Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(1) Consider the file prices.txt from Assignment 4 which contains daily closing prices for Microsoft (msft), General Electric (ge), and Ford Motor Company (ford),

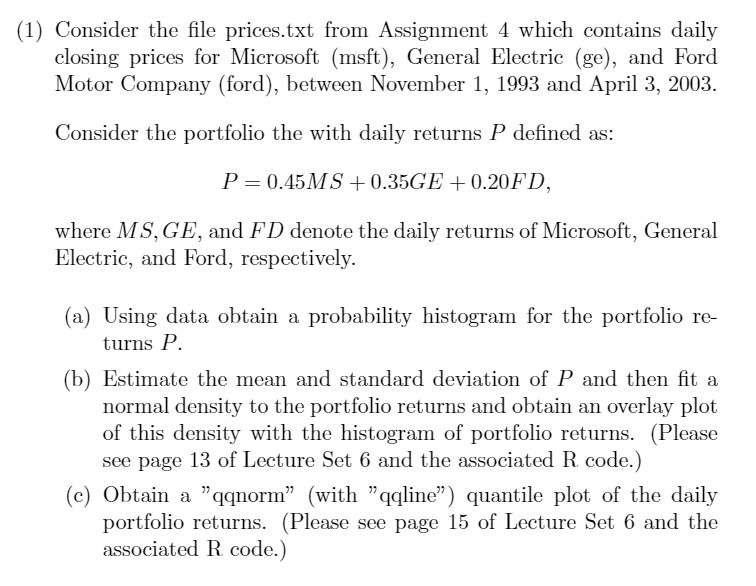

(1) Consider the file prices.txt from Assignment 4 which contains daily closing prices for Microsoft (msft), General Electric (ge), and Ford Motor Company (ford), between November 1, 1993 and April 3, 2003. Consider the portfolio the with daily returns P defined as: P=0.45MS +0.35GE + 0.20FD, where MS, GE, and FD denote the daily returns of Microsoft, General Electric, and Ford, respectively. (a) Using data obtain a probability histogram for the portfolio re- turns P. (b) Estimate the mean and standard deviation of P and then fit a normal density to the portfolio returns and obtain an overlay plot of this density with the histogram of portfolio returns. (Please see page 13 of Lecture Set 6 and the associated R. code.) (c) Obtain a "qqnorm" (with "qqline") quantile plot of the daily portfolio returns. (Please see page 15 of Lecture Set 6 and the associated R code.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started