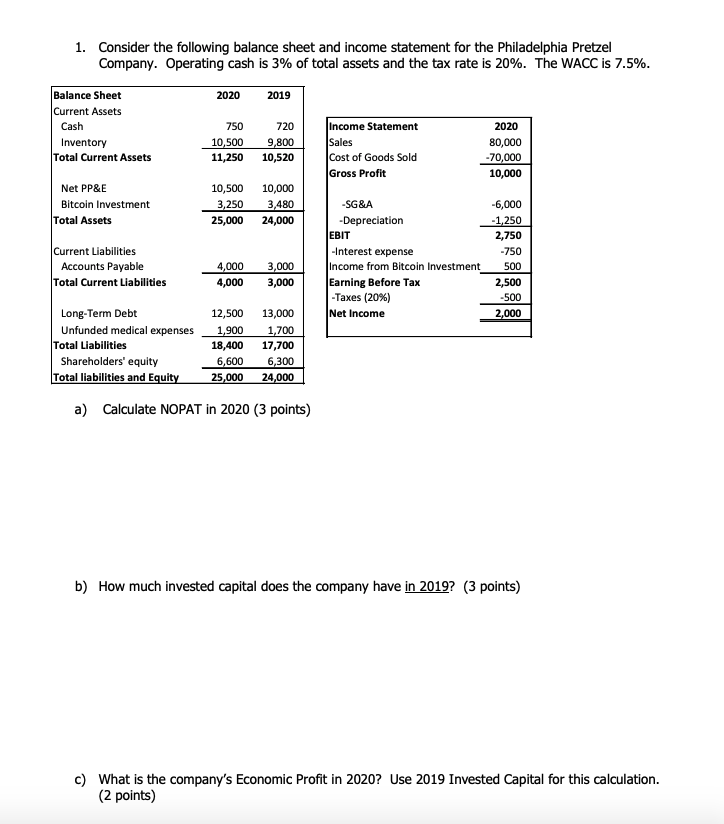

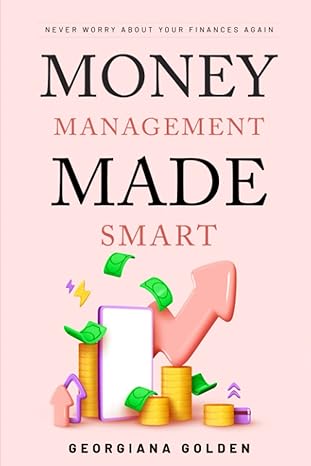

1. Consider the following balance sheet and income statement for the Philadelphia Pretzel Company. Operating cash is 3% of total assets and the tax rate is 20%. The WACC is 7.5%.

1. Consider the following balance sheet and income statement for the Philadelphia Pretzel Company. Operating cash is 3% of total assets and the tax rate is 20%. The WACC is 7.5%. 2020 2019 Balance Sheet Current Assets Cash Inventory Total Current Assets 750 10,500 11,250 720 9,800 10,520 income Statement Sales Cost of Goods Sold Gross Profit 2020 80,000 -70,000 10,000 Net PP&E Bitcoin Investment Total Assets 10,500 3,250 25,000 10,000 3,480 24,000 Current Liabilities Accounts Payable Total Current Liabilities 4,000 4,000 3,000 3,000 -SG&A -6,000 -Depreciation -1,250 EBIT 2,750 -Interest expense -750 Income from Bitcoin Investment 500 Earning Before Tax 2,500 -Taxes (20%) -500 Net Income 2,000 Long-Term Debt Unfunded medical expenses Total Liabilities Shareholders' equity Total liabilities and Equity 12,500 1.900 18,400 6,600 25,000 13,000 1,700 17,700 6,300 24,000 a) Calculate NOPAT in 2020 (3 points) b) How much invested capital does the company have in 2019? (3 points) c) What is the company's Economic Profit in 2020? Use 2019 Invested Capital for this calculation. (2 points) d) The unfunded medical expenses were promised to retired former employees. How would you categorize the unfunded medical expenses? (2 points) 1. Consider the following balance sheet and income statement for the Philadelphia Pretzel Company. Operating cash is 3% of total assets and the tax rate is 20%. The WACC is 7.5%. 2020 2019 Balance Sheet Current Assets Cash Inventory Total Current Assets 750 10,500 11,250 720 9,800 10,520 income Statement Sales Cost of Goods Sold Gross Profit 2020 80,000 -70,000 10,000 Net PP&E Bitcoin Investment Total Assets 10,500 3,250 25,000 10,000 3,480 24,000 Current Liabilities Accounts Payable Total Current Liabilities 4,000 4,000 3,000 3,000 -SG&A -6,000 -Depreciation -1,250 EBIT 2,750 -Interest expense -750 Income from Bitcoin Investment 500 Earning Before Tax 2,500 -Taxes (20%) -500 Net Income 2,000 Long-Term Debt Unfunded medical expenses Total Liabilities Shareholders' equity Total liabilities and Equity 12,500 1.900 18,400 6,600 25,000 13,000 1,700 17,700 6,300 24,000 a) Calculate NOPAT in 2020 (3 points) b) How much invested capital does the company have in 2019? (3 points) c) What is the company's Economic Profit in 2020? Use 2019 Invested Capital for this calculation. (2 points) d) The unfunded medical expenses were promised to retired former employees. How would you categorize the unfunded medical expenses? (2 points)