Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Consider a farmer choosing enterprises to invest in as part of the operation's portfolio. The three enterprises are apples with expected returns of 10%

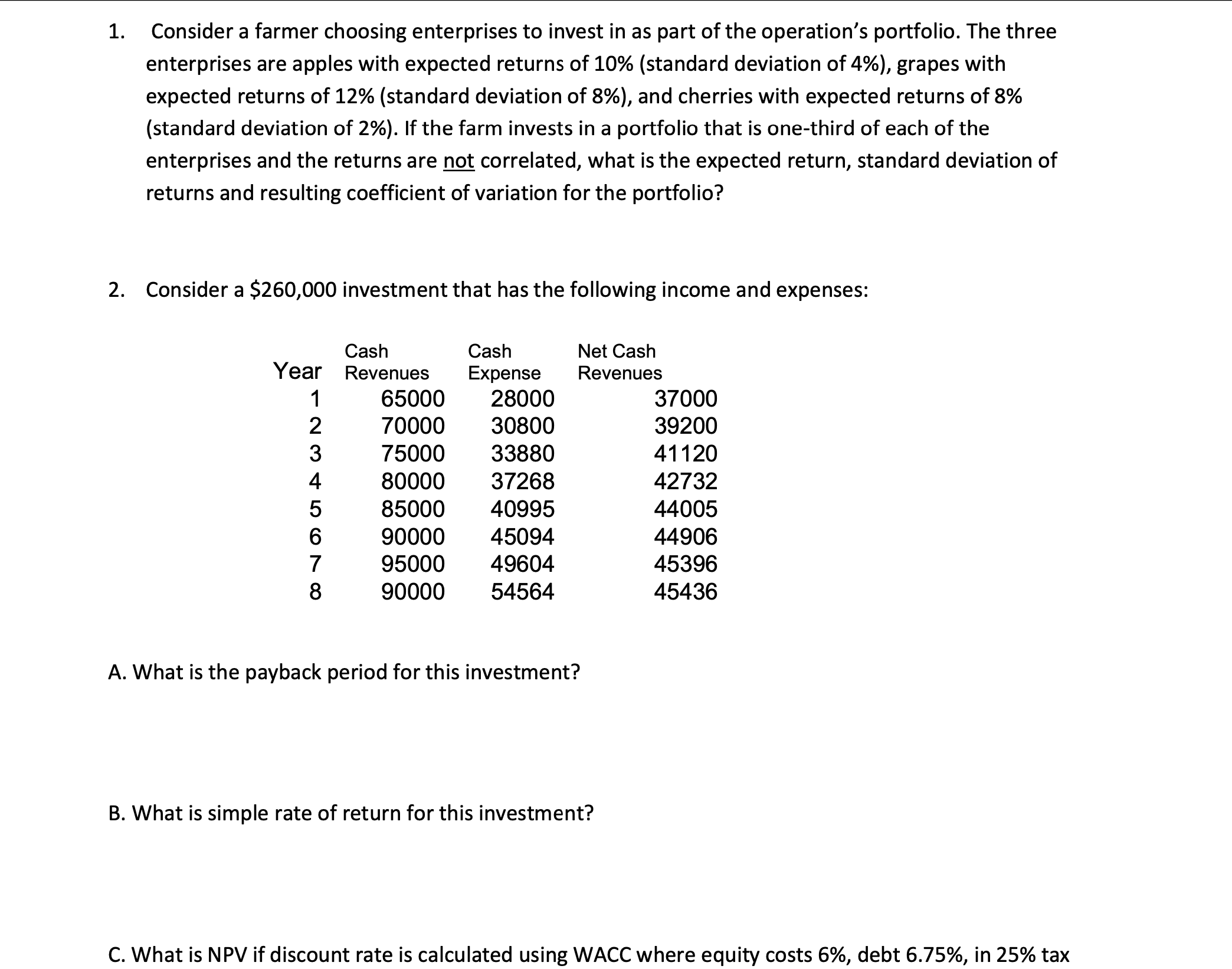

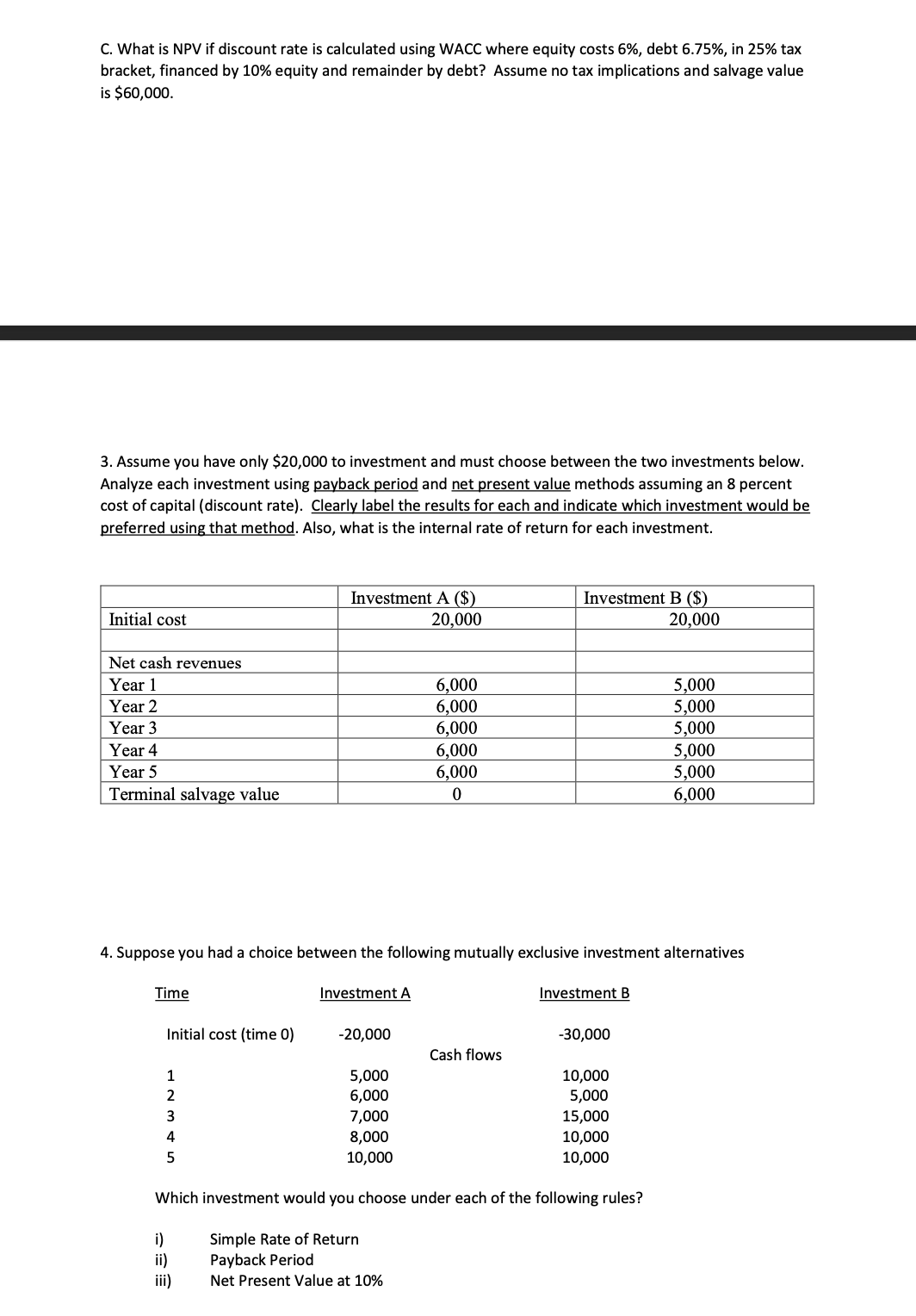

1. Consider a farmer choosing enterprises to invest in as part of the operation's portfolio. The three enterprises are apples with expected returns of 10% (standard deviation of 4% ), grapes with expected returns of 12% (standard deviation of 8% ), and cherries with expected returns of 8% (standard deviation of 2\%). If the farm invests in a portfolio that is one-third of each of the enterprises and the returns are not correlated, what is the expected return, standard deviation of returns and resulting coefficient of variation for the portfolio? 2. Consider a $260,000 investment that has the following income and expenses: A. What is the payback period for this investment? B. What is simple rate of return for this investment? C. What is NPV if discount rate is calculated using WACC where equity costs 6%, debt 6.75%, in 25% tax bracket, financed by 10% equity and remainder by debt? Assume no tax implications and salvage value is $60,000. 3. Assume you have only $20,000 to investment and must choose between the two investments below. Analyze each investment using payback period and net present value methods assuming an 8 percent cost of capital (discount rate). Clearly label the results for each and indicate which investment would be preferred using that method. Also, what is the internal rate of return for each investment. 4. Suppose you had a choice between the following mutually exclusive investment alternatives Which investment would you choose under each of the following rules? i) Simple Rate of Return ii) Payback Period iii) Net Present Value at 10%

1. Consider a farmer choosing enterprises to invest in as part of the operation's portfolio. The three enterprises are apples with expected returns of 10% (standard deviation of 4% ), grapes with expected returns of 12% (standard deviation of 8% ), and cherries with expected returns of 8% (standard deviation of 2\%). If the farm invests in a portfolio that is one-third of each of the enterprises and the returns are not correlated, what is the expected return, standard deviation of returns and resulting coefficient of variation for the portfolio? 2. Consider a $260,000 investment that has the following income and expenses: A. What is the payback period for this investment? B. What is simple rate of return for this investment? C. What is NPV if discount rate is calculated using WACC where equity costs 6%, debt 6.75%, in 25% tax bracket, financed by 10% equity and remainder by debt? Assume no tax implications and salvage value is $60,000. 3. Assume you have only $20,000 to investment and must choose between the two investments below. Analyze each investment using payback period and net present value methods assuming an 8 percent cost of capital (discount rate). Clearly label the results for each and indicate which investment would be preferred using that method. Also, what is the internal rate of return for each investment. 4. Suppose you had a choice between the following mutually exclusive investment alternatives Which investment would you choose under each of the following rules? i) Simple Rate of Return ii) Payback Period iii) Net Present Value at 10% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started