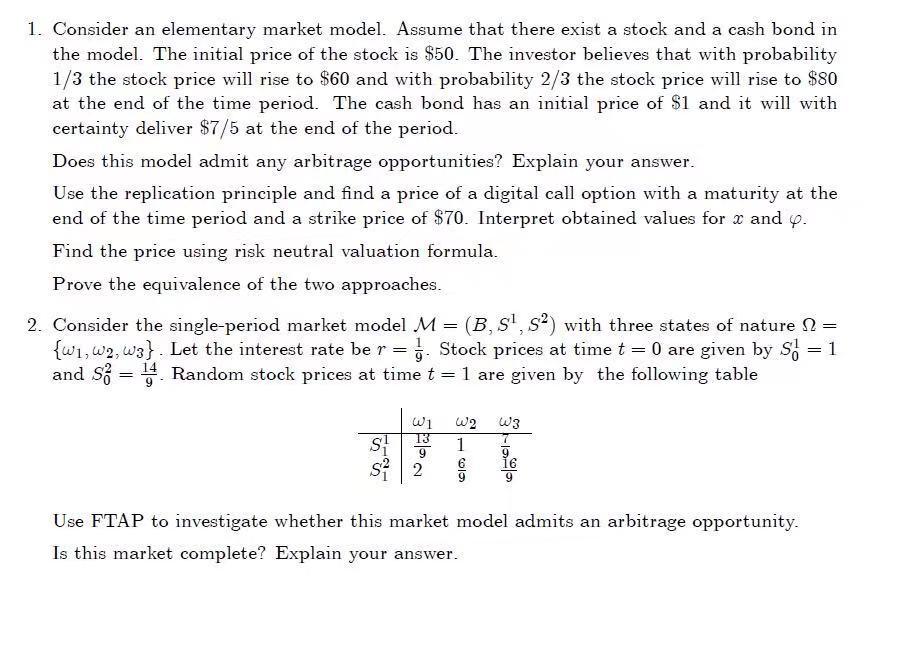

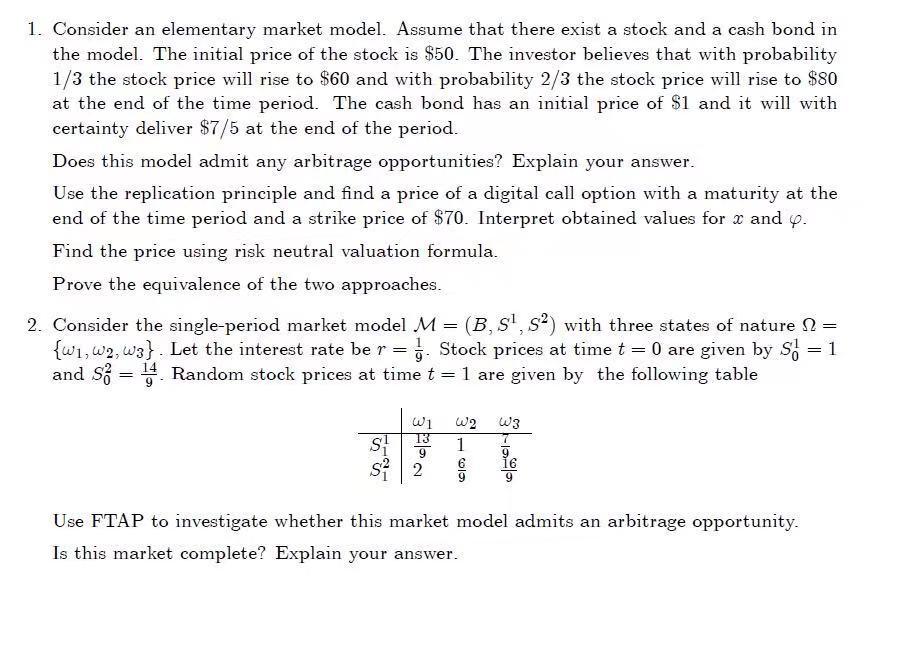

1. Consider an elementary market model. Assume that there exist a stock and a cash bond in the model. The initial price of the stock is $50. The investor believes that with probability 1/3 the stock price will rise to $60 and with probability 2/3 the stock price will rise to $80 at the end of the time period. The cash bond has an initial price of $1 and it will with certainty deliver $7/5 at the end of the period. Does this model admit any arbitrage opportunities? Explain your answer. Use the replication principle and find a price of a digital call option with a maturity at the end of the time period and a strike price of $70. Interpret obtained values for x and p. Find the price using risk neutral valuation formula. Prove the equivalence of the two approaches. 2. Consider the single-period market model M=(B, S1, ) with three states of nature 1 = {W1, W2, W3}. Let the interest rate ber= Stock prices at time t = 0 are given by S6 = 1 and S = 14. Random stock prices at time t = 1 are given by the following table W3 W1 Sil S22 W2 1 9 Use FTAP to investigate whether this market model admits an arbitrage opportunity. Is this market complete? Explain your answer. 1. Consider an elementary market model. Assume that there exist a stock and a cash bond in the model. The initial price of the stock is $50. The investor believes that with probability 1/3 the stock price will rise to $60 and with probability 2/3 the stock price will rise to $80 at the end of the time period. The cash bond has an initial price of $1 and it will with certainty deliver $7/5 at the end of the period. Does this model admit any arbitrage opportunities? Explain your answer. Use the replication principle and find a price of a digital call option with a maturity at the end of the time period and a strike price of $70. Interpret obtained values for x and p. Find the price using risk neutral valuation formula. Prove the equivalence of the two approaches. 2. Consider the single-period market model M=(B, S1, ) with three states of nature 1 = {W1, W2, W3}. Let the interest rate ber= Stock prices at time t = 0 are given by S6 = 1 and S = 14. Random stock prices at time t = 1 are given by the following table W3 W1 Sil S22 W2 1 9 Use FTAP to investigate whether this market model admits an arbitrage opportunity. Is this market complete? Explain your