Question

1. Consider the following: A firms operations are 45% GREATER than an average firm in the market. Relevant government securities trade @ 3.7%; and the

1. Consider the following: A firms operations are 45% GREATER than an average firm in the market. Relevant government securities trade @ 3.7%; and the current average return on the market as a whole is 9.1%. What rate of return must the firm pay to attract investors?

2. How does your answer to 1. above change if the companys operations stabilize and its risk relative to the market goes down to 110%; AND the expected return on the market GOES DOWN to 7.9%?

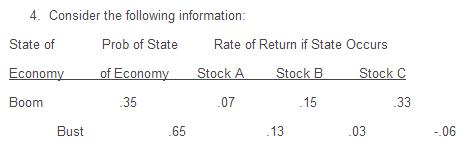

What is and expected return and variance of a portfolio which is equally weighted in investments of each of the three stocks?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started