Answered step by step

Verified Expert Solution

Question

1 Approved Answer

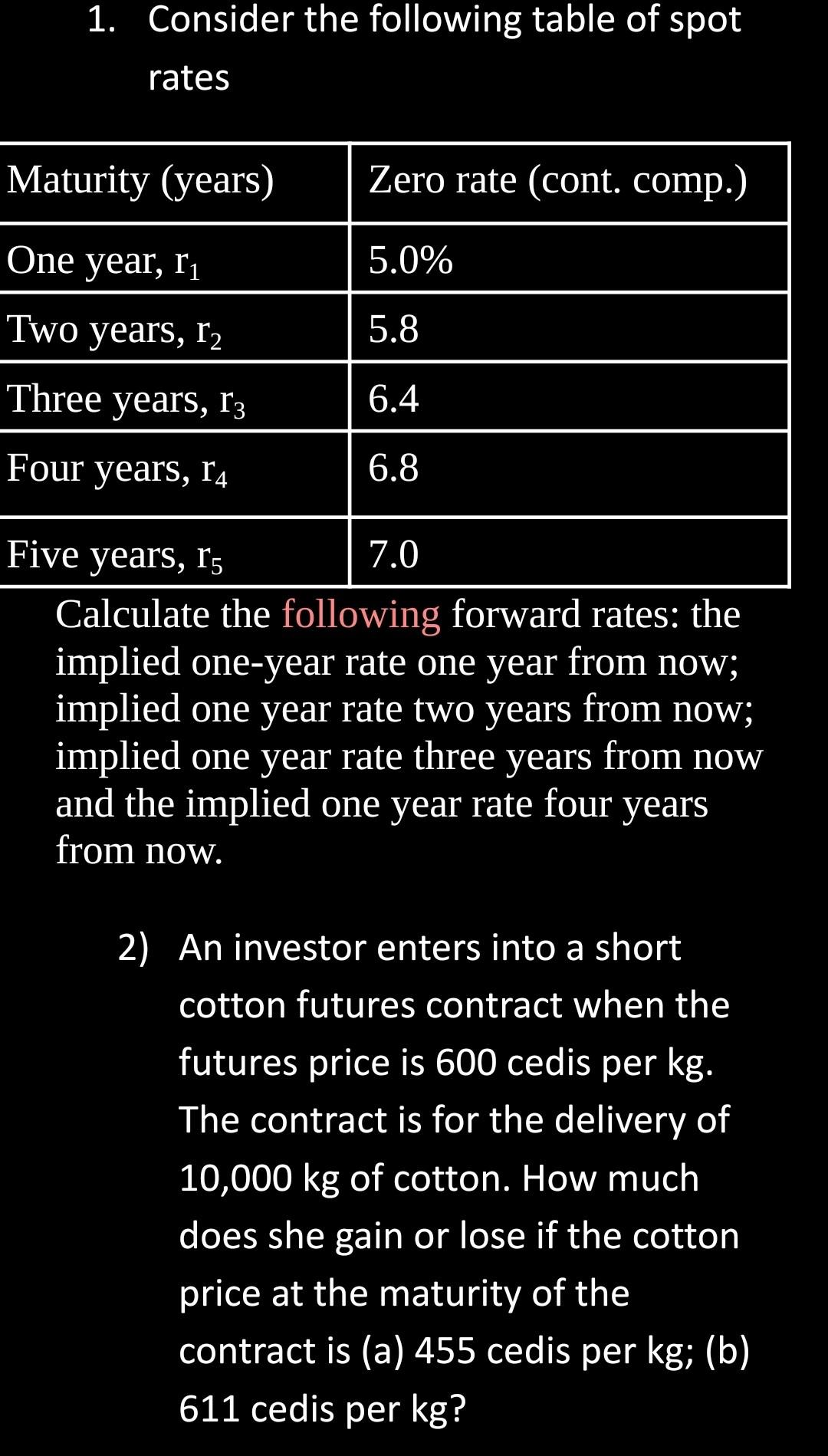

1. Consider the following table of spot rates Maturity (years) Zero rate (cont. comp.) One year, r 5.0% Two years, r2 5.8 Three years, 13

1. Consider the following table of spot rates Maturity (years) Zero rate (cont. comp.) One year, r 5.0% Two years, r2 5.8 Three years, 13 6.4 Four years, 14 6.8 Five years, 15 7.0 Calculate the following forward rates: the implied one-year rate one year from now; implied one year rate two years from now; implied one year rate three years from now and the implied one year rate four years from now. 2) An investor enters into a short cotton futures contract when the futures price is 600 cedis per kg. The contract is for the delivery of 10,000 kg of cotton. How much does she gain or lose if the cotton price at the maturity of the contract is (a) 455 cedis per kg; (b) 611 cedis per kg

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started