Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Consider the following facts about a bond that is trading on the New York Stock Exchange. Issue date: Maturity date: Par value Semi-annual coupon:

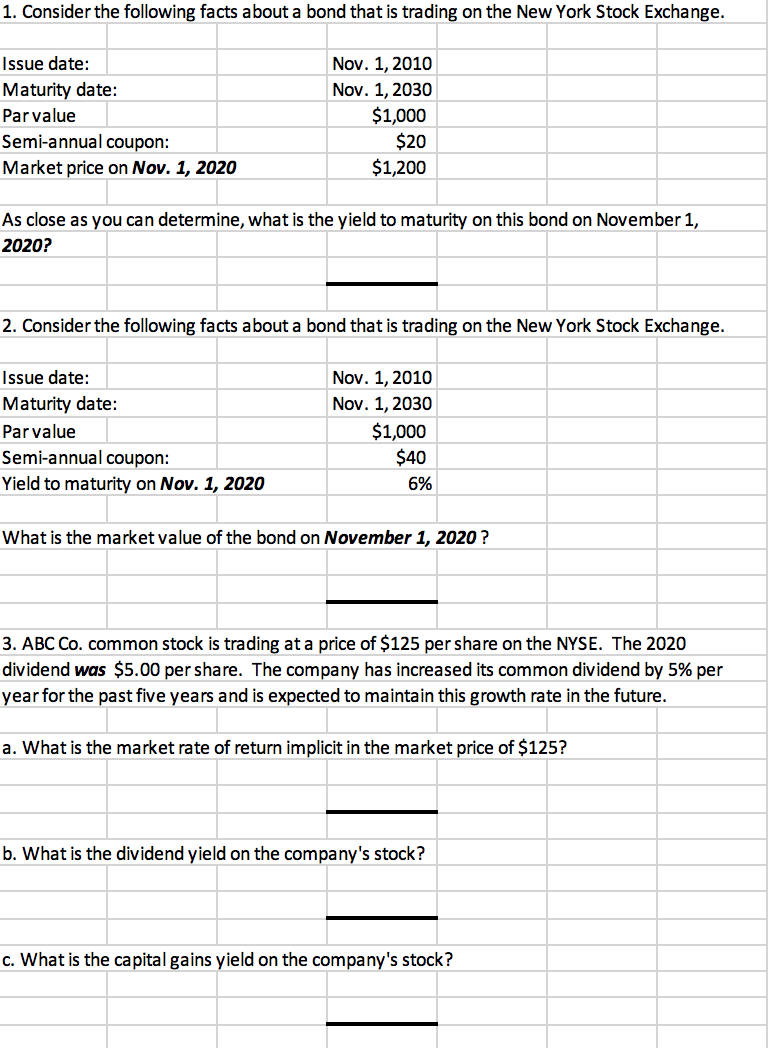

1. Consider the following facts about a bond that is trading on the New York Stock Exchange. Issue date: Maturity date: Par value Semi-annual coupon: Market price on Nov. 1, 2020 Nov. 1, 2010 Nov. 1, 2030 $1,000 $20 $1,200 As close as you can determine, what is the yield to maturity on this bond on November 1, 2020? 2. Consider the following facts about a bond that is trading on the New York Stock Exchange. Issue date: Maturity date: Par value Semi-annual coupon: Yield to maturity on Nov. 1, 2020 Nov. 1, 2010 Nov. 1, 2030 $1,000 $40 6% What is the market value of the bond on November 1, 2020 ? 3. ABC Co. common stock is trading at a price of $125 per share on the NYSE. The 2020 dividend was $5.00 per share. The company has increased its common dividend by 5% per year for the past five years and is expected to maintain this growth rate in the future. a. What is the market rate of return implicit in the market price of $125? b. What is the dividend yield on the company's stock? c. What is the capital gains yield on the company's stock

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started