Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 20X1, Porta Corporation purchased Swick Company's net assets and assigned goodwill of $80,100 to Reporting Division K. The following assets and

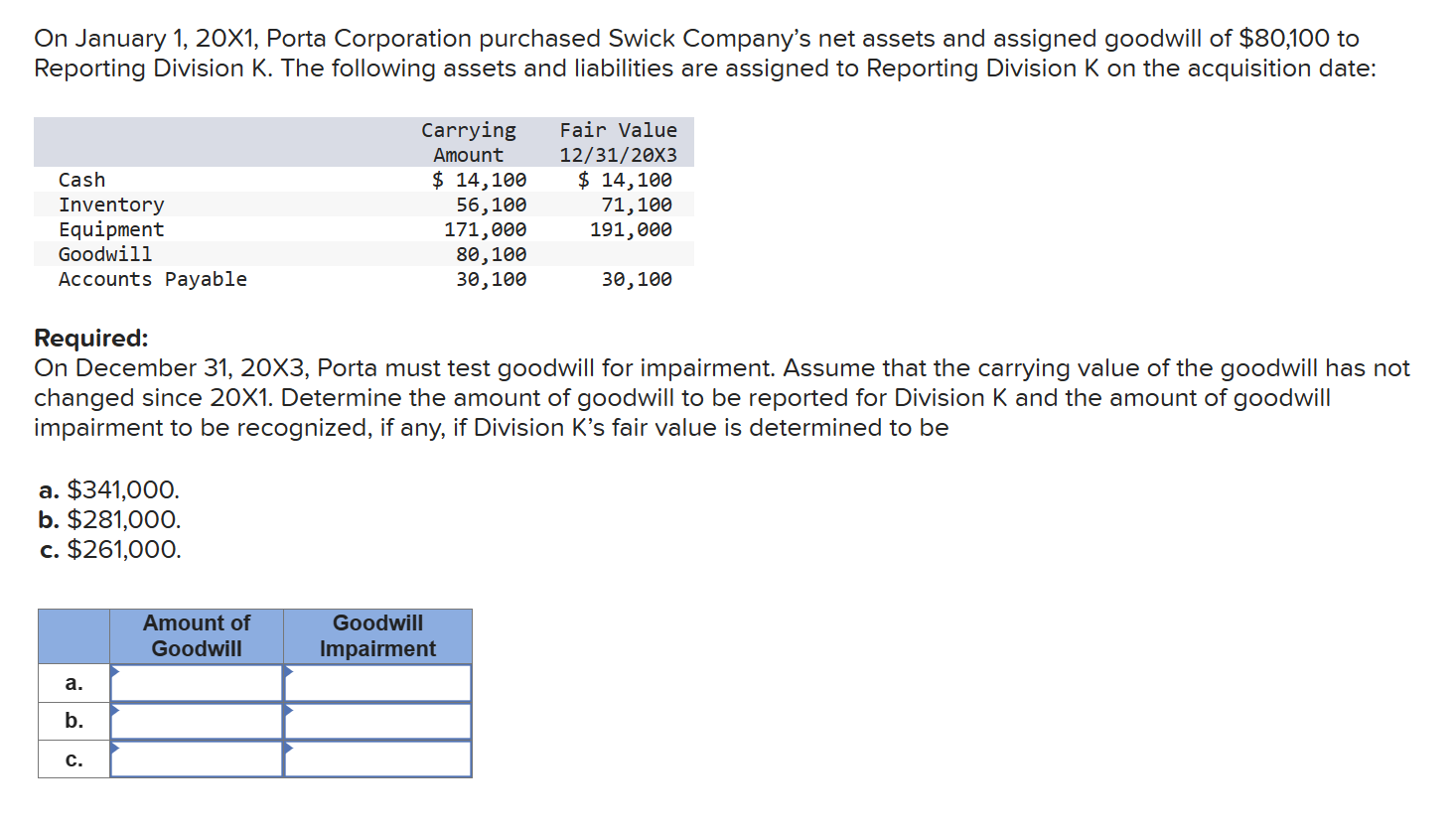

On January 1, 20X1, Porta Corporation purchased Swick Company's net assets and assigned goodwill of $80,100 to Reporting Division K. The following assets and liabilities are assigned to Reporting Division K on the acquisition date: Carrying Amount $ 14,100 Fair Value 12/31/20X3 Cash Inventory Equipment Goodwill Accounts Payable $ 14,100 56,100 71,100 171,000 191,000 80,100 30,100 30,100 Required: On December 31, 20X3, Porta must test goodwill for impairment. Assume that the carrying value of the goodwill has not changed since 201. Determine the amount of goodwill to be reported for Division K and the amount of goodwill impairment to be recognized, if any, if Division K's fair value is determined to be a. $341,000. b. $281,000. c. $261,000. a. b. C. Amount of Goodwill Goodwill Impairment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the amount of goodwill impairment we follow these steps 1 Calculate the Carrying Value ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started