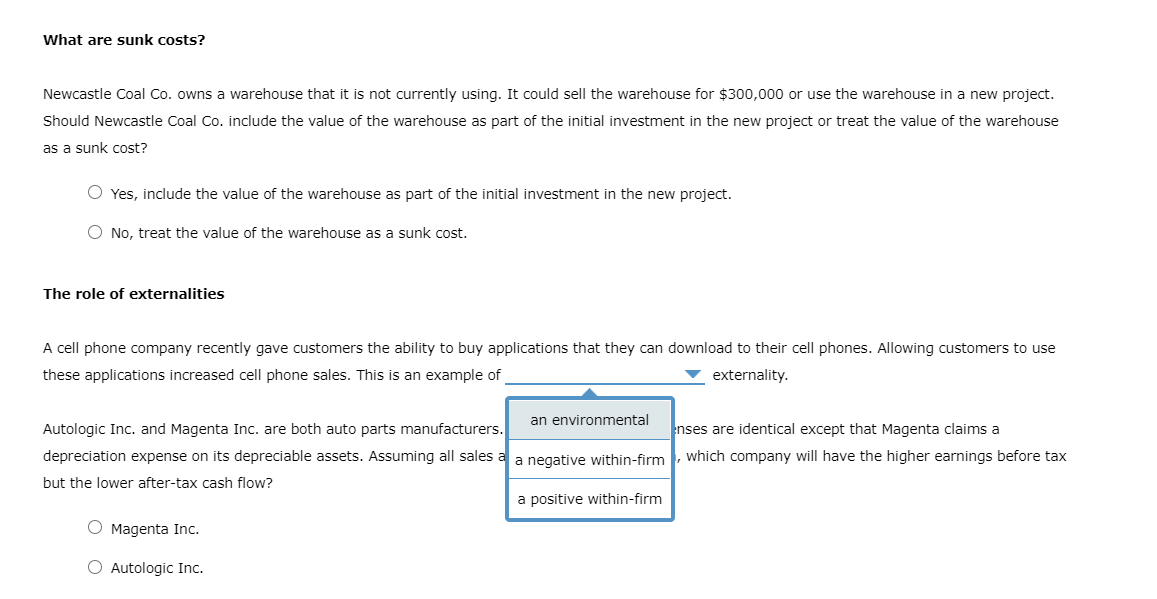

1. Concepts used in cash flow estimation Capital budgeting analysis requires not only the evaluation of cash flows but also the understanding of the origin of those cash flows. Based on your understanding of cash flows in a firm, complete the following questions. The present value of can be used to determine the basis of a firm's value. cash flows Which of the followin mental cash flows? accounting income O Incrementa Jelevant because they will occur whether or not the project is accepted. They are the difference between the cash flows the firm will have if it accepts the project versus the cash flows it will have if it rejects the project. Understanding the nature of projects Capital budgeting analysis often involves decisions related to expansion projects and/or replacement projects. Based on your understanding of expansion and replacement projects, complete the following question. If a clothing store opens a second retail location on the other side of town, this project would be considered project. What are sunk costs? Newcastle Coal Co. owns a warehouse that it is not currently using. It could sell the warehouse for $300,000 or use the warehouse in a new project. Should Newcastle Coal Co. include the value of the warehouse as part of the initial investment in the new project or treat the value of the warehouse as a sunk cost? Yes, include the value of the warehouse as part of the initial investment in the new project. expansion and replacement projects, complete the following question. If a clothing store opens a second retail location on the other side of town, this project would be considered project. a replacement What are sunk costs? an expansion Newcastle Coal Co. owns a warehouse that it is not currently using. It could sell the warehouse for $300,000 ur use this warehouse in a new project. Should Newcastle Coal Co. include the value of the warehouse as part of the initial investment in the new project or treat the value of the warehouse as a sunk cost? Yes, include the value of the warehouse as part of the initial investment in the new project. O No, treat the value of the warehouse as a sunk cost. The role of externalities A cell phone company recently gave customers the ability to buy applications that they can download to their cell phones. Allowing customers to use these applications increased cell phone sales. This is an example of externality. Autologic Inc. and Magenta Inc. are both auto parts manufacturers. Their revenues and expenses are identical except that Magenta claims a depreciation expense on its depreciable assets. Assuming all sales and expenses are for cash, which company will have the higher earnings before tax but the lower after-tax cash flow? O Magenta Inc. Autologic Inc. What are sunk costs? Newcastle Coal Co. owns a warehouse that it is not currently using. It could sell the warehouse for $300,000 or use the warehouse in a new project. Should Newcastle Coal Co. include the value of the warehouse as part of the initial investment in the new project or treat the value of the warehouse as a sunk cost? Yes, include the value of the warehouse as part of the initial investment in the new project. O No, treat the value of the warehouse as a sunk cost. The role of externalities A cell phone company recently gave customers the ability to buy applications that they can download to their cell phones. Allowing customers to use these applications increased cell phone sales. This is an example of externality. an environmental Autologic Inc. and Magenta Inc. are both auto parts manufacturers. nses are identical except that Magenta claims a depreciation expense on its depreciable assets. Assuming all sales a a negative within-firm which company will have the higher earnings before tax but the lower after-tax cash flow? a positive within-firm O Magenta Inc. O Autologic Inc