Question

1) Concerned about the health of low-income families, government officials are considering two alternative plans to help provide access to health care. Health Insurance Subsidy

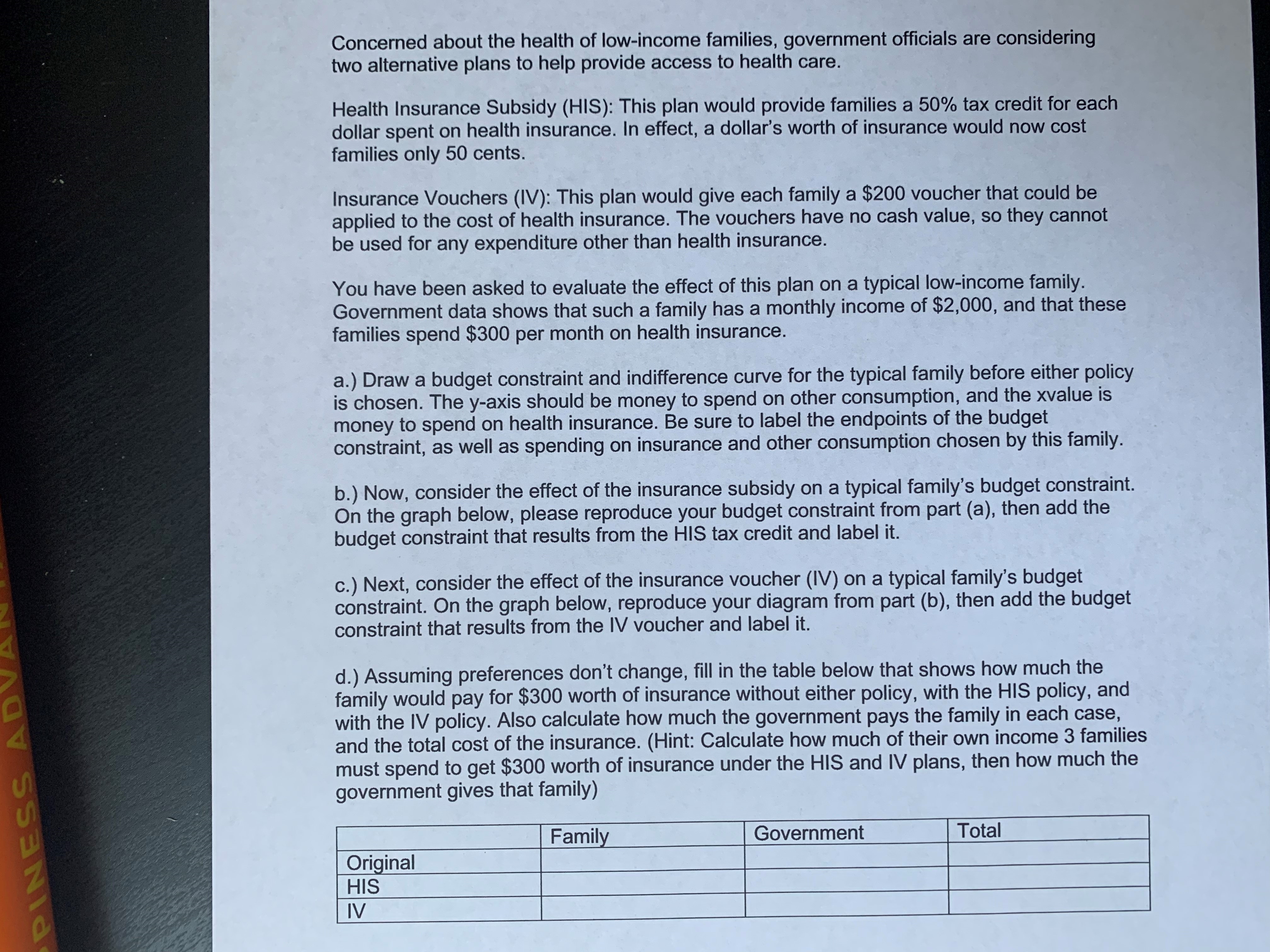

1) Concerned about the health of low-income families, government officials are considering two alternative plans to help provide access to health care.

Health

Insurance Subsidy (HIS): This plan would provide families a 50% tax credit for

each dollar spent on health insurance. In effect, a dollar's worth of insurance

would now cost families only 50 cents.

Insurance

Vouchers (IV): This plan would give each family a $200 voucher that could be

applied to the cost of health insurance. The vouchers have no cash value, so

they cannot be used for any expenditure other than health insurance.

You

have been asked to evaluate the effect of this plan on a typical low-income

family. Government data shows that such a family has a monthly income of

$2,000, and that these families spend $300 per month on health insurance.

a.)

Draw a budget constraint and indifference curve for the typical family before

either policy is chosen. The y-axis should be money to spend on other

consumption, and the xvalue is money to spend on health insurance. Be sure to

label the endpoints of the budget constraint, as well as spending on insurance

and other consumption chosen by this family.

b.) Now, consider the effect of the insurance subsidy on a typical family's budget constraint. On the graph below, please reproduce your budget constraint from part (a), then add the budget constraint that results from the HIS tax credit and label it.

c.) Next, consider the effect of the insurance voucher (IV) on a typical family's budget constraint. On the graph below, reproduce your diagram from part (b), then add the budget constraint that results from the IV voucher and label it.

d.) Assuming preferences don't change, fill in the table below that shows how much the family would pay for $300 worth of insurance without either policy, with the HIS policy, and with the IV policy. Also calculate how much the government pays the family in each case, and the total cost of the insurance. (Hint: Calculate how much of their own income 3 families must spend to get $300 worth of insurance under the HIS and IV plans, then how much the government gives that family).

Please see attached document with a repeat of questions listed and addiitonal table. Your help is much appreciated.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started