Answered step by step

Verified Expert Solution

Question

1 Approved Answer

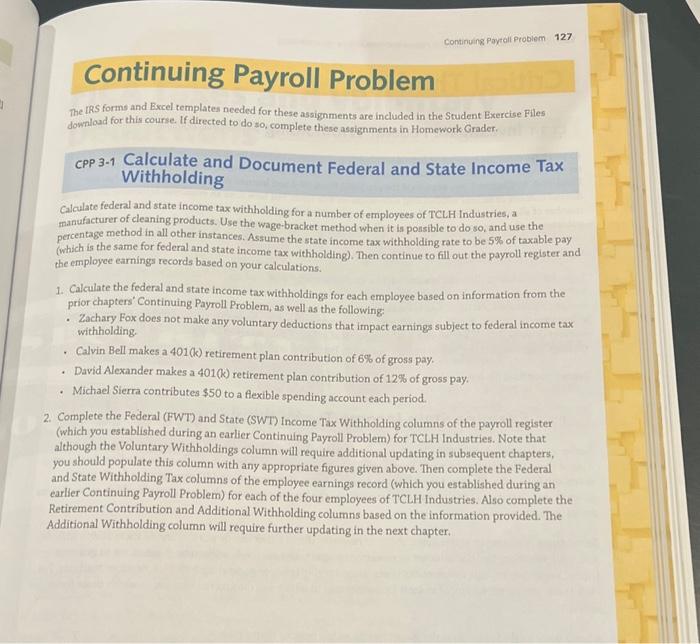

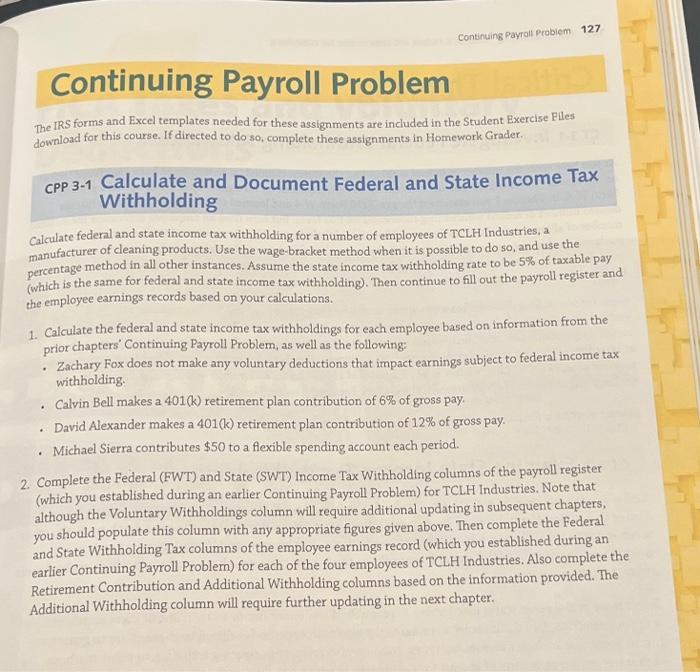

1 Continuing Payroll Problem download for this course. If directed to do so, complete these assignments in Homework Grader. The IRS forms and Excel templates

1 Continuing Payroll Problem download for this course. If directed to do so, complete these assignments in Homework Grader. The IRS forms and Excel templates needed for these assignments are included in the Student Exercise Files Continuing Payroll Problem 127 Calculate federal and state income tax withholding for a number of employees of TCLH Industries, a manufacturer of cleaning products. Use the wage-bracket method when it is possible to do so, and use the percentage method in all other instances. Assume the state income tax withholding rate to be 5% of taxable pay (which is the same for federal and state income tax withholding). Then continue to fill out the payroll register and the employee earnings records based on your calculations. 1. Calculate the federal and state income tax withholdings for each employee based on information from the prior chapters' Continuing Payroll Problem, as well as the following: Zachary Fox does not make any voluntary deductions that impact earnings subject to federal income tax withholding. . CPP 3-1 Calculate and Document Federal and State Income Tax Withholding . Calvin Bell makes a 401(k) retirement plan contribution of 6% of gross pay. David Alexander makes a 401(k) retirement plan contribution of 12% of gross pay. Michael Sierra contributes $50 to a flexible spending account each period. 2. Complete the Federal (FWT) and State (SWT) Income Tax Withholding columns of the payroll register (which you established during an earlier Continuing Payroll Problem) for TCLH Industries. Note that although the Voluntary Withholdings column will require additional updating in subsequent chapters, you should populate this column with any appropriate figures given above. Then complete the Federal and State Withholding Tax columns of the employee earnings record (which you established during an earlier Continuing Payroll Problem) for each of the four employees of TCLH Industries. Also complete the Retirement Contribution and Additional Withholding columns based on the information provided. The Additional Withholding column will require further updating in the next chapter.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started