Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Consider the following model.The banking industry holds one kind of deposit, a checking deposit. The money supply is defined to be currency in

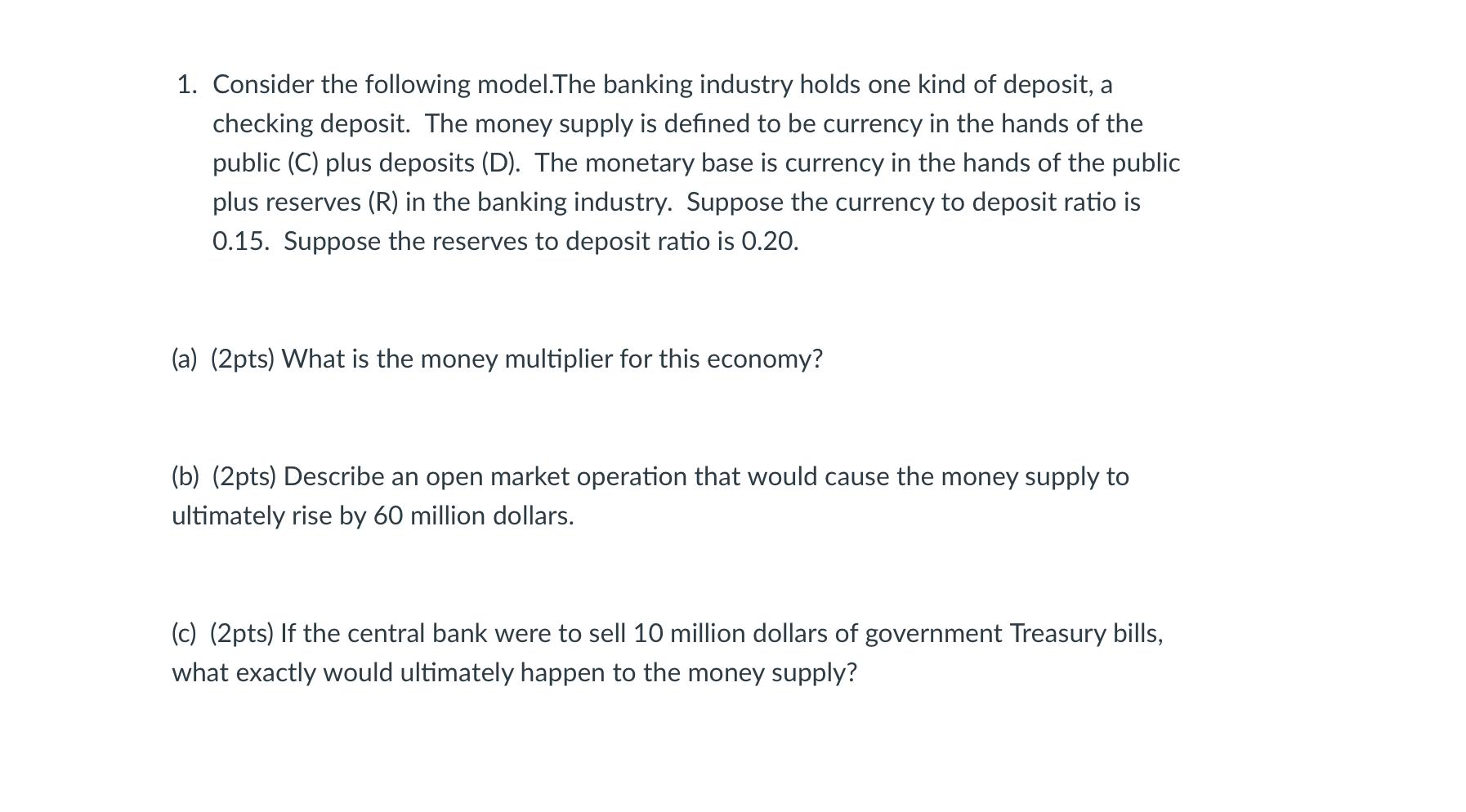

1. Consider the following model.The banking industry holds one kind of deposit, a checking deposit. The money supply is defined to be currency in the hands of the public (C) plus deposits (D). The monetary base is currency in the hands of the public plus reserves (R) in the banking industry. Suppose the currency to deposit ratio is 0.15. Suppose the reserves to deposit ratio is 0.20. (a) (2pts) What is the money multiplier for this economy? (b) (2pts) Describe an open market operation that would cause the money supply to ultimately rise by 60 million dollars. (c) (2pts) If the central bank were to sell 10 million dollars of government Treasury bills, what exactly would ultimately happen to the money supply?

Step by Step Solution

★★★★★

3.55 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a The money multiplier can be calculated using the formula Money Multiplier 1 Reserve Ratio Given th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started