Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Consider a model with five periods. Dave wants to buy an ihome in period 2, but is considering whether he should save up for

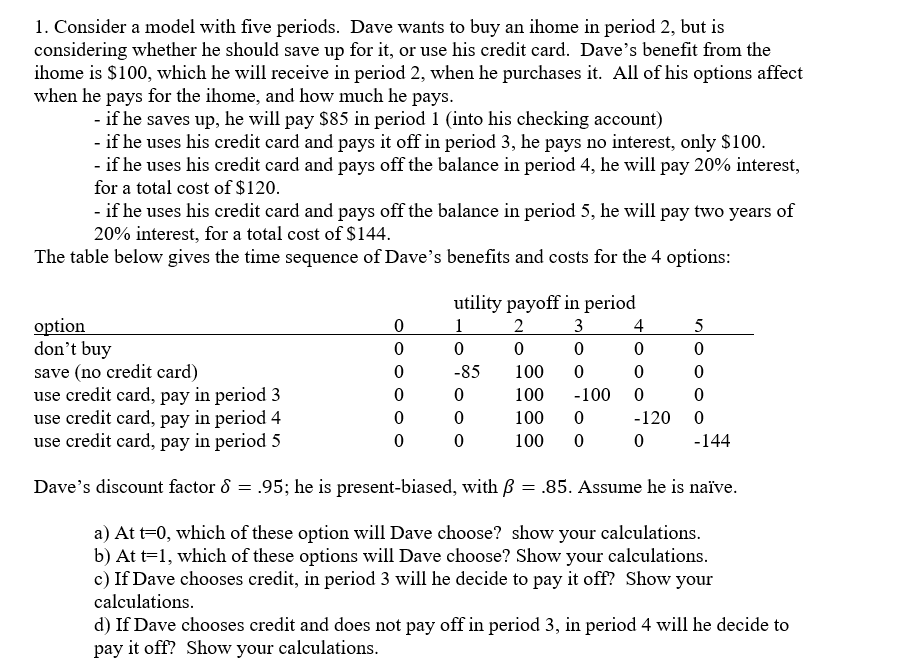

1. Consider a model with five periods. Dave wants to buy an ihome in period 2, but is considering whether he should save up for it, or use his credit card. Dave's benefit from the ihome is $100, which he will receive in period 2, when he purchases it. All of his options affect when he pays for the ihome, and how much he pays. - if he saves up, he will pay $85 in period 1 (into his checking account) - if he uses his credit card and pays it off in period 3, he pays no interest, only $100. - if he uses his credit card and pays off the balance in period 4 , he will pay 20% interest, for a total cost of $120. - if he uses his credit card and pays off the balance in period 5 , he will pay two years of 20% interest, for a total cost of $144. The table below gives the time sequence of Dave's benefits and costs for the 4 options: Dave's discount factor =.95; he is present-biased, with =.85. Assume he is nave. a) At t=0, which of these option will Dave choose? show your calculations. b) At t=1, which of these options will Dave choose? Show your calculations. c) If Dave chooses credit, in period 3 will he decide to pay it off? Show your calculations. d) If Dave chooses credit and does not pay off in period 3, in period 4 will he decide to pay it off? Show your calculations

1. Consider a model with five periods. Dave wants to buy an ihome in period 2, but is considering whether he should save up for it, or use his credit card. Dave's benefit from the ihome is $100, which he will receive in period 2, when he purchases it. All of his options affect when he pays for the ihome, and how much he pays. - if he saves up, he will pay $85 in period 1 (into his checking account) - if he uses his credit card and pays it off in period 3, he pays no interest, only $100. - if he uses his credit card and pays off the balance in period 4 , he will pay 20% interest, for a total cost of $120. - if he uses his credit card and pays off the balance in period 5 , he will pay two years of 20% interest, for a total cost of $144. The table below gives the time sequence of Dave's benefits and costs for the 4 options: Dave's discount factor =.95; he is present-biased, with =.85. Assume he is nave. a) At t=0, which of these option will Dave choose? show your calculations. b) At t=1, which of these options will Dave choose? Show your calculations. c) If Dave chooses credit, in period 3 will he decide to pay it off? Show your calculations. d) If Dave chooses credit and does not pay off in period 3, in period 4 will he decide to pay it off? Show your calculations Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started