Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Congratulations! You just won the lottery. You can take $20,000 a year for 25 years or $200,000 today. Your interest rate is 8%. What

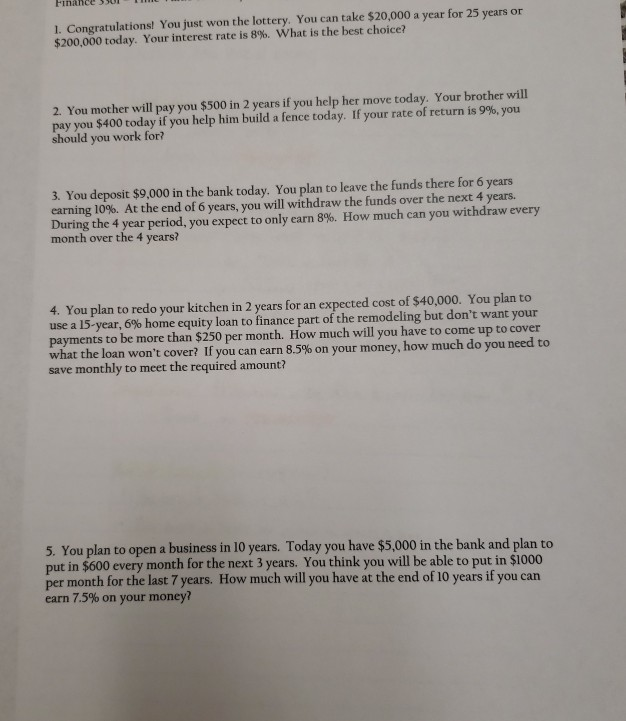

1. Congratulations! You just won the lottery. You can take $20,000 a year for 25 years or $200,000 today. Your interest rate is 8%. What is the best choice? 2. You mother will pay you $500 in 2 years if you help her move today. Your brother will pay you $400 today if you help him build a fence today. If your rate of return is 9%, you should you work for? 3. You deposit $9.000 in the bank today. You plan to leave the funds there for 6 years earning 10%. At the end of 6 years, you will withdraw the funds over the next 4 years. During the 4 year period, you expect to only earn 8%. How much can you withdraw every month over the 4 years? 4. You plan to redo your kitchen in 2 years for an expected cost of $40,000. You plan to use a 15-year, 6% home equity loan to finance part of the remodeling but don't want your payments to be more than $250 per month. How much will you have to come up to cover what the loan won't cover? If you can earn 8.5% on your money, how much do you need to save monthly to meet the required amount? 5. You plan to open a business in 10 years. Today you have $5,000 in the bank and plan to put in $600 every month for the next 3 years. You think you will be able to put in $1000 per month for the last 7 years. How much will you have at the end of 10 years if you can earn 7.5% on your money

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started