Question

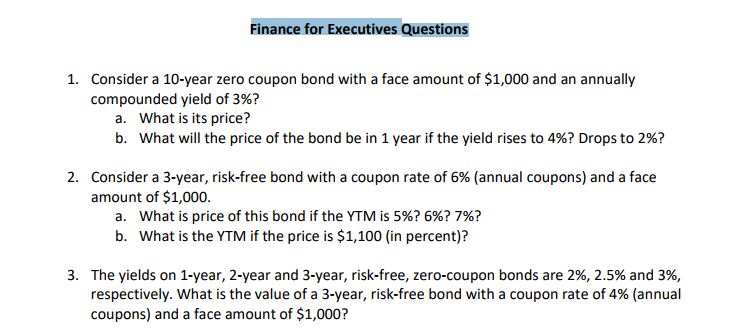

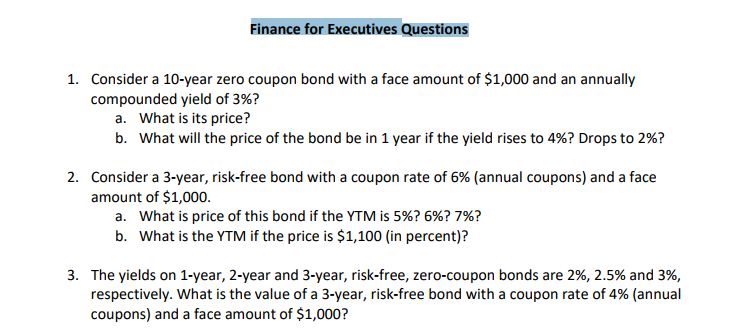

1. Consider a 10-year zero coupon bond with a face amount of $1,000 and an annually compounded yield of 3%? a. What is its price?

1. Consider a 10-year zero coupon bond with a face amount of $1,000 and an annually compounded yield of 3%?

a. What is its price?

b. What will the price of the bond be in 1 year if the yield rises to 4%? Drops to 2%?

2. Consider a 3-year, risk-free bond with a coupon rate of 6% (annual coupons) and a face amount of $1,000.

a. What is price of this bond if the YTM is 5%? 6%? 7%?

b. What is the YTM if the price is $1,100 (in percent)?

3. The yields on 1-year, 2-year and 3-year, risk-free, zero-coupon bonds are 2%, 2.5% and 3%, respectively. What is the value of a 3-year, risk-free bond with a coupon rate of 4% (annual coupons) and a face amount of $1,000?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started