Question

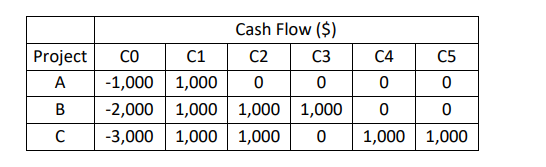

1. Consider the following independent projects: a) If the opportunity cost of capital is 8%, calculate the net present value (NPV) of each project. b)

1. Consider the following independent projects:

a) If the opportunity cost of capital is 8%, calculate the net present value (NPV) of each project. b) Based on the NPV calculated in a), which project (s) should a firm accept? Why? c) Calculate the payback period for each project. d) Which project(s) would a firm using only the payback rule accept if the cutoff period is three years?

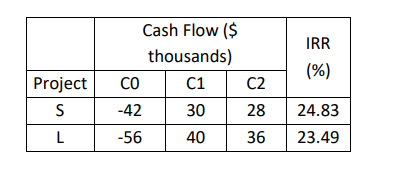

2. The president of Giant Enterprises has to make a choice between two mutually exclusive investments:

The opportunity cost of capital is 12%. He is tempted to take Project S, which has the higher IRR.

a) Explain why this is not the correct procedure. b) Show him how to adapt the IRR rule to choose the best project. b) Show him how to adapt the IRR rule to choose the best project.

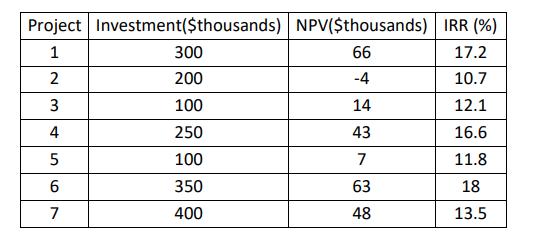

3. B Pharmaceuticals has $900,000 allocated for capital expenditures. Which of the following 7 projects should the company accept to stay within the $900,000 budget? How much does the budget limit cost the company in terms of its market value? The opportunity cost of capital for each project is 11 percent.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started