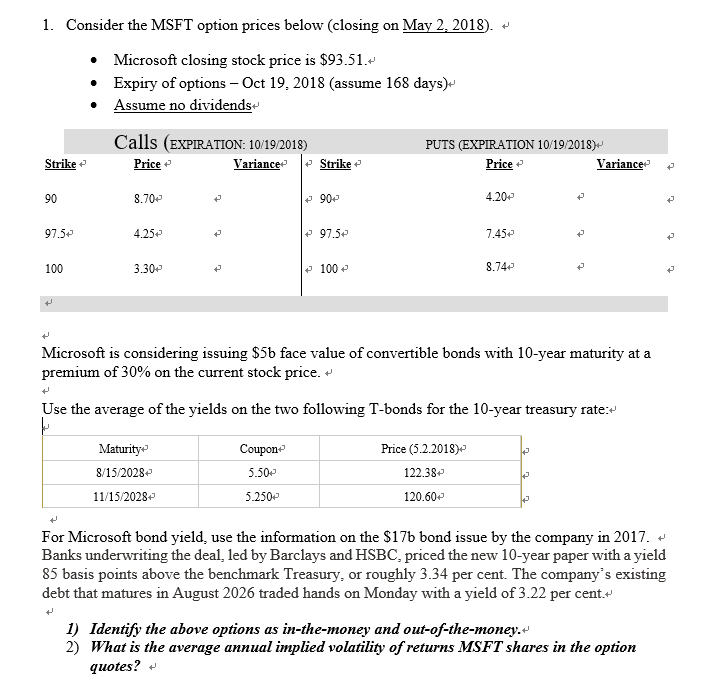

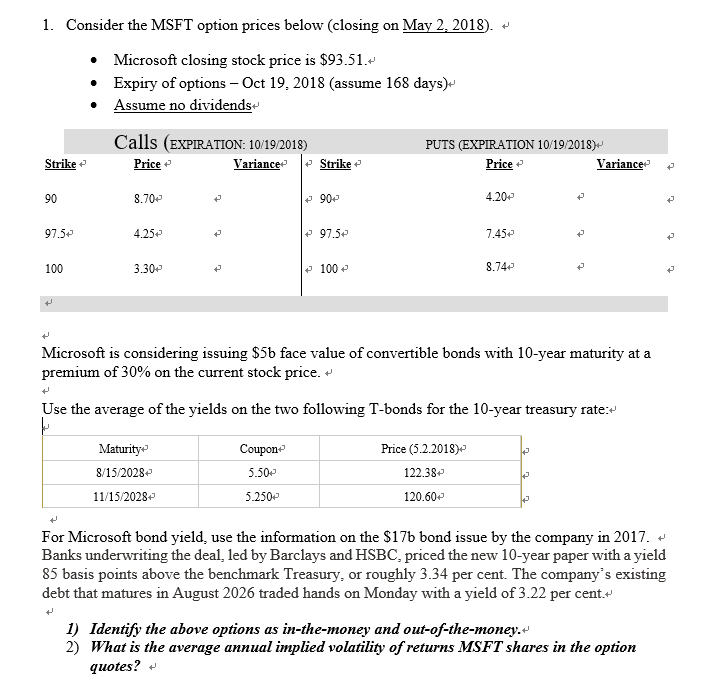

1. Consider the MSFT option prices below (closing on May 2. 2018). + Microsoft closin Expiry of options- Oct 19, 2018 (assume 168 days) g stock price is S93.51 Assume no dividends Calls (EXPIRATION: 10/19/2018) Variance Strike PUTS (EXPIRATION 10/19/2018)- Strike Price Price Variance 4.20 8.70p 90 4.25 97.5 7.45 8.74 100 100 Microsoft is considering issuing $5b face value of convertible bonds with 10-year maturity at a premium of 30% on the current stock price Use the average of the yields on the two following T-bonds for the 10-year treasury rate:* Maturity Coupon' Price (5.2.2018)' 5.50p 8/15/2028 122.38 11/15/2028+ 5.250 120.60 For Microsoft bond yield, use the information on the $17b bond issue by the company in 2017. * Banks underwriting the deal, led by Barclays and HSBC, priced the new 10-year paper with a yield 85 basis points above the benchmark Treasury, or roughly 3.34 per cent. The company's existing debt that matures in August 2026 traded hands on Monday with a yield of 3.22 per cent. 1) Identify the above options as in-the-money and out-of-the-money.- 2) What is the average annual implied volatility of returns MSFTshares in the option quotes? 1. Consider the MSFT option prices below (closing on May 2. 2018). + Microsoft closin Expiry of options- Oct 19, 2018 (assume 168 days) g stock price is S93.51 Assume no dividends Calls (EXPIRATION: 10/19/2018) Variance Strike PUTS (EXPIRATION 10/19/2018)- Strike Price Price Variance 4.20 8.70p 90 4.25 97.5 7.45 8.74 100 100 Microsoft is considering issuing $5b face value of convertible bonds with 10-year maturity at a premium of 30% on the current stock price Use the average of the yields on the two following T-bonds for the 10-year treasury rate:* Maturity Coupon' Price (5.2.2018)' 5.50p 8/15/2028 122.38 11/15/2028+ 5.250 120.60 For Microsoft bond yield, use the information on the $17b bond issue by the company in 2017. * Banks underwriting the deal, led by Barclays and HSBC, priced the new 10-year paper with a yield 85 basis points above the benchmark Treasury, or roughly 3.34 per cent. The company's existing debt that matures in August 2026 traded hands on Monday with a yield of 3.22 per cent. 1) Identify the above options as in-the-money and out-of-the-money.- 2) What is the average annual implied volatility of returns MSFTshares in the option quotes