Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Connie recently entered into a receive fixed-rate interest rate swap to hedge the Bank's newly purchase agency bond. The swap terms are as follows:

1. Connie recently entered into a receive fixed-rate interest rate swap to hedge the Bank's newly purchase agency bond. The swap terms are as follows:

i. Notional $5M

ii. Effective/Settle Date 5/01/2021

i. Maturity Date 5/1/2023

iv. Fixed-Rate 1.25% quarterly payment

V. Floating-Rate: 3-month LIBOR

- Using Bloomberg SWPM, calculate the value of the new swap with the 5/1/2021 curve date and valuation date.

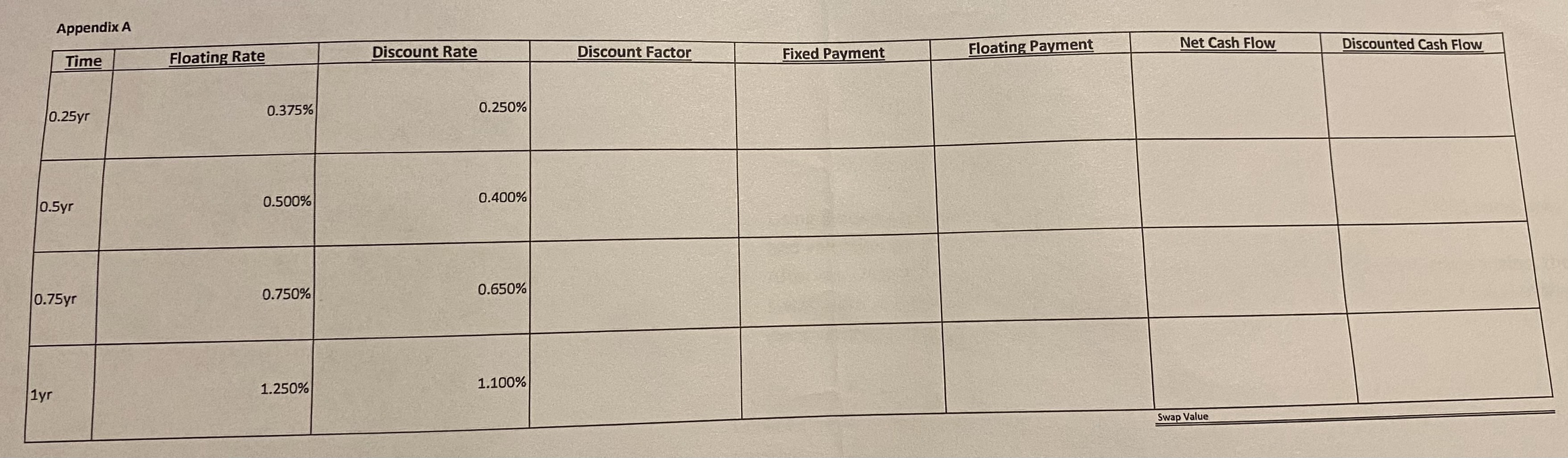

- After one year, the counterparty has decided to call the Bank to collect collateral against the swap, but the Bank got rid of the expensive Bloomberg Terminal! Calculate the value of the swap as of 5/1/2022 manually, using the table in Appendix A.

Appendix A Appendix A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started