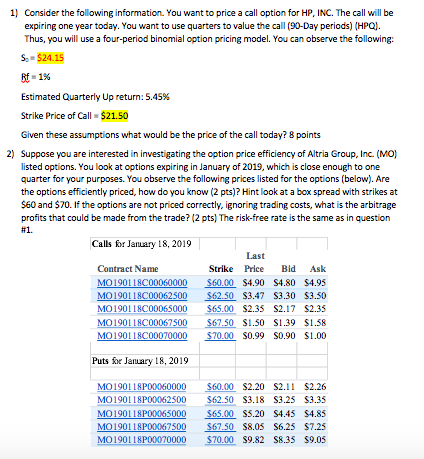

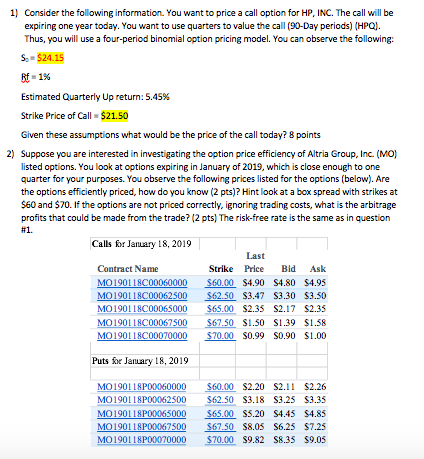

1) Consider the following information. You want to price a call option for HP, INC. The call will be expiring one year today. You want to use quarters to value the call (90-Day periods) (HPO). Thus, you will use a four-period binomial option pricing model. You can observe the following: S $24.15 Estimated Quarterly up return: 5.45% Strike Price of Call $21.50 Given these assumptions what would be the price of the call today? 8 points 2) Suppose you are interested in investigating the option price efficiency of Altria Group, Inc. (Mo) listed options. You look at options expiring in January of 2019, which is close enough to one quarter for your purposes. You observe the following prices listed for the options (below). Are the options efficiently priced, how do you know (2 pts)? Hint lookata bx spread with strikes at $60 and $70. If the options are not priced correctly, ignoring trading costs, what is the arbitrage profits that could be made from the trade? (2 pts) The risk-free rate isthe same as in question Calls for January 18, 2019 Last Contract Name Strike Price Bld Ask MO190118C00060000 60.00 $4.90 S4.80 $4.95 $62.50 $3.47 S3.30 S3.50 MO190118C00065000 $65.00 S2.35 S2.17 $2.35 MO 190118000067500 $67.50 S1.50 S1.39 $1.58 S0.99 S0.90 $1.00 Puts for Jauary 18, 2019 MO1901180000 $60.00 $2.20 S2.11 $2.26 MO190118P0062500 62.50 $3.18 S3.25 S3.3:5 MO190118P00065000 65.00 S5.20 S4.45 $4.85 $6750 $8.05 S6.25 $7.25 90118P00070000 $70.00 S9.82 s8.35 s9.405 190118P000675 1) Consider the following information. You want to price a call option for HP, INC. The call will be expiring one year today. You want to use quarters to value the call (90-Day periods) (HPO). Thus, you will use a four-period binomial option pricing model. You can observe the following: S $24.15 Estimated Quarterly up return: 5.45% Strike Price of Call $21.50 Given these assumptions what would be the price of the call today? 8 points 2) Suppose you are interested in investigating the option price efficiency of Altria Group, Inc. (Mo) listed options. You look at options expiring in January of 2019, which is close enough to one quarter for your purposes. You observe the following prices listed for the options (below). Are the options efficiently priced, how do you know (2 pts)? Hint lookata bx spread with strikes at $60 and $70. If the options are not priced correctly, ignoring trading costs, what is the arbitrage profits that could be made from the trade? (2 pts) The risk-free rate isthe same as in question Calls for January 18, 2019 Last Contract Name Strike Price Bld Ask MO190118C00060000 60.00 $4.90 S4.80 $4.95 $62.50 $3.47 S3.30 S3.50 MO190118C00065000 $65.00 S2.35 S2.17 $2.35 MO 190118000067500 $67.50 S1.50 S1.39 $1.58 S0.99 S0.90 $1.00 Puts for Jauary 18, 2019 MO1901180000 $60.00 $2.20 S2.11 $2.26 MO190118P0062500 62.50 $3.18 S3.25 S3.3:5 MO190118P00065000 65.00 S5.20 S4.45 $4.85 $6750 $8.05 S6.25 $7.25 90118P00070000 $70.00 S9.82 s8.35 s9.405 190118P000675