Answered step by step

Verified Expert Solution

Question

1 Approved Answer

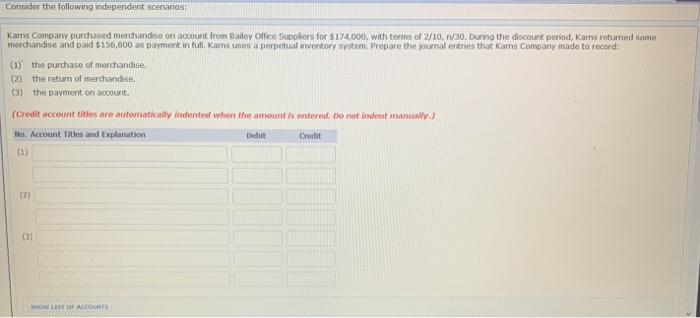

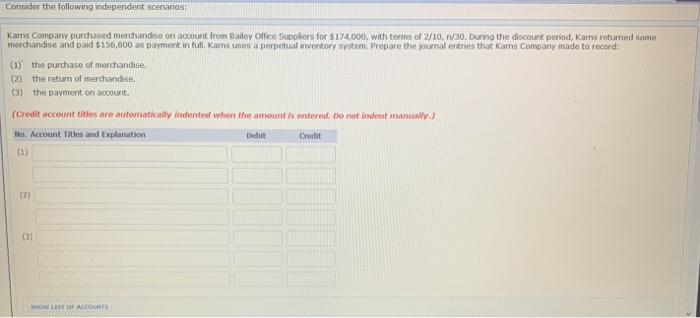

1 Consider the following independent scenarios: Kamns Company purchased merchandise on account from Bailey Office Suppliers for $174.000, with terms of 2/10, 1/30. During the

1

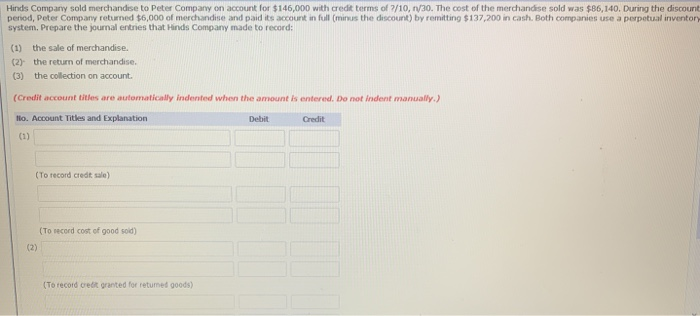

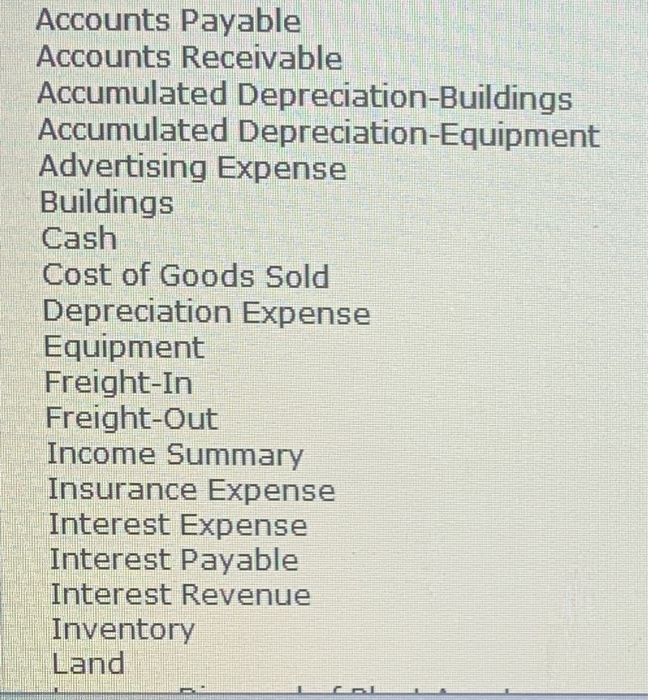

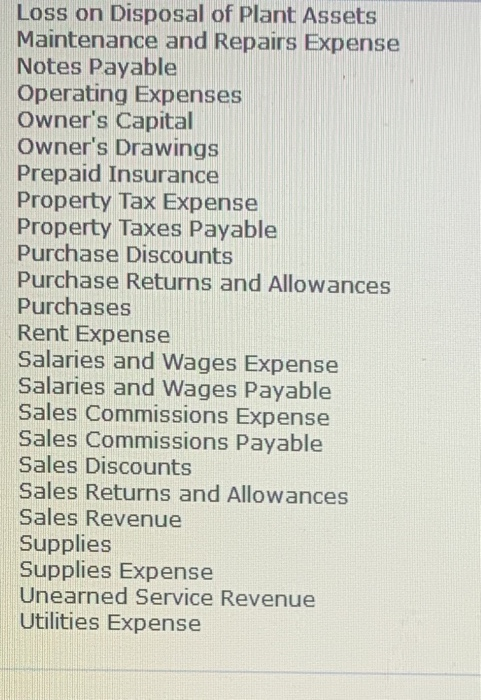

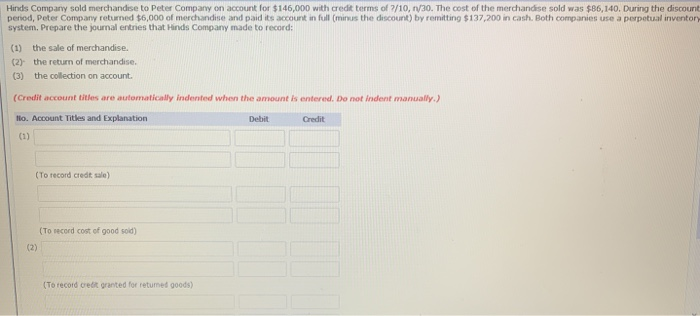

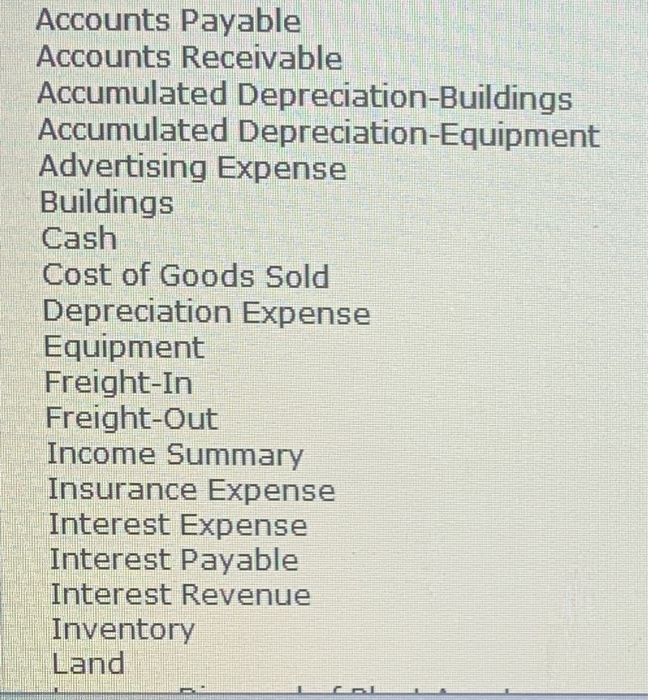

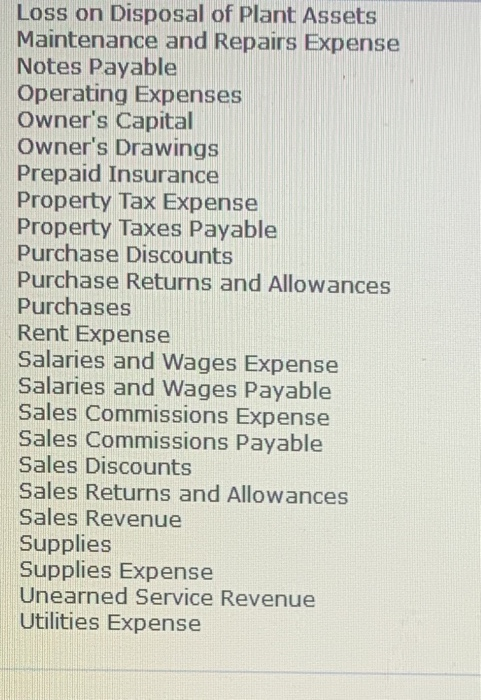

Consider the following independent scenarios: Kamns Company purchased merchandise on account from Bailey Office Suppliers for $174.000, with terms of 2/10, 1/30. During the discount period, Karns returned some merchandise and paid $156,800 as payment in full. Karns uses a perpetual inventory system. Prepare the journal entries that Kams Company made to record: (1) the purchase of merchandise. (2) the return of merchandise (3) the payment on account. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) No. Account Titles and Explanation Debit Credit Hinds Company sold merchandise to Peter Company on account for $146,000 with credit terms of 7/10, n/30. The cost of the merchandise sold was $86,140. During the discount period, Peter Company returned $6,000 of merchandise and paid its account in full (minus the discount) by remitting $137,200 in cash. Both companies use a perpetual inventor system. Prepare the journal entries that Hinds Company made to record: (1) (2) the sale of merchandise. the return of merchandise. the collection on account (3) (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Ilo. Account Titles and Explanation Debit Credit (To record credit sale) (To record cost of good sold) (To record et granted for returned goods) Accounts Payable Accounts Receivable Accumulated Depreciation-Buildings Accumulated Depreciation-Equipment Advertising Expense Buildings Cash Cost of Goods Sold Depreciation Expense Equipment Freight-In Freight-Out Income Summary Insurance Expense Interest Expense Interest Payable Interest Revenue Inventory and Loss on Disposal of Plant Assets Maintenance and Repairs Expense Notes Payable Operating Expenses Owner's Capital Owner's Drawings Prepaid Insurance Property Tax Expense Property Taxes Payable Purchase Discounts Purchase Returns and Allowances Purchases Rent Expense Salaries and Wages Expense Salaries and Wages Payable Sales Commissions Expense Sales Commissions Payable Sales Discounts Sales Returns and Allowances Sales Revenue Supplies Supplies Expense Unearned Service Revenue Utilities Expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started