Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Consider two countries, A and B, whose currencies are and , respectively. The interest rate in A is greater than the interest rate in

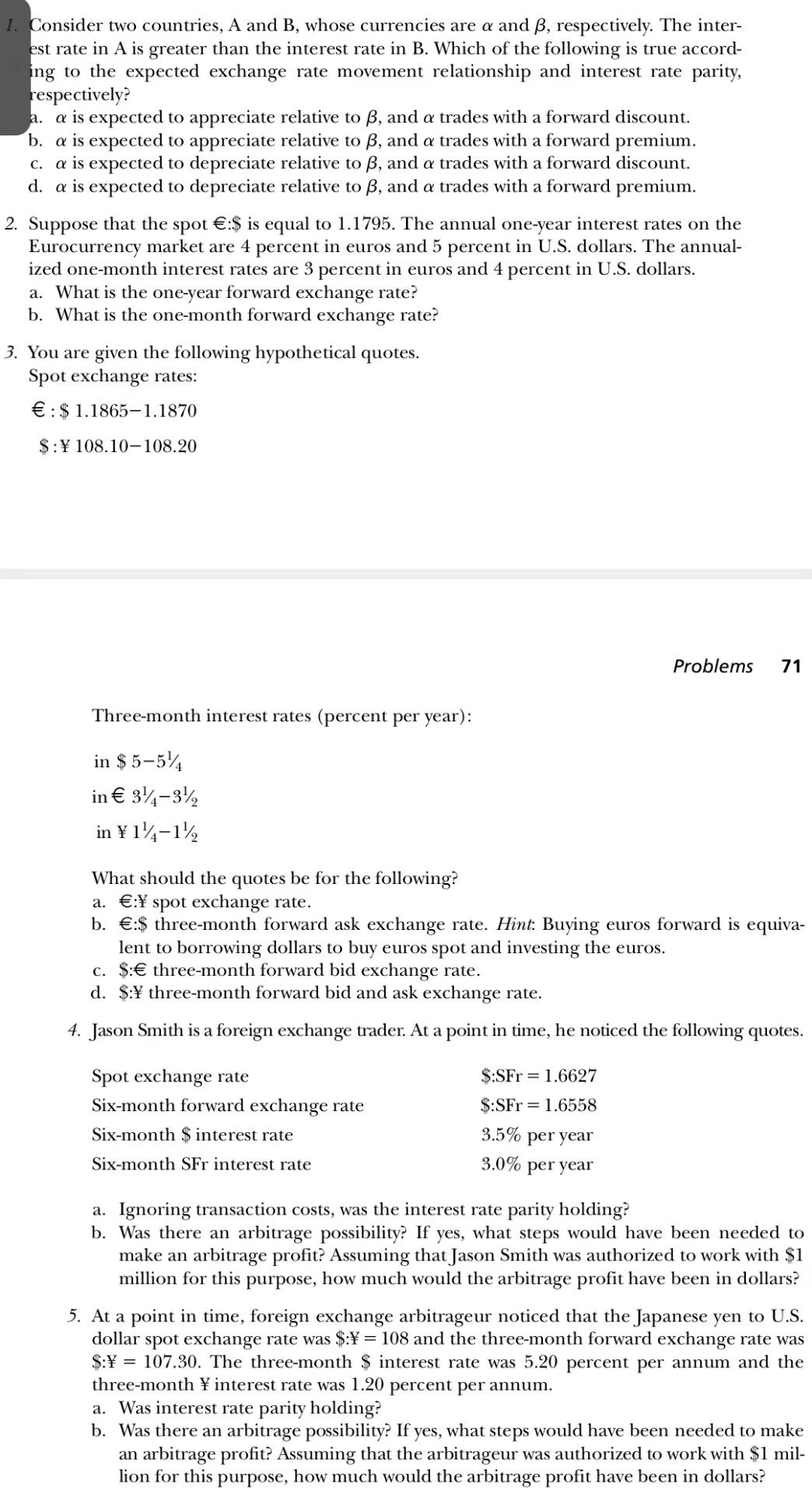

1. Consider two countries, A and B, whose currencies are and , respectively. The interest rate in A is greater than the interest rate in B. Which of the following is true according to the expected exchange rate movement relationship and interest rate parity, respectively? a. is expected to appreciate relative to , and trades with a forward discount. b. is expected to appreciate relative to , and trades with a forward premium. c. is expected to depreciate relative to , and trades with a forward discount. d. is expected to depreciate relative to , and trades with a forward premium. 2. Suppose that the spot :$ is equal to 1.1795. The annual one-year interest rates on the Eurocurrency market are 4 percent in euros and 5 percent in U.S. dollars. The annualized one-month interest rates are 3 percent in euros and 4 percent in U.S. dollars. a. What is the one-year forward exchange rate? b. What is the one-month forward exchange rate? 3. You are given the following hypothetical quotes. Spot exchange rates: :$1.18651.1870 \$: 108.10108.20 Problems 71 Three-month interest rates (percent per year): in$5541in341321in141121 What should the quotes be for the following? a. : spot exchange rate. b. :$ three-month forward ask exchange rate. Hint: Buying euros forward is equivalent to borrowing dollars to buy euros spot and investing the euros. c. \$: three-month forward bid exchange rate. d. \$: three-month forward bid and ask exchange rate. 4. Jason Smith is a foreign exchange trader. At a point in time, he noticed the following quotes. a. Ignoring transaction costs, was the interest rate parity holding? b. Was there an arbitrage possibility? If yes, what steps would have been needed to make an arbitrage profit? Assuming that Jason Smith was authorized to work with $1 million for this purpose, how much would the arbitrage profit have been in dollars? 5. At a point in time, foreign exchange arbitrageur noticed that the Japanese yen to U.S. dollar spot exchange rate was $:=108 and the three-month forward exchange rate was $:=107.30. The three-month $ interest rate was 5.20 percent per annum and the three-month interest rate was 1.20 percent per annum. a. Was interest rate parity holding? b. Was there an arbitrage possibility? If yes, what steps would have been needed to make an arbitrage profit? Assuming that the arbitrageur was authorized to work with $1 million for this purpose, how much would the arbitrage profit have been in dollars

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started