Answered step by step

Verified Expert Solution

Question

1 Approved Answer

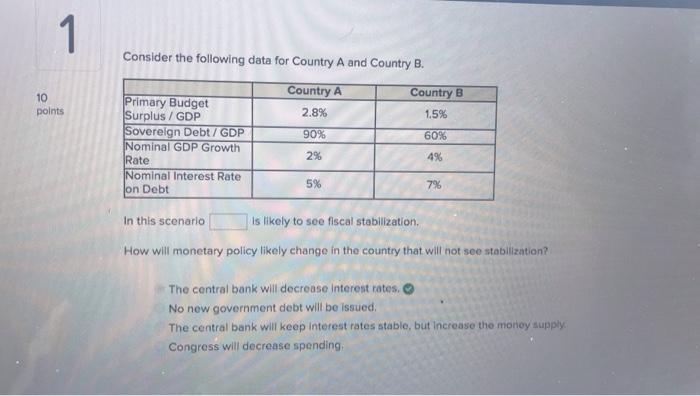

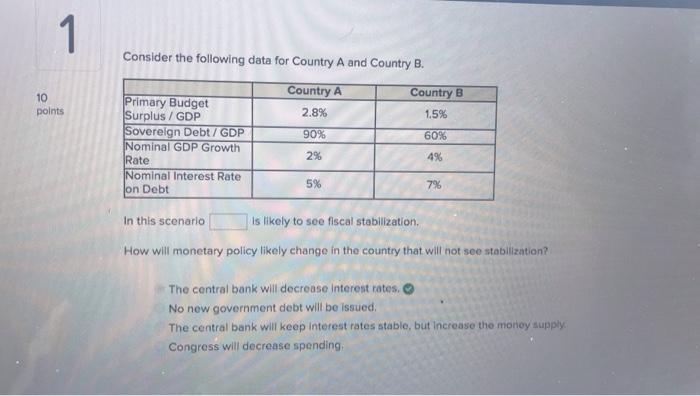

1 Consider the following data for Country A and Country B. 10 points Country A 2.8% Country B 1.5% 90% 60% Primary Budget Surplus /

1 Consider the following data for Country A and Country B. 10 points Country A 2.8% Country B 1.5% 90% 60% Primary Budget Surplus / GDP Sovereign Debt / GDP Nominal GDP Growth Rate Nominal Interest Rate on Debt 2% 496 5% 7% In this scenario is likely to see fiscal stabilization How will monetary policy likely change in the country that will not see stabilization? The central bank will decrease interest rates No new government debt will be issued The central bank will keep interest rates stable, but increase the money supply Congress will decrease spending

1 Consider the following data for Country A and Country B. 10 points Country A 2.8% Country B 1.5% 90% 60% Primary Budget Surplus / GDP Sovereign Debt / GDP Nominal GDP Growth Rate Nominal Interest Rate on Debt 2% 496 5% 7% In this scenario is likely to see fiscal stabilization How will monetary policy likely change in the country that will not see stabilization? The central bank will decrease interest rates No new government debt will be issued The central bank will keep interest rates stable, but increase the money supply Congress will decrease spending

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started