Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Consider a risk neutral entrepreneur endowed with a technology. This technology generates two random streams of returns. In a good state of returns, the

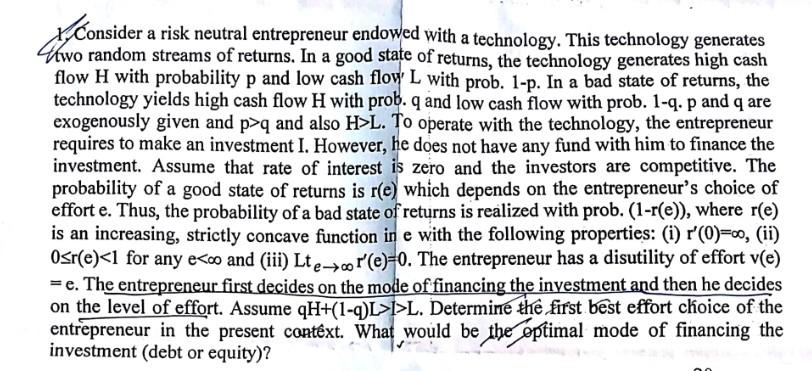

1. Consider a risk neutral entrepreneur endowed with a technology. This technology generates two random streams of returns. In a good state of returns, the technology generates high cash flow H with probability p and low cash flow L with prob. 1-p. In a bad state of returns, the technology yields high cash flow H with prob. q and low cash flow with prob. 1q.p and q are exogenously given and p>q and also H>L. To operate with the technology, the entrepreneur requires to make an investment I. However, he does not have any fund with him to finance the investment. Assume that rate of interest is zero and the investors are competitive. The probability of a good state of returns is r(e) which depends on the entrepreneur's choice of effort e. Thus, the probability of a bad state of returns is realized with prob. (1-r(e)), where r(e) is an increasing, strictly concave function in e with the following properties: (i) r(0)=, (ii) 0r(e)l>L. Determine the first best effort choice of the entrepreneur in the present cantext. What would be the optimal mode of financing the investment (debt or equity)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started