Question

1). Consider the stock marked as stock number 5 . Using the regression function in Excel to calculate the alpha of this stock. (answer in

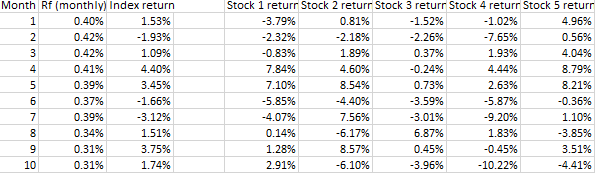

1). Consider the stock marked as stock number 5. Using the regression function in Excel to calculate the alpha of this stock. (answer in PERCENT with at least three (3) decimal places, e.g. "0.145" means 0.145% monthly alpha; Note that if your return data is in decimals then the regression will tell you the alpha in decimals, not in percent, in which case you will need to multiply your answer by 100.)

2). What is the beta of an equal-weighted portfolio of all 5 stocks (i.e., the same 1/5 fraction of dollars invested in every stock--and rebalanced every period so that the portfolio weights remains the same)? (answer with at least three decimal places, e.g. 1.361)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started