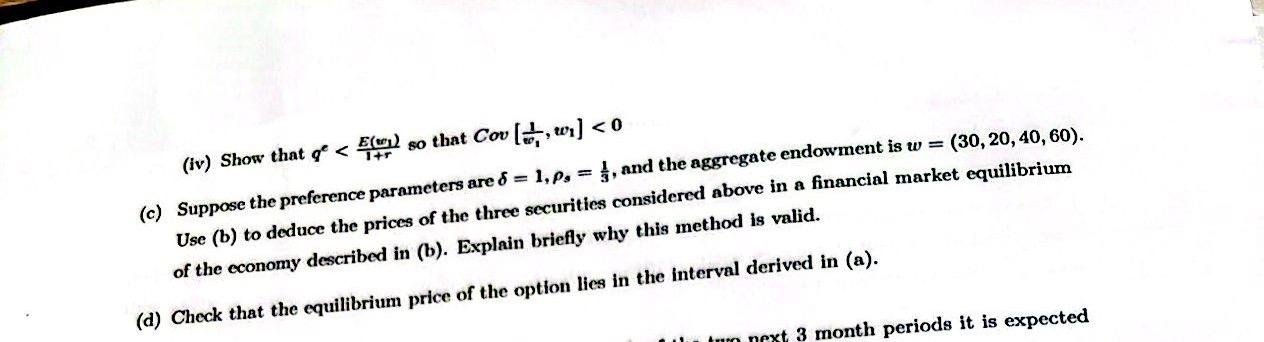

1. Consider an cconomy with two dates (t=0,1) and 3 states at date 1. Suppose there are three securities, a sure bond with payoff (1,1,1), an equity contract with payoff (20,40,60) and a call option on equity with strike price 50 , i.e. its payoff is (0,0,10). (a) Suppose initially that only the bond and equity are available, and suppose the price of the bond qb and the price of equity qe are exogenously known. Show that using the partial equilibrium approach, the no-arbitrage condition gives rise to an interval of possible prices for the call option: derive this interval. (b) Since the payoff of the option can not be replicated by the bond and equity we need more than just the price of equity and the bond to price the option. Another way to calculate its price is to calculate the financial market equilibrium given the endowments and preferences of the agents assuming that they can trade these three assets. Actually an easier approach is to calculate the Arrow-Debreu equilibrium prices and to use these prices to calculate the security prices for the associated financial market equilibrium. Suppose all the agents have the same utility function u(x0,x1,x2,x3)=ln(x0)+s=13sln(xs) and initial endowments i=(0i,1i,2i,3i),i=1,,I. Let w=ii denote the aggregate endowment. Find the Arrow-Debreu equilibrium prices of this economy. You may use the following property: when all agents have the same log utility function then the vector of Arrow-Debreu prices is the present value vector of the representative agent at the aggregate endowment with this utility function. Find expressions for the equilibrium prices qb,qe and qc. As we shall now see these expressions have an interesting economic interpretation. (i) Show that the bond and equity prices can be expressed as qb=E(w1w0),qe=(1+r)E(w1)+Cov[w1w0,w1] where qb=1/(1+r) and r is the rate of interest. (ii) Interpret the expression for the bond price: what is the condition that the rate of interest be positive? Does this explain why the interest rate is typically positive? iii) Interpret the expression for the equity price. Why might the covariance term be negative and how would you interpret the negative term (hint: some kind of risk premium)? (iv) Show that qe