Answered step by step

Verified Expert Solution

Question

1 Approved Answer

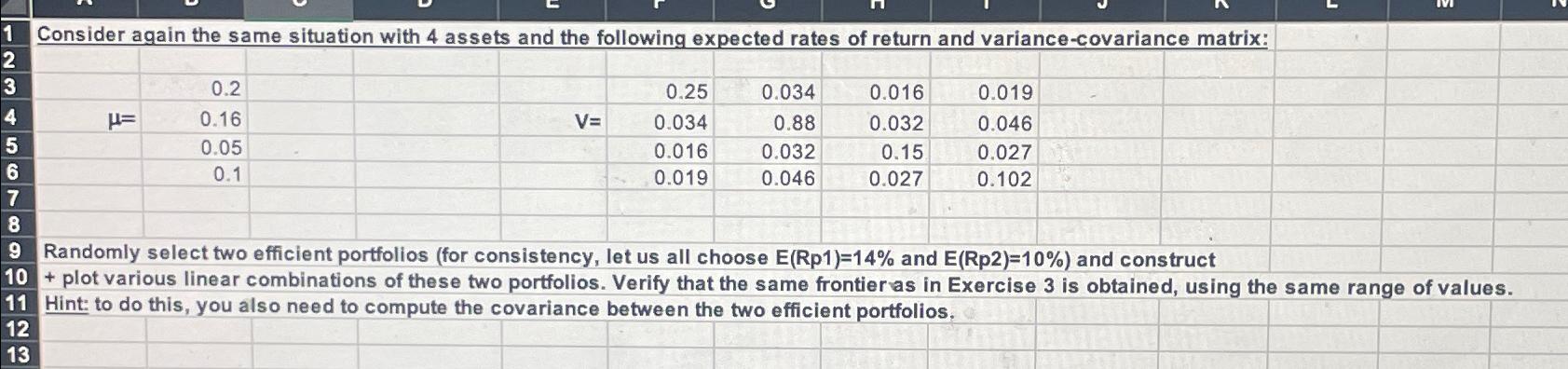

1 Consider again the same situation with 4 assets and the following expected rates of return and variance - covariance matrix: table [ [

Consider again the same situation with assets and the following expected rates of return and variancecovariance matrix:

table

Randomly select two efficient portfolios for consistency, let us all choose and and construct

plot various linear combinations of these two portfolios. Verify that the same frontieras in Exercise is obtained, using the same range of values.

Hint: to do this, you also need to compute the covariance between the two efficient portfolios.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started