Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Consider a European put option with expiry T = 100 and strike price K = S0 = 1. Calculate the price at time 0

1. Consider a European put option with expiry T = 100 and strike price K = S0 = 1. Calculate the price at time 0 of such a put

(a) by exact methods, working backward from time T;

(b) by Monte Carlo simulation, quantifying your error. You may measure the error either in absolute or relative terms.

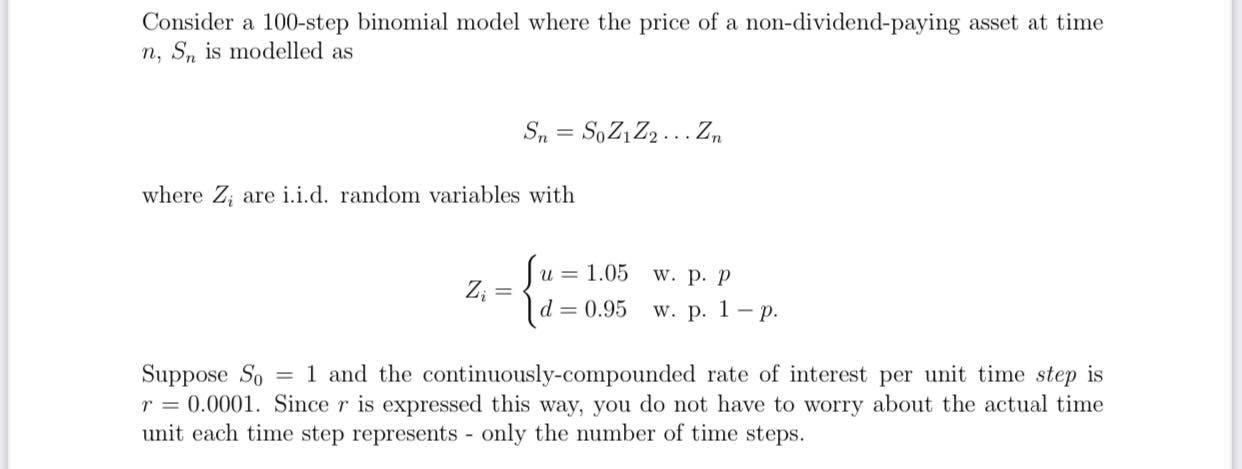

Consider a 100-step binomial model where the price of a non-dividend-paying asset at time n, Sn is modelled as Sn = SoZIZ2... Zn where Z, are i.i.d. random variables with Z u = 1.05 w. p. p d = 0.95 w. p. 1 p. Suppose So 1 and the continuously-compounded rate of interest per unit time step is r = 0.0001. Since r is expressed this way, you do not have to worry about the actual time unit each time step represents only the number of time steps.

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the price of the put option by exact methods Work backwards from time T 100 to time 0 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started