Answered step by step

Verified Expert Solution

Question

1 Approved Answer

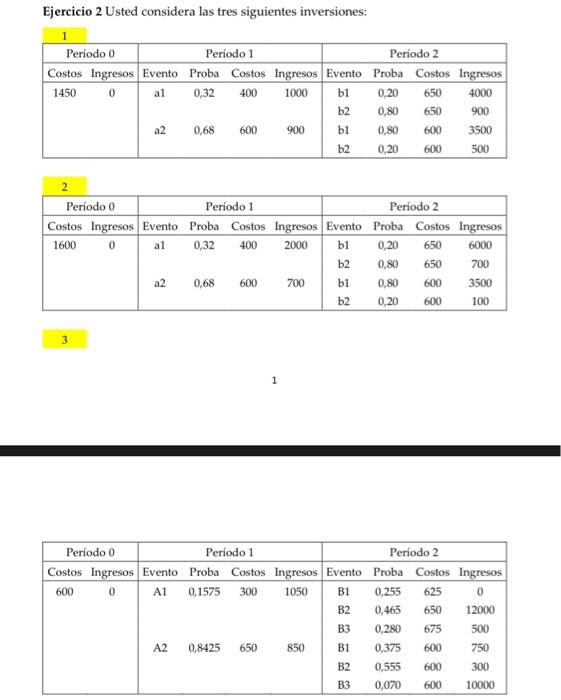

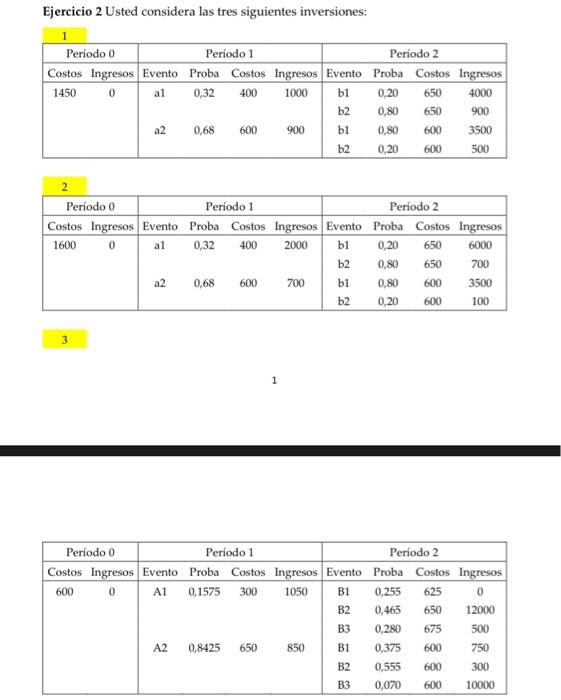

Period 0 Period 1 Period 2 Event Costs Income Probable Event Costs Income Probable Event Costs Income 1450 0 a1 0.32 400 1000 b1 0.20

Period 0 Period 1 Period 2 Event Costs Income Probable Event Costs Income Probable Event Costs Income 1450 0 a1 0.32 400 1000 b1 0.20 b2 0.80 a2 0.68 600 900 b1 0.80 b2 0.20 2 650 4000 650 900 600 3500 600 500 Period 0 Period 1 Period 2 Event Costs Income Probable Event Costs Income Probable Event Costs Income 1600 0 a1 0.32 400 2000 b1 0.20 b2 0.80 a2 0.68 600 700 b1 0.80 b2 0.20 3 650 6000 650 700 600 3500 600 100 1 Period 0 Period 1 Period 2 Event Costs Income Probable Event Costs Income Probable Event Costs Income 600 0 A1 A2 0.8425 650 850 B1 B2 0.555 600 300 0.1575 300 1050 B1 B2 0.465 650 0.255 625 0 12000 B3 0.280 675 500 0.375 600 750 B3 0.070 600 10,000 Based on a 10% opportunity rate: 1. Determine the different possible events and their respective probabilities. 2. Determine the cash flows and subsequent NPV of each investment, depending on each possible event. 3. Calculate the expectation of the NPV, the variance of the NPV and the coefficient of variability of the NPV of each investment. 4. Calculate the expectation of the NPV, the variance of the NPV and the coefficient of variability of the NPV of the multiple selection composed of investments 1 and 2. To do this, bear in mind that these two investments depend on the same events. 5. Calculate the expectation of the NPV, the variance of the NPV and the coefficient of variability of the NPV of the other possible multiple selections: 1 + 3, 2 + 3 and 1 + 2 + 3. To do this, bear in mind that investment 3 depends on events other than the events that influence investments 1 and 2. 6. Deduce which multiple selection minimizes the NPV coefficient of variability and explain why this selection should be implemented.

th first paragraph is the table shown in the picture, then it explain what the problem is

Ejercicio 2 Usted considera las tres siguientes inversiones: Periodo 0 Periodo 1 Periodo 2 Costos Ingresos Evento Proba Costos ingresos Evento Proba Costos Ingresos 1450 0 al 0,32 400 1000 bi 0,20 650 4000 b2 0,80 650 900 a2 0,68 600 900 bi 0,80 600 3500 b2 0,20 600 500 Periodo 0 Perodo 1 Periodo 2 Costos ingresos Evento Proba Costos Ingresos Evento Proba Costos ingresos 1600 0 al 0,32 400 2000 bi 0,20 650 6000 b2 0,80 650 700 a2 0,68 b1 0,80 600 3500 b2 0,20 600 100 600 700 3 Periodo o Periodo 1 Periodo 2 Costos Ingresos Evento Proba Costos Ingresos Evento Proba Costos Ingresos 600 0 A1 0,1575 300 1050 B1 0,255 625 0 B2 0,465 650 12000 B3 0,280 675 500 A2 0,8425 650 850 B1 0,375 600 750 B2 0,555 600 300 B3 0,070 600 10000 Ejercicio 2 Usted considera las tres siguientes inversiones: Periodo 0 Periodo 1 Periodo 2 Costos Ingresos Evento Proba Costos ingresos Evento Proba Costos Ingresos 1450 0 al 0,32 400 1000 bi 0,20 650 4000 b2 0,80 650 900 a2 0,68 600 900 bi 0,80 600 3500 b2 0,20 600 500 Periodo 0 Perodo 1 Periodo 2 Costos ingresos Evento Proba Costos Ingresos Evento Proba Costos ingresos 1600 0 al 0,32 400 2000 bi 0,20 650 6000 b2 0,80 650 700 a2 0,68 b1 0,80 600 3500 b2 0,20 600 100 600 700 3 Periodo o Periodo 1 Periodo 2 Costos Ingresos Evento Proba Costos Ingresos Evento Proba Costos Ingresos 600 0 A1 0,1575 300 1050 B1 0,255 625 0 B2 0,465 650 12000 B3 0,280 675 500 A2 0,8425 650 850 B1 0,375 600 750 B2 0,555 600 300 B3 0,070 600 10000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started