1. Consider the following financial statements and table of ratios. a. Determine if the firms individual ratios indicate a better or worse position than that

1. Consider the following financial statements and table of ratios.

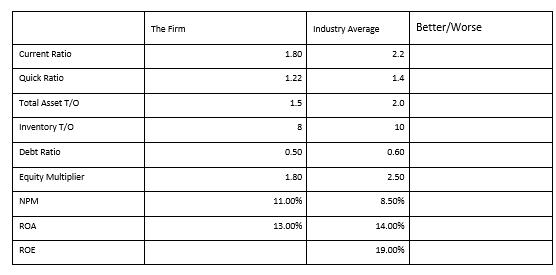

a. Determine if the firm’s individual ratios indicate a better or worse position than that of the industry average.

b. Using the DuPont Equation, calculate ROE.

c. Do the ratios indicate the firm is more or less profitable than the industry average? Justify your response

Current Ratio Quick Ratio Total Asset T/O Inventory T/O Debt Ratio Equity Multiplier NPM ROA ROE The Firm 1.80 1.22 1.5 8 0.50 1.80 11.00% 13.00% Industry Average 2.2 1.4 2.0 10 0.60 2.50 8.50% 14.00% 19.00% Better/Worse

Step by Step Solution

3.47 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

a The firm Industry average BetterWorse Current ratio 18 22 Worse Quick ratio 122 14 W...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Authors: Scott Besley, Eugene F. Brigham

6th edition

9781305178045, 1285429648, 1305178041, 978-1285429649

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App