Answered step by step

Verified Expert Solution

Question

1 Approved Answer

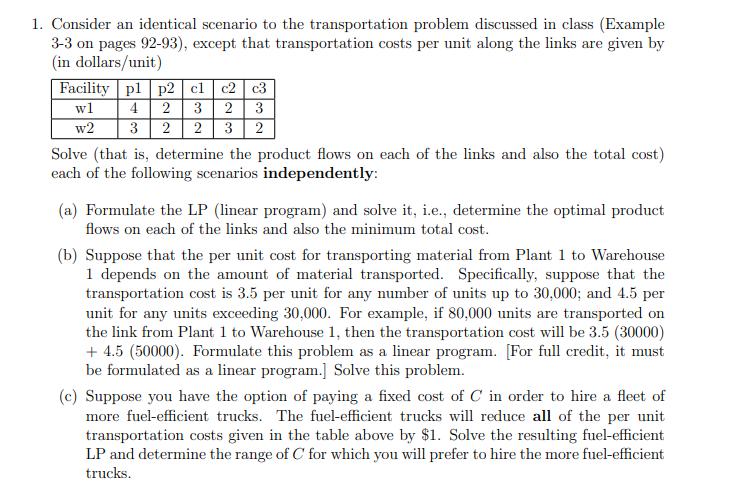

1. Consider an identical scenario to the transportation problem discussed in class (Example 3-3 on pages 92-93), except that transportation costs per unit along

1. Consider an identical scenario to the transportation problem discussed in class (Example 3-3 on pages 92-93), except that transportation costs per unit along the links are given by (in dollars/unit) Facility pl p2 cl c2 c3 4 wl w2 3 2 3 2 3 2 3 2 2 Solve (that is, determine the product flows on each of the links and also the total cost) each of the following scenarios independently: (a) Formulate the LP (linear program) and solve it, i.e., determine the optimal product flows on each of the links and also the minimum total cost. (b) Suppose that the per unit cost for transporting material from Plant 1 to Warehouse 1 depends on the amount of material transported. Specifically, suppose that the transportation cost is 3.5 per unit for any number of units up to 30,000; and 4.5 per unit for any units exceeding 30,000. For example, if 80,000 units are transported on the link from Plant 1 to Warehouse 1, then the transportation cost will be 3.5 (30000) + 4.5 (50000). Formulate this problem as a linear program. [For full credit, it must be formulated as a linear program.] Solve this problem. (c) Suppose you have the option of paying a fixed cost of C in order to hire a fleet of more fuel-efficient trucks. The fuel-efficient trucks will reduce all of the per unit transportation costs given in the table above by $1. Solve the resulting fuel-efficient LP and determine the range of C for which you will prefer to hire the more fuel-efficient trucks. (d) Suppose that the per unit cost for transporting material from Plant 1 to Warehouse 1 is linearly proportional to the flow and is given by x(P, W) 40000 [Note: the per unit cost is constant in the original formulation.] Can this problem be formulated as a linear program? If so, do it; if not, why not? Solve this problem. 2. Consider the supply contract problem scenario that we discussed in class (and in Chapter 4). That is, the seller (supplier) is MTO; the seller pays a fixed cost of $100,000 to produce, and its per unit production cost is $35; the buyer pays the seller $80 per item purchased, and sells the items, for which there is a demand, for $125; the residual price is $20. The demand probability mass function was given in class. As discussed, the globally optimal solution which maximizes the combined expected profit, is for the buyer to purchase Q* = 16,000 items. This results in a combined expected profit of $1,014,500. Suppose that the buyer and seller do not share any information beyond that in the following contract: Suppose that the buyer and seller have a revenue sharing contract with Cew being the new cost per unit for the buyer in exchange for 2% revenue sharing. Suppose CB = CM = 35. Does there exist a value of a that will both: yield both the maximum combined expected profit and equally split it between the buyer and the seller? If so, determine this value of r. If not, explain why no such value exists.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 1 attachment)

639152e73418c_107848.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started