Answered step by step

Verified Expert Solution

Question

1 Approved Answer

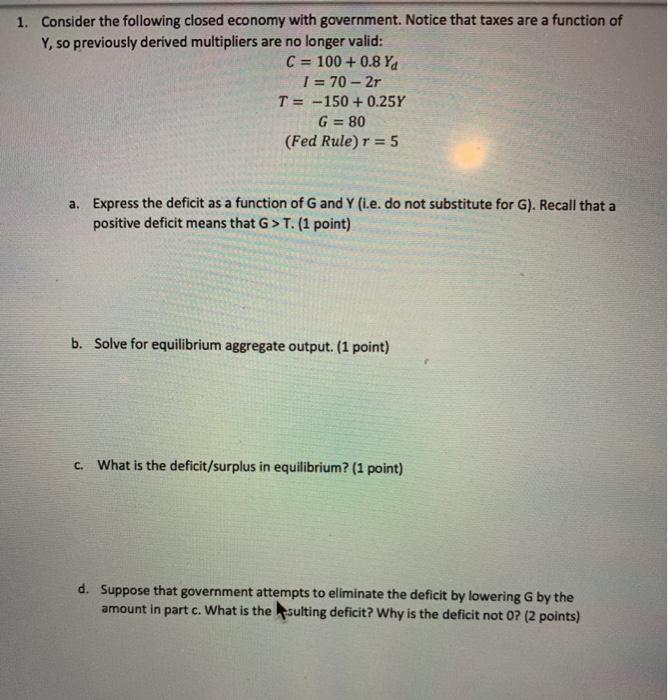

1. Consider the following closed economy with government. Notice that taxes are a function of Y, so previously derived multipliers are no longer valid:

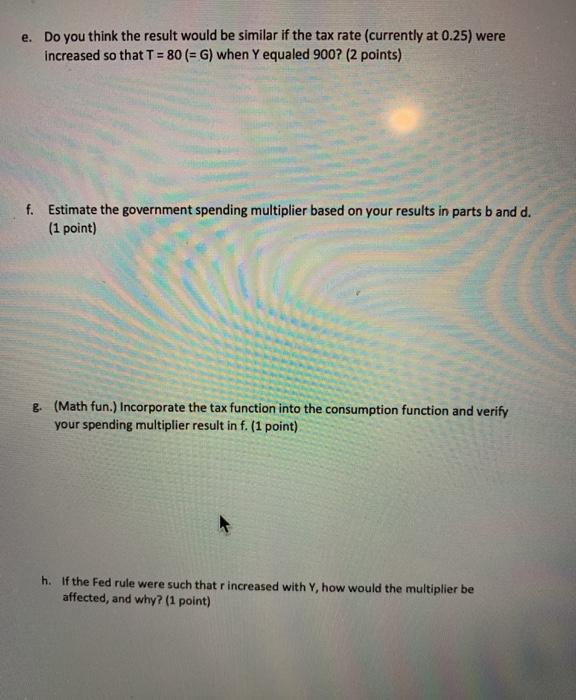

1. Consider the following closed economy with government. Notice that taxes are a function of Y, so previously derived multipliers are no longer valid: C= 100+ 0.8 Ya I=70-2r T= -150+ 0.25Y G=80 (Fed Rule) r = 5 a. Express the deficit as a function of G and Y (i.e. do not substitute for G). Recall that a positive deficit means that G> T. (1 point) b. Solve for equilibrium aggregate output. (1 point) c. What is the deficit/surplus in equilibrium? (1 point) d. Suppose that government attempts to eliminate the deficit by lowering G by the amount in part c. What is the sulting deficit? Why is the deficit not 0? (2 points) e. Do you think the result would be similar if the tax rate (currently at 0.25) were increased so that T = 80 (= G) when Y equaled 900? (2 points) f. Estimate the government spending multiplier based on your results in parts b and d. (1 point) 8. (Math fun.) Incorporate the tax function into the consumption function and verify your spending multiplier result in f. (1 point) h. If the Fed rule were such that r increased with Y, how would the multiplier be affected, and why? (1 point)

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a To express the deficit as a function of G and Y we first need to calculate the total tax revenue T ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started