Answered step by step

Verified Expert Solution

Question

1 Approved Answer

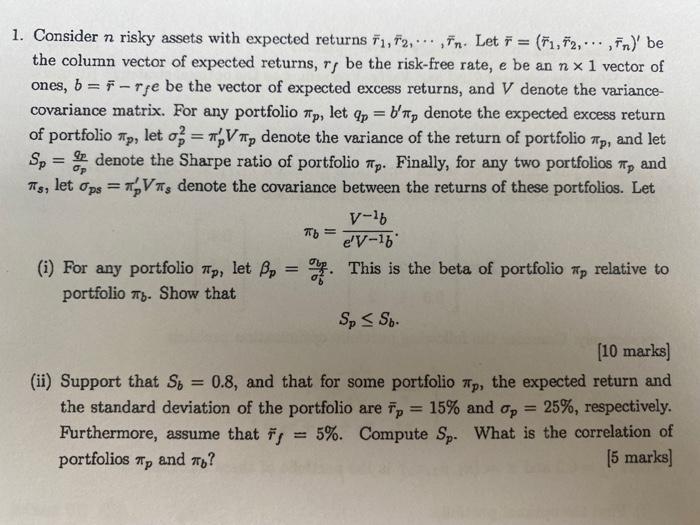

1. Consider n risky assets with expected returns F1, F2, Fn. Let F= (F1,F2,,Fn) be the column vector of expected returns, rj be the

1. Consider n risky assets with expected returns F1, F2, Fn. Let F= (F1,F2,,Fn) be the column vector of expected returns, rj be the risk-free rate, e be an n x 1 vector of ones, b= F-rje be the vector of expected excess returns, and V denote the variance- covariance matrix. For any portfolio Tp, let qp = b'p denote the expected excess return of portfolio Tp, let o2 = Vp denote the variance of the return of portfolio #p, and let Sp denote the Sharpe ratio of portfolio Tp. Finally, for any two portfolios and Ts, let Ops =Vs denote the covariance between the returns of these portfolios. Let Op V-6 e'V-16 b = (i) For any portfolio #p, let Bp = . This is the beta of portfolio relative to portfolio T. Show that Sp Sb. [10 marks] (ii) Support that St = 0.8, and that for some portfolio #p, the expected return and the standard deviation of the portfolio are fp = 15% and op = 25%, respectively. Furthermore, assume that f = 5%. Compute Sp. What is the correlation of portfolios and ? [5 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 When working with large portfolios the algebra of representing ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started